What Does CAG’s Big Quarter Mean?

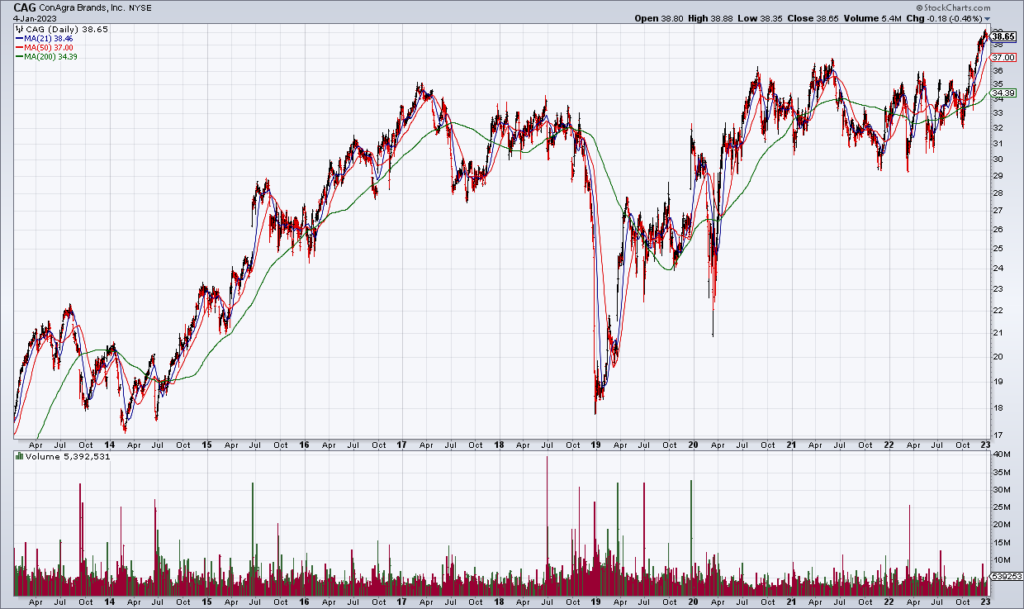

Conagra Foods (CAG) – maker of frozen foods like Marie Calendar’s and Healthy Choice – is one of the most boring stocks in the market. But they just reported monster numbers for their quarter ended November 27, 2022. What does it mean?

First let’s take a look at the quarter. Organic sales were +8.6% and EPS +27% to 81 cents. As a result, CAG significantly raised its full year FY23 guidance to organic sales +7% to +8% and adjusted EPS to $2.60-$2.70. That compares to guidance they gave three months ago of organic sales +4% to +5% and adjusted EPS of $2.43. It’s no wonder this stodgy frozen food stock is +4% in the premarket to all time highs just over $40.

But what does it mean? Let’s just say that if people are buying more CAG frozen food as well as its Reddi Wip whip cream and Orville Redenbacher popcorn they’re probably not going out to eat as much. In other words: While CAG’s big quarter is great for shareholders, it’s a negative tell on the consumer and the macro economy. You’re going to want to continue to stay long defensive consumer staples like CAG and away from consumer discretionary companies. Defense will continue to win in 2023.