Sniffing Out A Fed Pivot…. Again

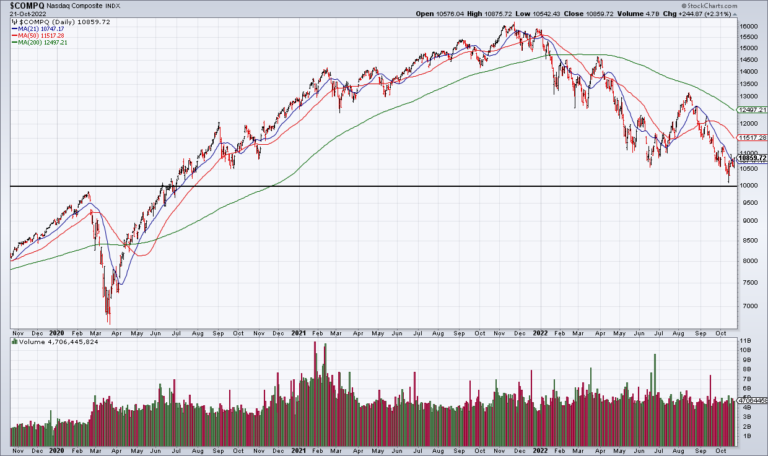

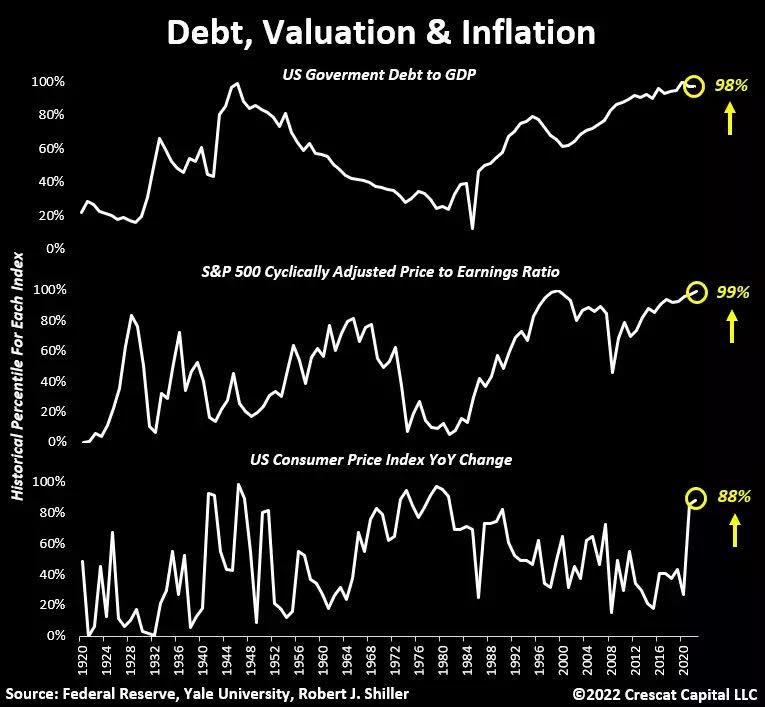

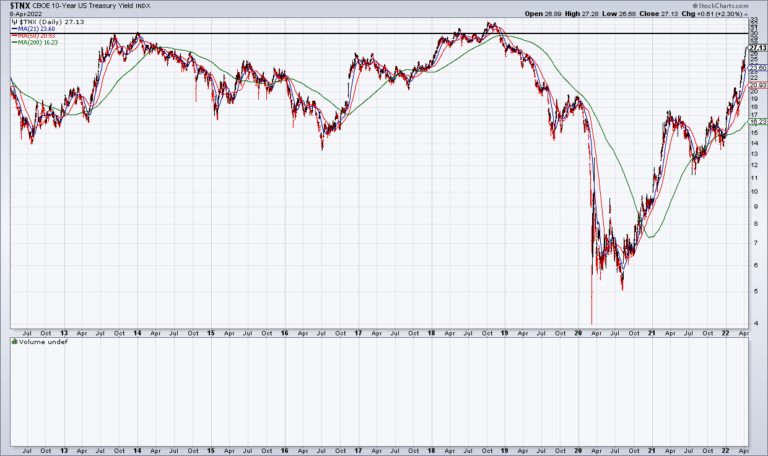

Stocks rallied Friday as The Fed Whisperer Nick Timiraos penned a column suggesting that the Fed may be close to pivoting to a less hawkish stance. Timiraos suggested that – while the Fed will raise another 75 points on November…