Sniffing Out A Fed Pivot…. Again

Stocks rallied Friday as The Fed Whisperer Nick Timiraos penned a column suggesting that the Fed may be close to pivoting to a less hawkish stance. Timiraos suggested that – while the Fed will raise another 75 points on November 2 – there will be a debate about whether to raise only 50 points in December. Markets have been awaiting such a pivot for much of the year and it may finally be at hand.

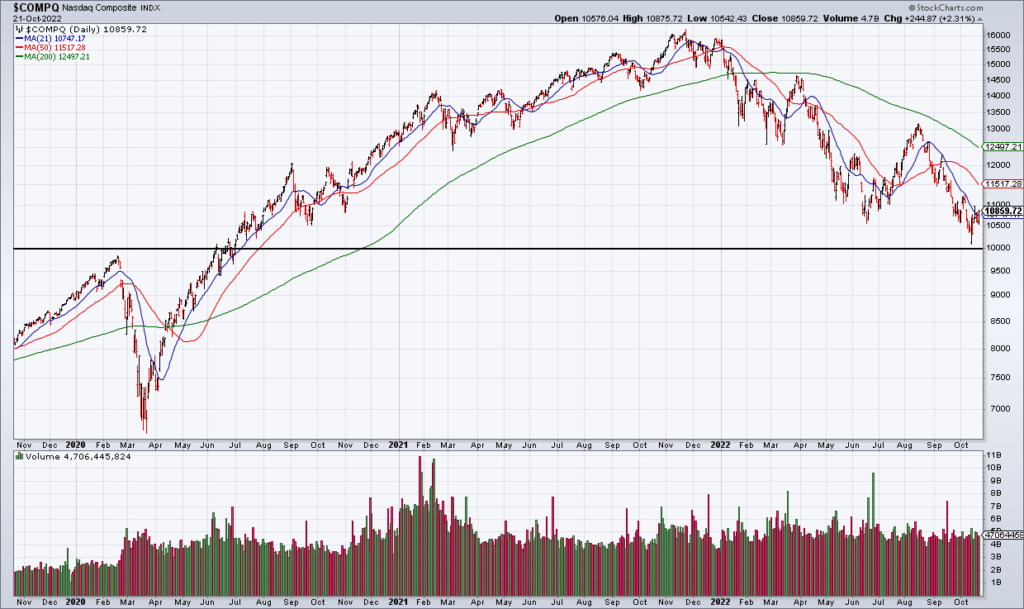

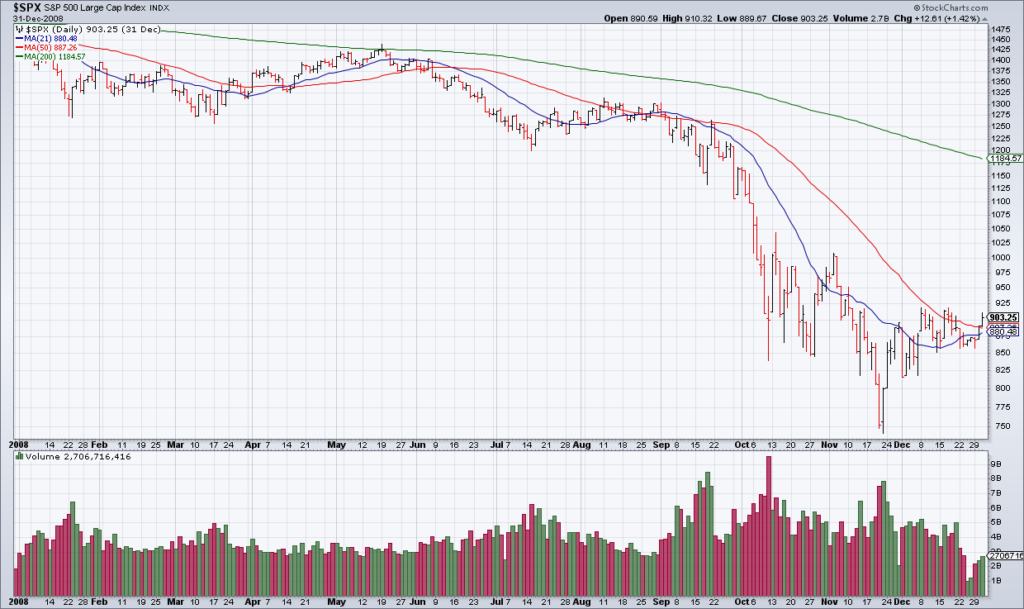

What does it mean? One thing it means is that the lows of the year – around 10,000 on the NASDAQ – are probably in and the 2008 analog – much touted by permabear Michael Kramer on Twitter – will not hold up. That is: there will be no late year crash to new lows.

