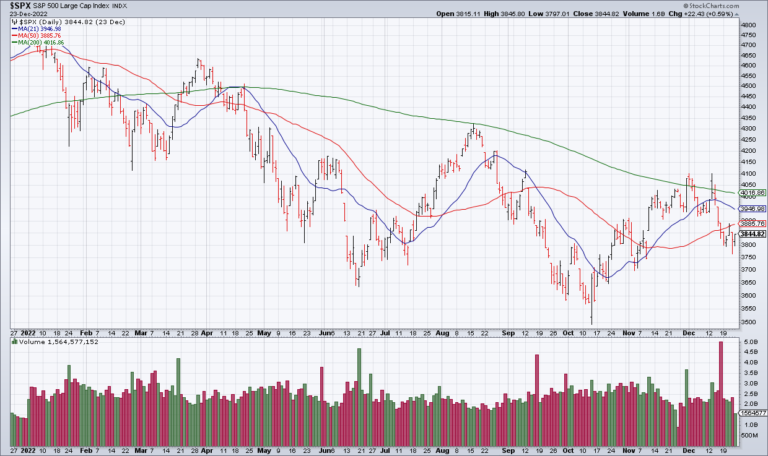

The Market Will Soon Hit An Air Pocket And Drop 20% In A Matter Of Months

Yesterday, in a presentation to investors, Dubravko Lokas-Bujas, JP Morgan’s Chief Global Equity Strategist, called for an “out of the blue” stock market crash to finish 2024 at 4200 – about 20% below current levels. The reason he gave is…