NVDA Earnings And The Popping Of The Mag 7 Bubble

S&P 5000. I can’t say I expected that 15 years ago when the market was crashing and the S&P fell below 700. It’s been an incredible run since then – led by the Big 5, now the Magnificent 7 (Tesla and Nvidia). Alas, nothing lasts forever. And while calling market tops is almost impossible, I think the end could be just around the corner.

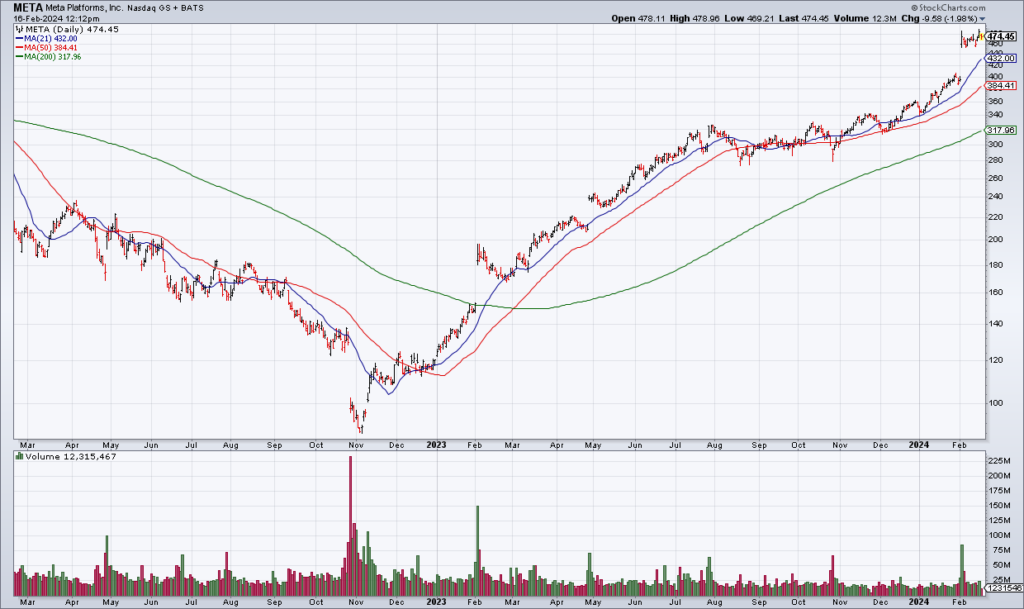

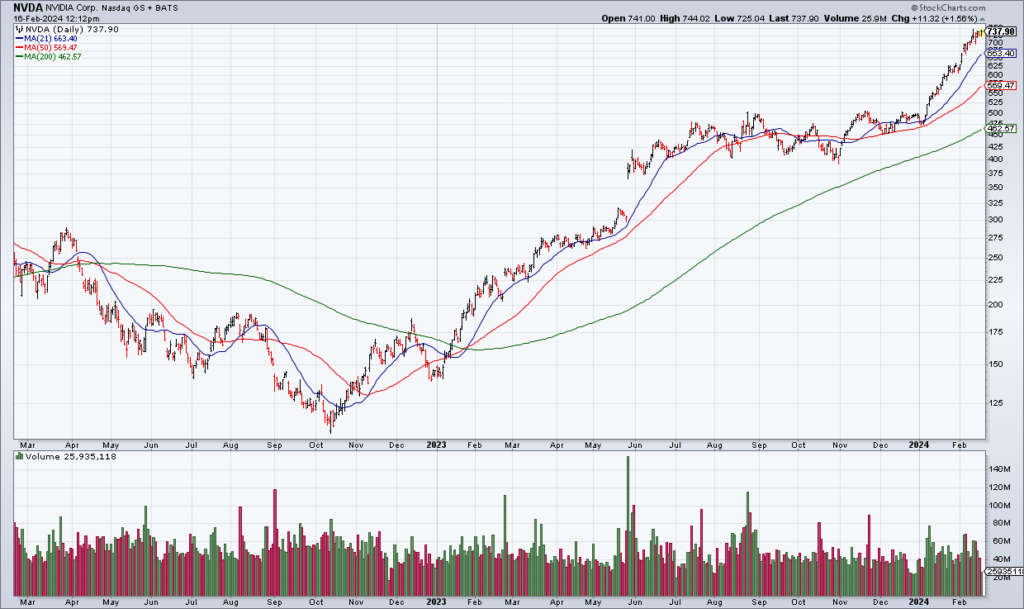

That’s because the Magnificent 7 – which is carrying this narrow market – is running out of gas. Apple is down 5% (and there are good reasons for that) and Tesla 19% YTD. Microsoft, Amazon and Google are mostly treading water. The two stocks doing the heavy lifting this year are Nvidia (NVDA) and Facebook (META), up 49% and 34% YTD, respectively. I wish I knew how to calculate how much of the S&P’s YTD gains those two stocks represent but I bet that it’s a big proportion.

I wrote about META two weeks ago in the wake of its 4Q23 earnings report. 2023 was indeed a remarkable turnaround year for the company and the stock. Revenue grew 16% and cost discipline expanded margins resulting in EPS of almost $15. But – as I argued in that blog – the good news is now fully priced into shares. Even using generous assumptions, the stock is fully valued.

That leaves NVDA which reports 4Q23 earnings next Wednesday after the close. NVDA shares have been levitating since last May – and for good reason. The last two quarters have been absolute blowouts and this one looks set to be another. Three months ago NVDA guided 4Q23 revenue to $20 billion and gross margins to 75%. Those are terrific numbers and I expect NVDA to meet them.

But I have to wonder how much is priced in already. NVDA earned $4.02/share in 3Q23 and estimates for the current quarter appear to be ~$4.50/share. Let’s say NVDA earns $20/share in 2024. At its current price of $740, that’s 37x forward earnings. And that’s assuming AI spending continues to percolate throughout 2024. As with META, even with generous assumptions the stock is fully valued.

That’s why I think NVDA’s report next Wednesday afternoon could be a doozy – and not for bulls. My suspicion is that it will be another blowout quarter – and shares will tank in Thursday’s session potentially putting in a top for the overall market. Remember: Calling market tops is a great way to lose money. But even if I’m wrong about next Wednesday, the logic of my argument holds and the Mag 7 are running out of steam.