NVDA On Deck, PANW This Afternoon, LIT For The Long Term

Obviously the highlight of the week is Nvidia (NVDA) earnings Wednesday afternoon. As I wrote in my last blog, NVDA is guiding the Jan quarter to $20 billion in revenue and 75% gross margins. NVDA only provides quarterly guidance and Wall Street is expecting $21.6 billion in revenue for the April quarter, according to the WSJ’s Dan Gallagher. BofA’s NVDA analyst Vivek Arya is expecting a “notable but brief pullback” following earnings while UBS’s Tim Arcuri sees earnings reaching $28/share this fiscal year and has an $850 price target. At a price of $802, NVDA would become the third US traded stock with a $2 trillion market cap (Dan Gallagher, “Nvidia’s Staying Power Is The $2 Trillion Question” [SUBSCRIPTION REQUIRED], WSJ, Tue 2/20).

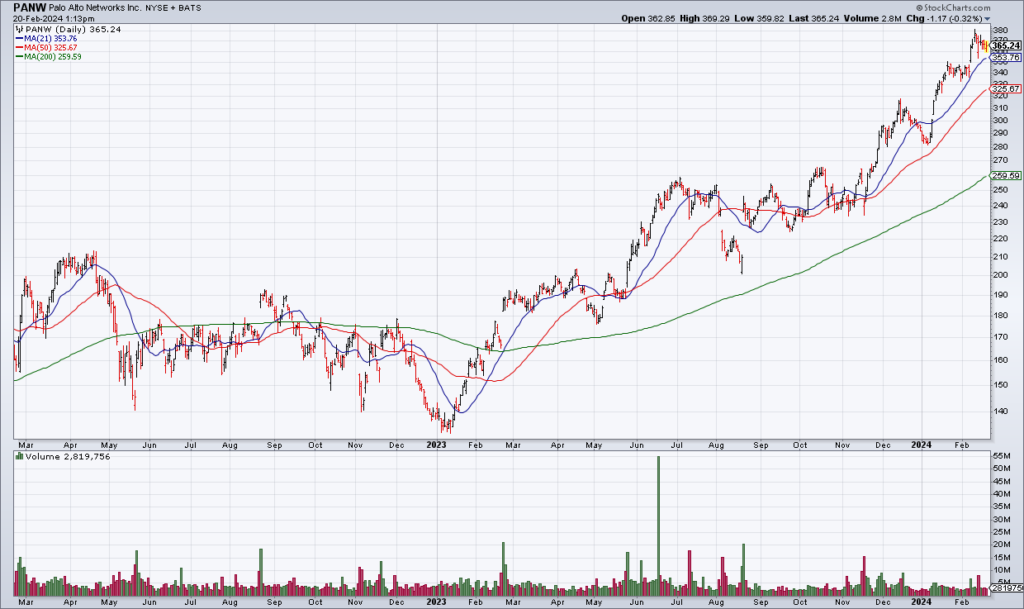

But before NVDA, another wildly popular stock – Palo Alto Networks (PANW) – reports earnings this afternoon. PANW beats and raises almost every quarter but I wonder if that will be enough this time around. At a current price of $365 and full year EPS guidance of $5.40-$5.53, PANW is in lofty territory at almost 70x earnings. PANW has been a terrific stock but I just sold the PANW $400 2/23 Calls for $6.60.

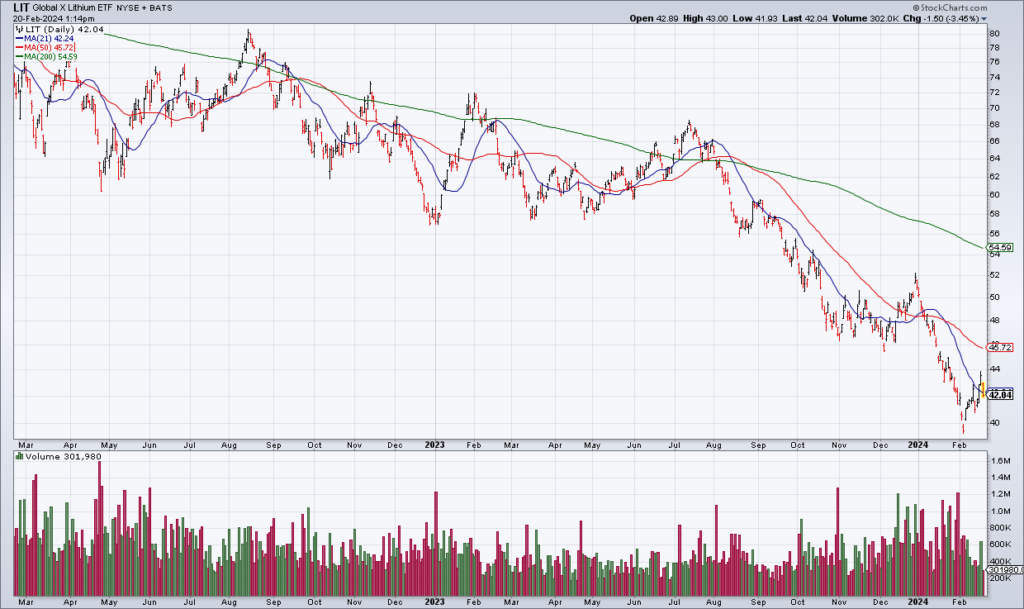

Lastly, it may be time to buy the lithium stocks (Stephen Wilmot, “Are Lithium Stocks At Rock Bottom?” [SUBSCRIPTION REQUIRED], WSJ, Tue 2/20). Lithium is used to make electric vehicle batteries and EVs are the future of cars – if for no other reason than governments are forcing them on consumers in the name of climate change. At any rate, lithium prices have plummeted but are sure to bounce back at some point due to this secular trend. You can buy the largest US producer, Albermarle (ALB), or the Lithium ETF (LIT) for diversification, I significantly increased my long term positions in both today.