The Bear Market Rally Of Oct22-Mar24 Is Over

The bear market rally which began on October 13, 2022 with an intraday low of 3,492 topped on March 28, 2024 with an intrday high of 5,265. From top to bottom the S&P rallied about 50%. It has been well…

The bear market rally which began on October 13, 2022 with an intraday low of 3,492 topped on March 28, 2024 with an intrday high of 5,265. From top to bottom the S&P rallied about 50%. It has been well…

I was born on April 4, 1977 at Stanford Hospital in Palo Alto, CA. My parents – Robert and Diane – were the first generation children of Jewish mother immigrants from Europe. My grandmother on my father’s side, Ethel, came…

The market was cruising along as usual Thursday before reversing hard to the downside starting around 2pm EST. At the time, it wasn’t clear if the catalyst was a speech by Fed President Neel Kashkari in which he said the…

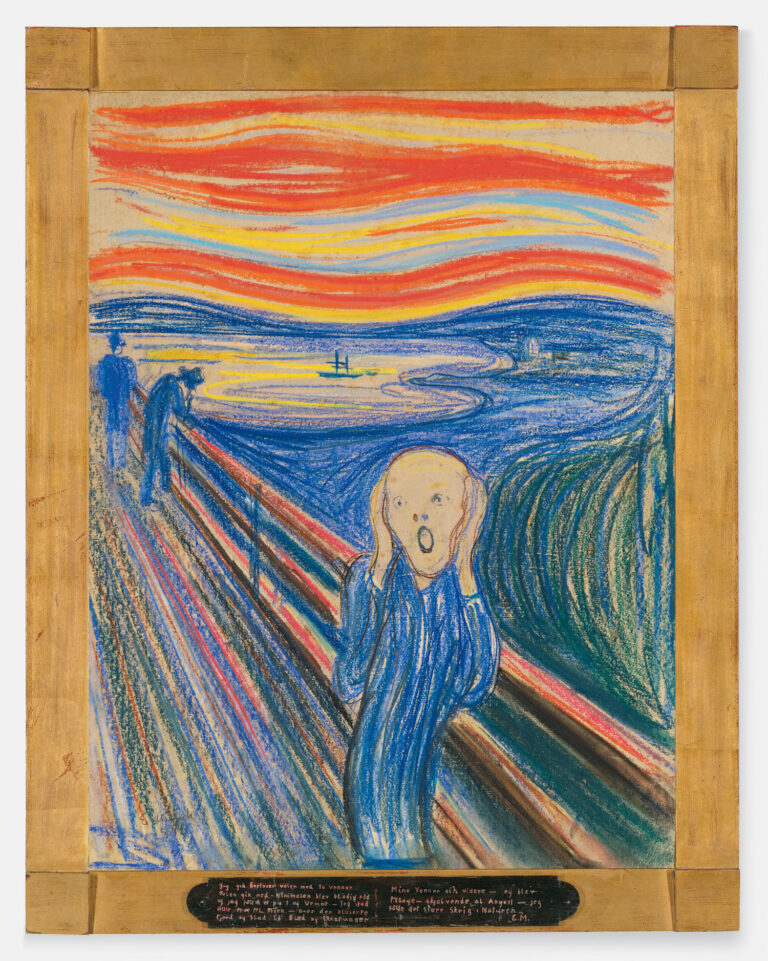

In a previous blog, I defined the culture of nihilism as follows: We live in what I have come to term “the culture of nihilism”. It is a culture characterized by self absorption, selfishness, lack of concern for others, incivility,…

