Reminiscences Of 2007: SIVB, Bear Stearns And The Fed Decision

As everybody prepares for tomorrow morning’s Jobs Report, I’m focused on Silicon Valley Bank (SIVB) – a small bank that caters to early stage technology companies (the heartbeat of the Silicon Valley economy). As interest rates have risen and financial conditions tightened, venture capital financing has dried up. This has put pressure on early stage, unprofitable technology companies that depend on this financing to survive. That has in turn put pressure on SIVB – the bank of choice for many of these companies as well as an investor in them.

SIVB announced yesterday afternoon that it would be selling $2.25 billion in stock in an attempt to shore up its balance sheet. While the company is assuring investors that everything is fine, Wall Street is not so sure: SIVB shares are down ~35% at the open.

This feels like a canary in the coal mine, much like the demise of two Bear Stearns hedge funds that invested in subprime mortgage backed securities was back in 2007. “Subprime is contained”, then Fed Chair Ben Bernanke had assured markets only a few months prior.

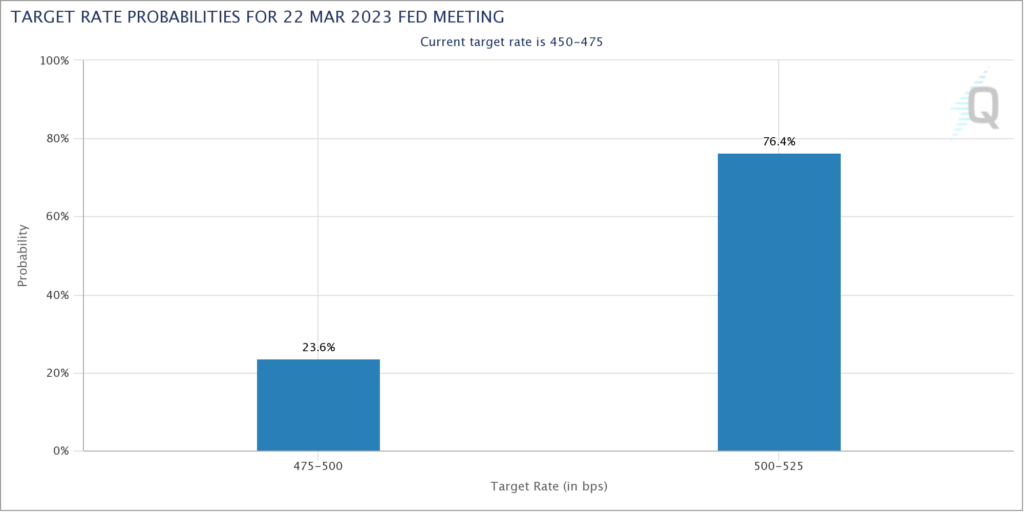

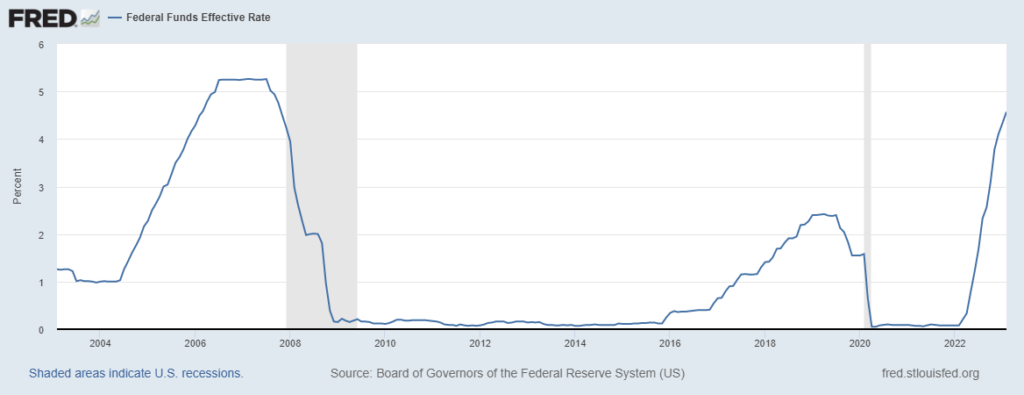

Nevertheless, the Fed seems intent on hiking 50 basis points in two weeks on the basis of recent strength in the economic reports. As I made clear on Tuesday, I believe this would be a policy mistake and the Fed will have to reverse course in the near future to clean up the mess it made – just like it did in 2008.

Disclosure: Top Gun covered its small short position in SIVB just prior to publishing this blog.

Also see:

“Something Is Going To Break”, Top Gun Financial, September 26, 2022

“Things Are Starting To Break”, Top Gun Financial, November 10, 2022