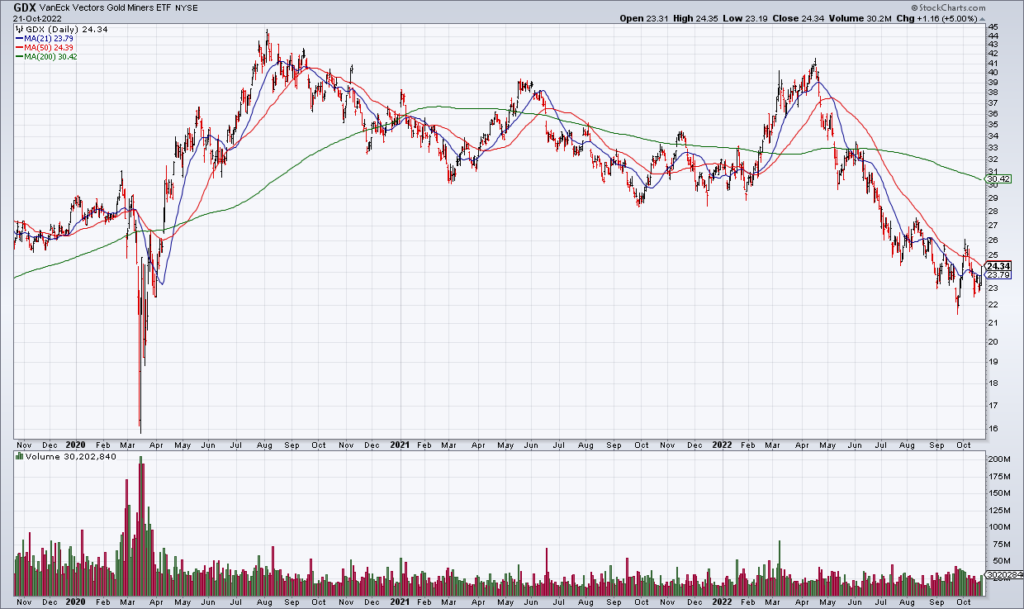

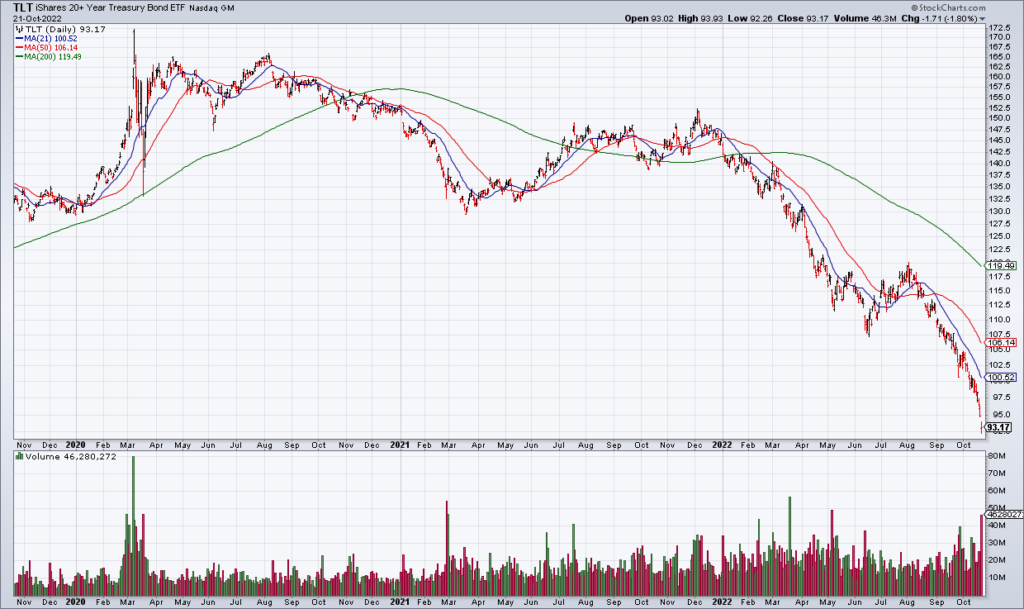

Another thing it means is that everything will rally. Inflation plays like the precious metals have been destroyed by Fed hawkishness and inflation itself has wreaked havoc on long term treasuries. A Fed pivot would take pressure off of the former and the realization that inflation is starting to come under control should lead to a rally in the latter as well.

The Fed should pivot. They have raised rates extremely quickly and it’s time for them to pause and take stock of the effects of what they’ve already done. The risks to inflation and the economy are now more evenly balanced and continuing to press ahead risks overshooting and something breaking. A pivot at this point would be good policy.

Finally a pivot would mean that investors could stop worrying so much about every Fed speech and focus more on company specific fundamentals. It’s been a very interesting – but exhausting – year from a macro perspective. And while macro themes will continue to be extremely important going forward perhaps they will be a little less so.