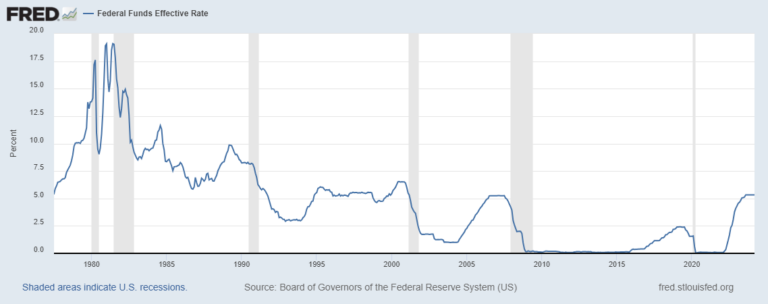

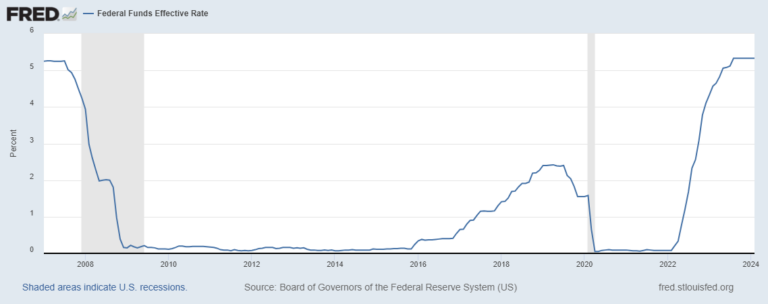

In “The Market Will Soon Hit An Air Pocket And Drop 20% In A Matter Of Months” (Thursday March 28) the second reason I gave for the coming crash was: Monetary policy acts with a lag and will hit the…

Yesterday, in a presentation to investors, Dubravko Lokas-Bujas, JP Morgan’s Chief Global Equity Strategist, called for an “out of the blue” stock market crash to finish 2024 at 4200 – about 20% below current levels. The reason he gave is…

I just filled up my gas tank and it was over $5/gallon. This is just another example of sticky inflation: Inflation may not be going up as fast as it was a couple years ago but prices are still quite…

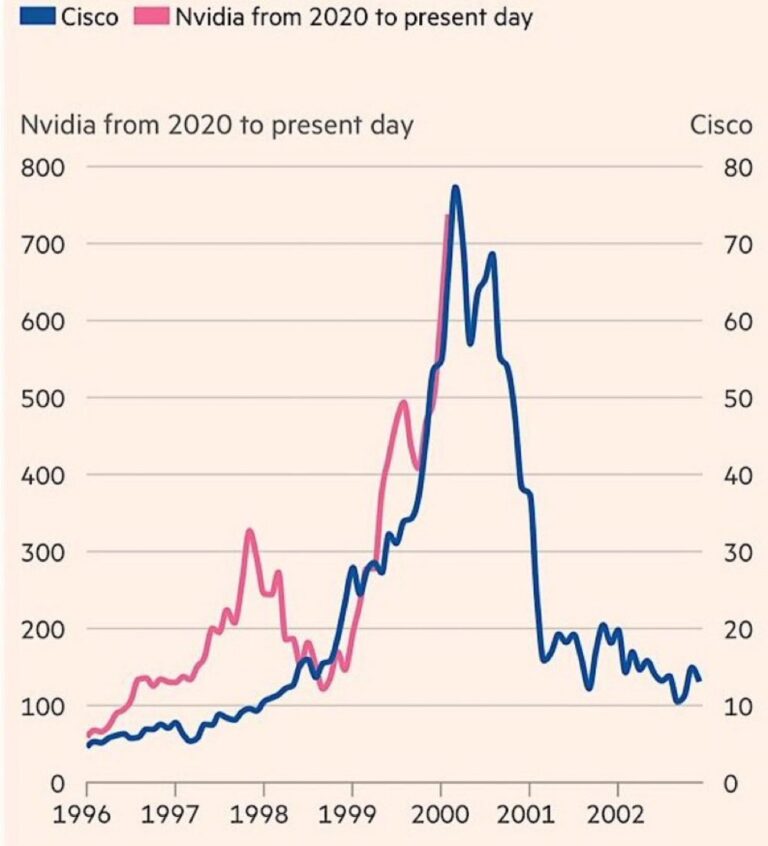

Jon Sindreu wrote a very interesting article for the WSJ’s Heard On The Street section this morning (“Don’t Call AI Craze A Bubble” [SUBSCRIPTION REQUIRED]). Sindreu wants to make a distinction between the current market – in which blue chip…

History doesn’t repeat itself but it rhymes – Mark Twain In the late 1960s and early 1970s there was a group of high quality companies including Kodak and Xerox that led the market and which investors piled into regardless of…

As everybody prepares for tomorrow morning’s Jobs Report, I’m focused on Silicon Valley Bank (SIVB) – a small bank that caters to early stage technology companies (the heartbeat of the Silicon Valley economy). As interest rates have risen and financial…