Earnings/Growth: The Next Domino To Fall

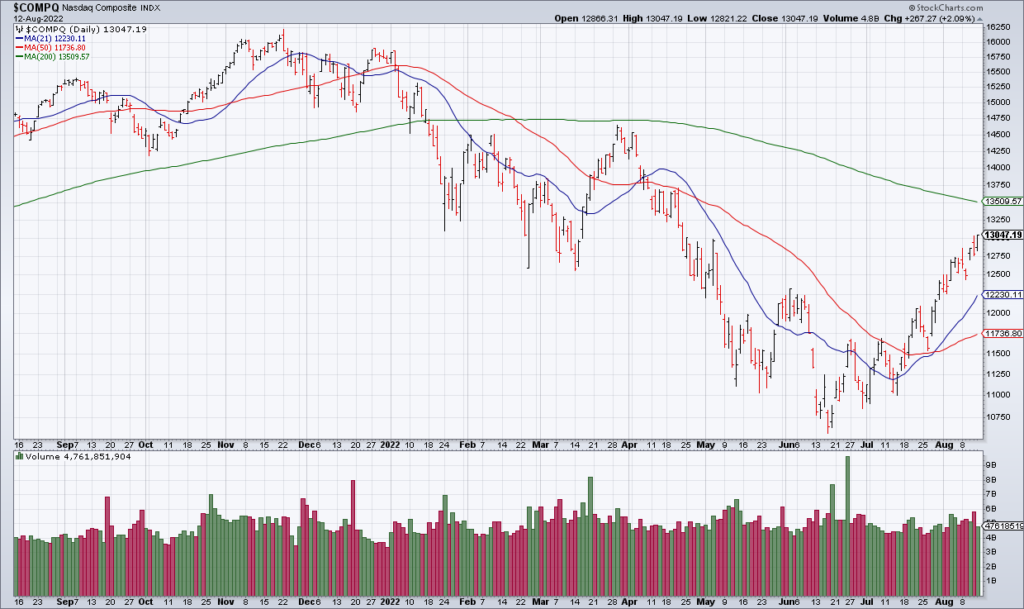

The market is in a happy place right now. Last Wednesday’s cooler than expected July CPI Report cemented the belief in The Peak Inflation Narrative and The Fed Pivot. The idea is that inflation has peaked and therefore the Fed will be able to ease its foot off the gas somewhat in its fight against inflation. This loosening of monetary policy relative to expectations will in turn relieve pressure on risk assets. In many ways, Wednesday’s CPI Report is being viewed as Mission Accomplished and the belief can be felt in certain corners of a soft landing and a new bull market.

Unfortunately it’s not likely to be that easy because businesses are telling us inflation and the monetary tightening that has already taken place are putting a damper on profitability and growth. Let’s start with the retailers Walmart (WMT) and (TGT). Both companies have told us that inflation is squeezing consumer spending. As consumers have to spend more on necessities like gas and groceries, they are cutting back on durables and discretionary items with higher margins. Both TGT and WMT announced significant cuts to operating margin guidance as a result. Take a look at the gap downs in the two charts above.

