FRG Is An Interesting Value Play

WSJ Heard On The Street columnist Jinjoo Lee profiled an interesting value stock – Franchise Group (FRG) – that I’d never heard of before in this morning’s paper (“A Dose Of Vitamin Shoppe Can Be Healthy” [SUBSCRIPTION REQUIRED]).

FRG reported 2Q22 earnings last Thursday afternoon and they were not good. They lowered full year guidance across the board: Revenue from $4.45 billion to $4.3 billion, Adjusted EBITDA from $450 million to $390 million and Adjusted EPS from $5 to $4. The stock dropped ~10% the following day creating a nice set up for potential new investors.

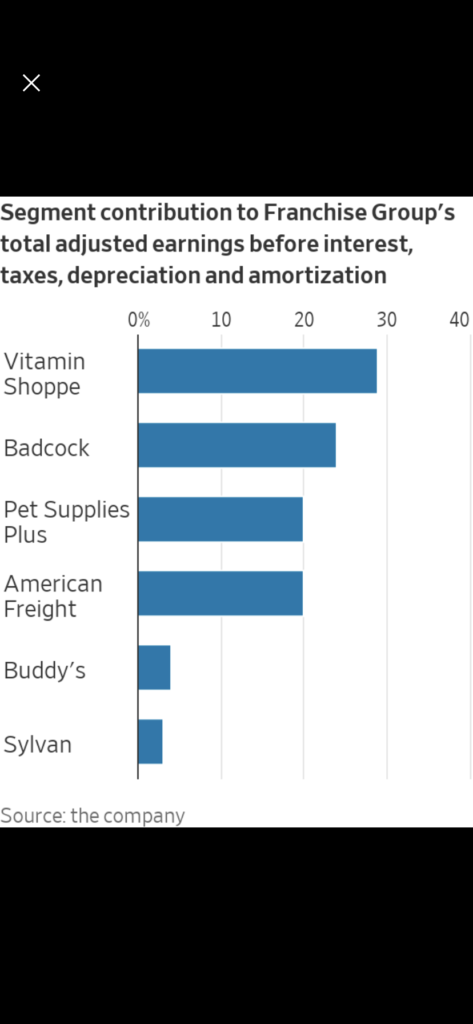

FRG is a conglomerate with six main divisions: Vitamin Shoppe, Badcock, Pet Supplies Plus, American Freight, Buddy’s and Sylvan. Badcock, American Freight and Buddy’s are home furnishing companies which are likely to struggle going forward as inflation squeezes consumers and the housing market cools down. Vitamin Shoppe, Pet Supplies Plus and Sylvan – a tutoring company – are more interesting. All grew same stores sales in 2Q22, according to Lee.

While the combination of businesses is good though not great and all the brands are second or third best in their category, it’s the valuation that is FRG’s real draw. With a market cap of $1.4 billion, FRG is trading at less than 4x their full year Adjusted EBITDA guidance and less than 9x their Adjusted EPS guidance. In addition, the stock pays a juicy 7.28% dividend. Even though markets are currently declaring victory over inflation, if you are like me and believe inflation is likely to be stickier than expected value stocks like FRG are a better bet than growth stocks going forward. In other words, the macro environment is somewhat favorable for FRG.

In addition, FRG has an opportunity to grow the percentage of its stores that are franchises. Currently 40%, Oppenheimer analyst Ian Zaffino thinks the company can increase that to 90%. Franchising can be a quite lucrative business model.