Will The Fed Please Shut Up

You don’t want to overdo the rate increases – Fed Governor Christopher Waller, quoted in Nick Timiraos, “Fed Leans Towards Another 75 Point Increase: Consensus Builds Against Larger Boost Despite Worry Over June Inflation Report” [SUBSCRIPTION REQUIRED], WSJ A1, Monday July 18

Federal Reserve officials talk too much – James Mackintosh, “Fed Causes Problems By Speaking Too Plainly” [SUBSCRIPTION REQUIRED], WSJ B1, Monday July 18

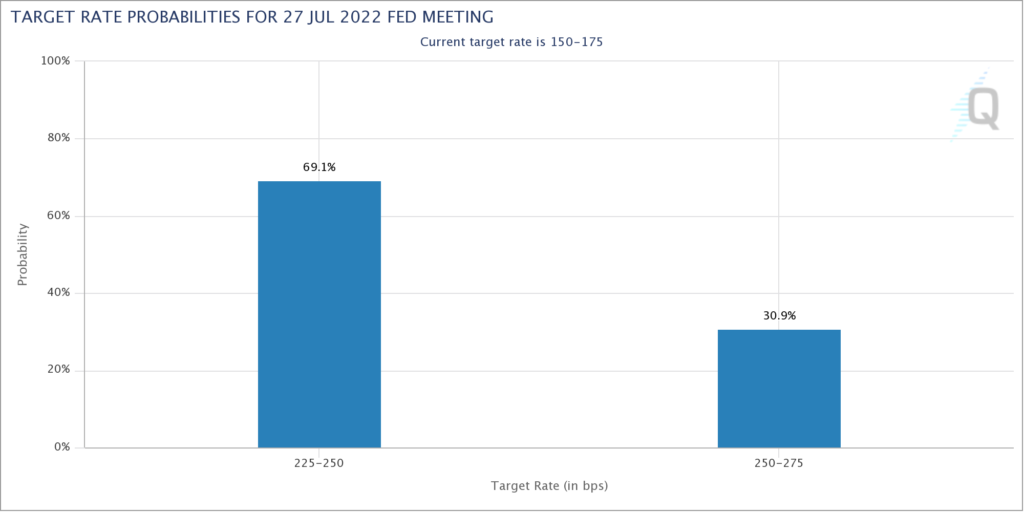

Will the Fed Please SHUT UP! Last Wednesday morning the June CPI Report came in hotter than expected at 9.1% and the talking heads went bananas. At one point on Friday the Fed Futures were pricing in an 80% probability of an unprecedented 100 basis point hike on July 27. The great Jim Bianco went on Fast Money calling for 100 basis points in July and another 75 in September. At that moment it seemed like a certainty.

Until the Fed started walking it back. To relieve any doubt, Nick Timiraos – The Fed Whisperer – wrote a front page story in today’s Wall Street Journal saying that the Fed is strongly leaning toward a 75 basis point hike. This isn’t Timiraos’s opinion. Everybody knows the Fed communicates with him to influence market perception. So 75 points it is.

But – as James Mackintosh wrote in a perfectly timed piece in this morning’s Wall Street Journal – the Fed needs to reconsider its policy of forward guidance. Investing has become almost entirely about handicapping the Fed at this point. In addition to hamstringing the Fed’s policies based on its forward guidance, investors are spending more time worrying about the Fed’s next move than analyzing economic fundamentals. It’s ridiculous for a supposedly free market economy to be so attuned to every shift of its monetary central planner. The Fed needs to stop trying to hold investors’ hands, do what’s right for the economy, and let the market sort things out for itself.