The Stealth Bear Market And The Nature of Bull Market Tops

Cassandra was an ancient Greek priestess cursed to utter true prophecies but never to be believed. I can relate! On Monday I called for a Second Great Depression. This evening I am going to write about why I think this process may very well have already started.

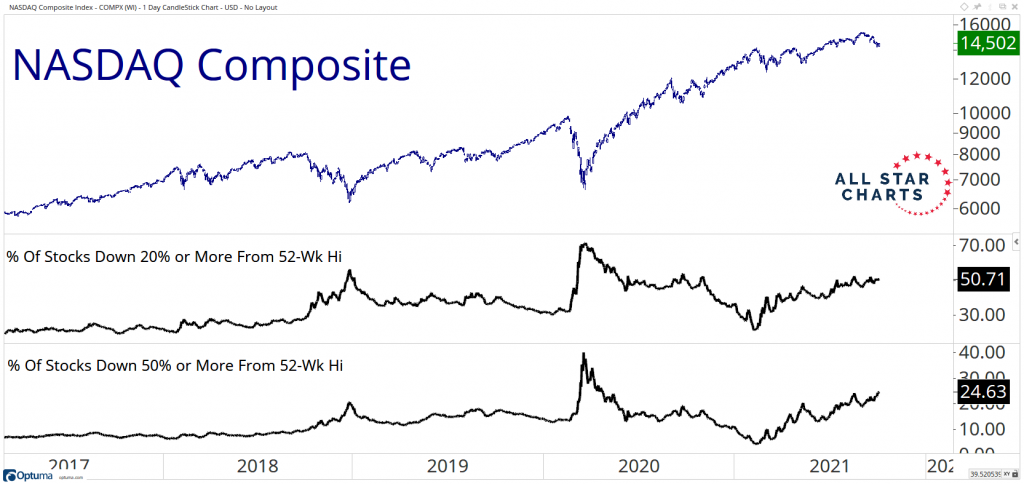

It starts with an excellent blog post by Steve Strazza of All Star Charts today entitled “Are Stocks In A Bear Market?” While the overall NASDAQ is less than 5% below its all time closing high from September 3rd (15,364) at today’s close, beneath the surface there is carnage. As you can see in the chart above, 51% of NASDAQ components are at least 20% below their 52 week highs and 25% are at least 50% below their 52 week highs.

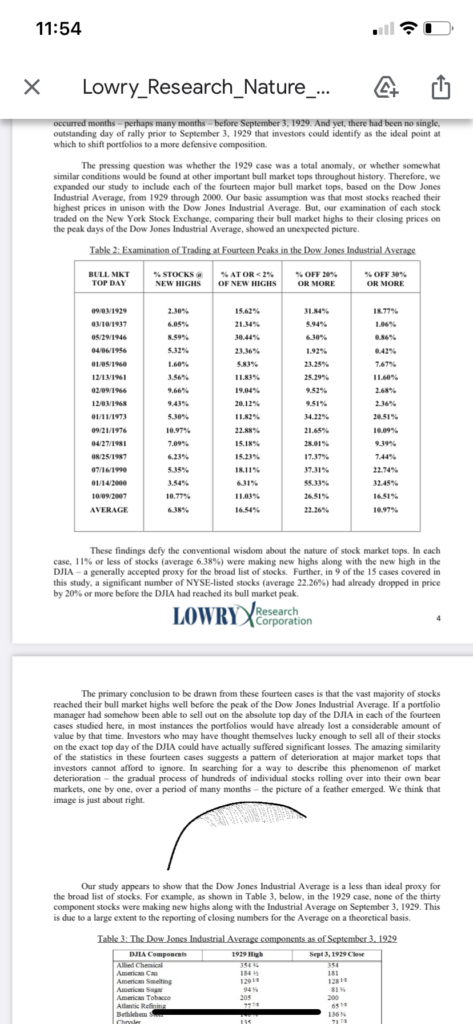

While Strazza concludes that this is bullish since a stealth bear market has already taken place, history shows something different. The best research ever done on bull market tops was a white paper by Lowry Research Corporation entitled “An Exploration of the Nature of Bull Market Tops” (you can get a free copy from their site). As you can see in the graphic above, at the date the last 14 bull markets have topped, many of the underlying components had already rolled over and were far below their highs.

I want to focus in on the epic tops of 1929 and 2000 because I think they are most similar to what we are seeing now. As you can see, when the the market topped on 9/3/1929, 32% of stocks in the DJIA were already at least 20% below their highs and 19% were at least 30% below. On 1/14/2000, the numbers were 55% and 32%. These compare favorably with the numbers cited from Strazza’s post earlier on the NASDAQ in my opinion.

That’s why I believe everything is now coming together. On Monday, I laid out the fundamental case. Tonight, I am laying out the technical case. The fundamental premise of value investing is a distinction between value and price. Value is reality (though it can only be approximated) while price is perception. What you need to make money as a value investor is for price to converge with value. The argument I am making here is that that is exactly what is starting to happen.