Sticky Inflation And The Neutral Rate

I just filled up my gas tank and it was over $5/gallon. This is just another example of sticky inflation: Inflation may not be going up as fast as it was a couple years ago but prices are still quite high relative to where they were prior to the pandemic. And that’s good reason to think that the neutral rate – the Fed Funds rate which is neither loose nor restrictive – has gone up since before the pandemic. So what?

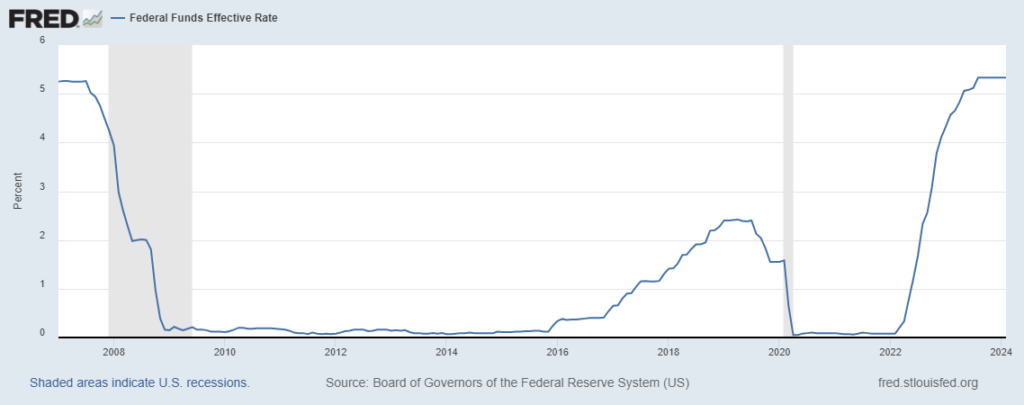

One of the reasons – perhaps the main reason – stock returns have been so strong over the past 15 years is an extremely low – frequently 0% – Fed Funds rate. My argument is that that era is over. At some point, the Fed will have to cut again due to economic weakness – but it won’t have the latitude it did in the past due to higher entrenched inflation. Going forward, it will have to more carefully balance economic growth with inflation because an elevated level of inflation is here to stay.

This is just another reason to be concerned about the current rally. In addition to the Magnificent 7 being technically extended and higher for longer in the short term, longer term the Fed will have to be more judicious when it needs to cut rates. It’s ability to bail out the economy isn’t what it was in 2008 or 2020. A repeat of the 2009-2024 stock market – therefore – is not in the cards.