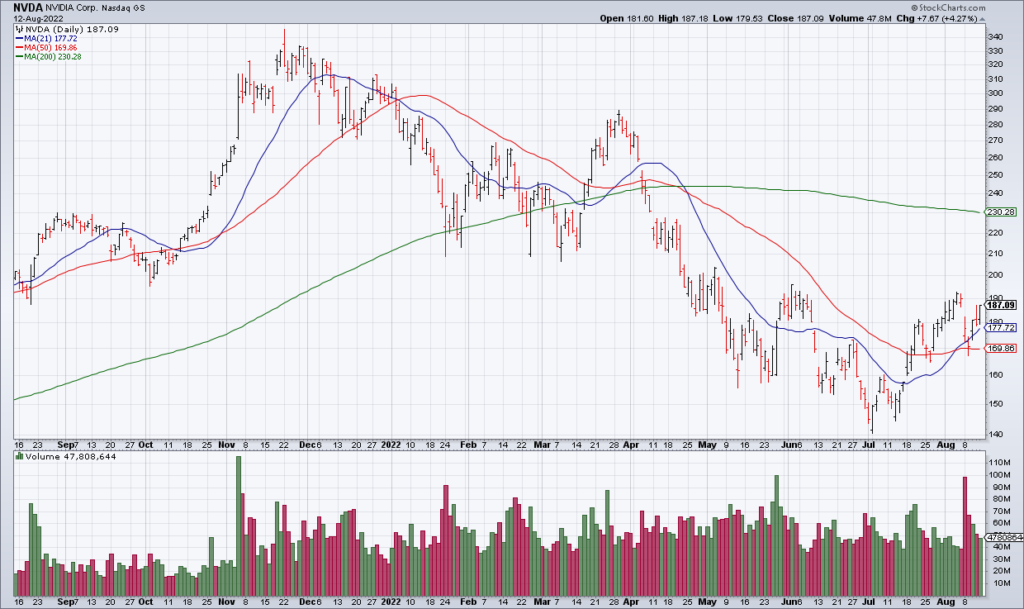

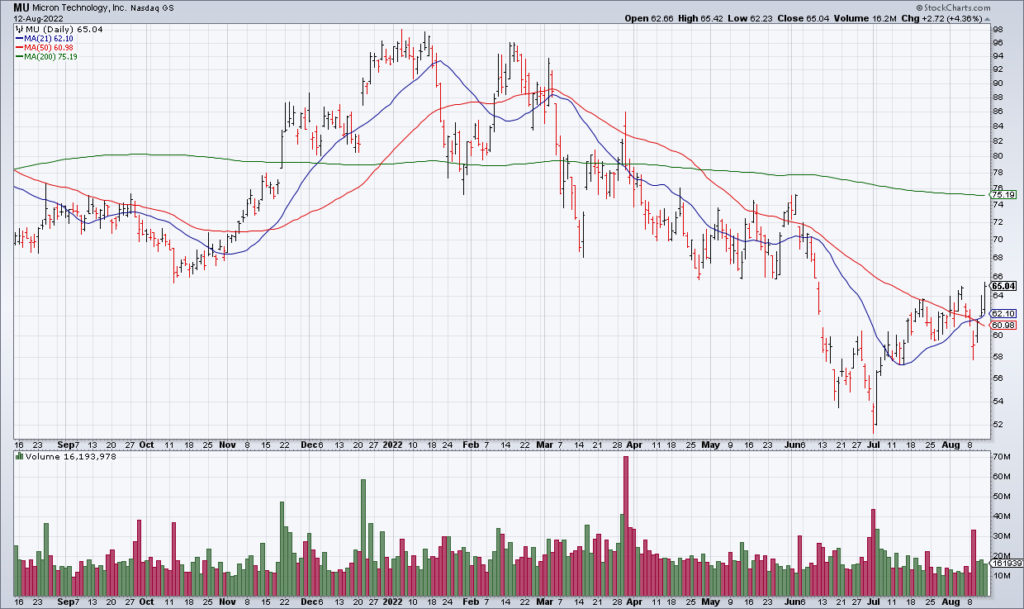

And last week semiconductor companies Nvidia (NVDA) and Micron (MU) significantly cut revenue and margin guidance. After all the talk about a semiconductor shortage during the supply chain crisis not too long ago all of a sudden the demand isn’t there. In my opinion that’s a result of the tightening the Fed has already done making its way through the system and it will be felt in other areas of the economy as well.

So while the market is celebrating the victory over inflation, the earnings and growth domino is about to fall. That’s why I believe the easy money has been made in the current bear market rally and it’s time to start to position for what comes next. All the monetary excess of the last 15 years has created enormous imbalances in the economy and it’s going to take a lot more than six months to right them.