Play Chips With MU, Not NVDA

It has been said that semiconductors are the new oil, so central are they to the contemporary economy. Currently, a scarcity of semiconductors is the bottleneck holding up production of many goods such as automobiles. Many investors have exposure to chips through behemoth Nvidia (NVDA) but I prefer Micron (MU) in the current environment.

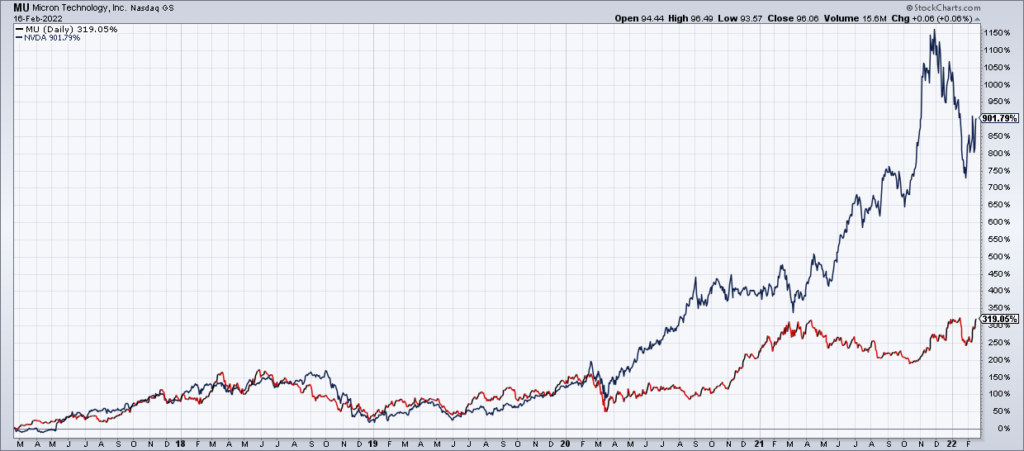

As you can see in the chart above, NVDA is up about 900% in the last 5 years compared with 300% for MU – with all of that outperformance coming post-COVID. As a result, NVDA trades for 50x my calendar 2022 EPS estimate of $5.25. By contrast, MU trades at only 12x my calendar 2022 EPS estimate of $8. With interest rates going up, now is the time for value stocks like MU as opposed to growth stocks like NVDA.

In addition, as you can see in the tweet by Carter Worth, MU is on the verge of a breakout to all time highs while NVDA is in a correction. In sum, MU is significantly cheaper than NVDA at a time when this matters a great deal while also being technically stronger. Play chips with MU, not NVDA.