Don’t Call It A Bubble, BBY Earnings

Jon Sindreu wrote a very interesting article for the WSJ’s Heard On The Street section this morning (“Don’t Call AI Craze A Bubble” [SUBSCRIPTION REQUIRED]). Sindreu wants to make a distinction between the current market – in which blue chip stocks may be overvalued but are in no danger of going bust – and something like the Dot Com Bubble in which many stocks had no real business and eventually did go bust. The more appropriate analogy is to the Nifty Fifty of the 1970s. (I made the same analogy in “The Magnificent 7 Will Go The Way Of The Nifty Fifty”, January 29).

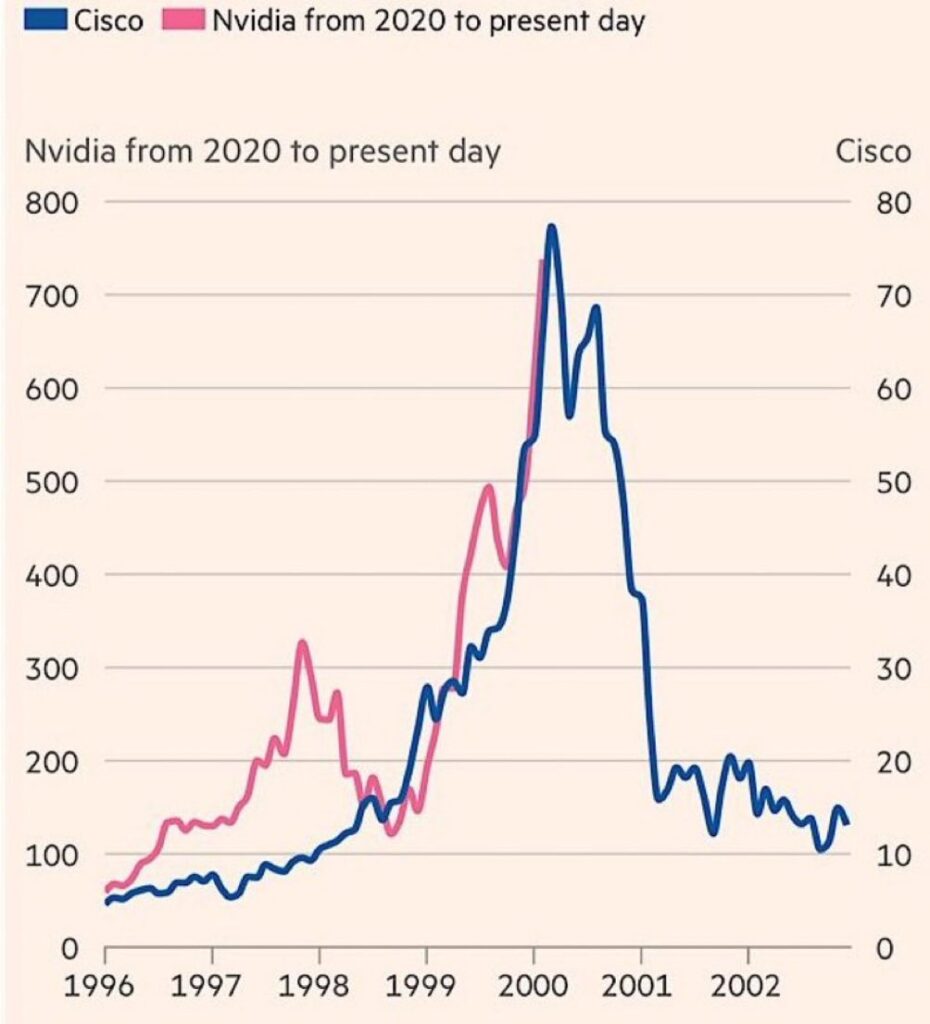

The right analogy for Nvidia (NVDA) then, according to Sindreu, is Cisco (CSCO). CSCO’s stock boomed during the Dot Com Bubble on the strength of enormous earnings growth as companies bought its networking equipment to build out the infrastructure for the internet. CSCO stock reached a P/E of 126 in 2000. The problem was never that blue chip CSCO was in danger of going bankrupt. The problem was that its earnings were unsustainable and therefore the valuation completely out of whack. As you can see in the chart above, CSCO stock lost most of its value when capital spending on its networking equipment collapsed.

And that’s the precisely the risk investors face with NVDA. Spending on its chips to build out the infrastructure for AI is clearly booming right now based on its recent earnings reports. The question is: Is this spending sustainable? That’s what I was getting at last week in “How Much Is NVDA Worth? Markets Are Auctions; Valuation Is An Art” when I wrote:

Analysts estimate NVDA will earn about $25/share in 2024. Even harder is determining how much NVDA will earn in future years, like 2025, 2026 and beyond. Much of the value of the stock depends on these earnings and your valuation on your assumptions about them. For example, if you believe that Artificial Intelligence is going to radically change the world, your assumptions about how big those out year earnings are going to be will be higher than someone who thinks it’s a fad.

Bulls argue that NVDA is only trading for 30x current year earnings – hardly a bubble (see, for example, “At $2 Trillion, Nvidia Is Getting Cheaper” [SUBSCRIPTION REQUIRED], Dan Gallagher, WSJ 2/24). But if those earnings are unsustainable, it could be trading at 60x 2026 earnings. P/E is a heuristic but most of a growth company’s value resides in the out year earnings. That’s where the debate is.

Best Buy (BBY) reported 4Q23 earnings earlier this morning. Current year guidance suggests the business is finally stabilizing after a couple years of big sales declines. BBY expects 2024 enterprise comps of -3% to 0% compared to -6.8% and -9.9% the previous two years. EPS is also expected to stabilize at $5.75-$6.20 compared to $6.37 and $7.08 the previous two years. This is good news and the stock is cheap at 13x guidance but I suspect the lack of growth means it will continue to be dead money for the foreseeable future.

Disclosure: Top Gun is short shares of NVDA.