WSJ A1: Rising Rates Start To Ripple Through Economy

Rising Treasury yields are cascading throughout the economy in the form of higher borrowing costs, squeezing households and businesses alike. Car loans, credit cards and corporate debt all stand to get more expensive as rates rise – “Surging Interest Rates Start To Ripple Through Economy” [SUBSCRIPTION REQUIRED], Saturday 4/9

When Jennifer Osorio began making plans to buy a house in Houston at the beginning of the year she thought she could get a mortgage with about a 3.5% rate. Instead, when it came time to make an offer the best she could find was 4.99%. Because she wanted to cap her monthly payment at $1200 she had to adjust her search down to condos instead of homes and look further away from the school where she teaches. This anecdote is just one of many that rising interest rates are forcing on governments, businesses and consumers throughout the economy.

The first order effects are stifling enough: rising mortgage, loan, bond, credit card and auto loans all make things more expensive. However, it doesn’t stop there; there are second order effects. If I’m paying more to finance my credit card debt, for example, I have less money to spend elsewhere and so I’ll have to cut back on something. If a business is paying more to carry its debt, it will have less money to spend on jobs, operating expenses or capital; it, too, will have to cut back somewhere. Rising interest rates are economically contractionary – especially in a highly indebted world like the one we live in.

Rising interest rates also make financial assets less valuable by increasing the discount rate used in Discounted Cash Flow (DCF) models. If I can now get 3% “risk free” compared to 2% previously, future earnings are less valuable reducing the intrinsic value of all financial assets – especially growth assets with much of their value in future earnings.

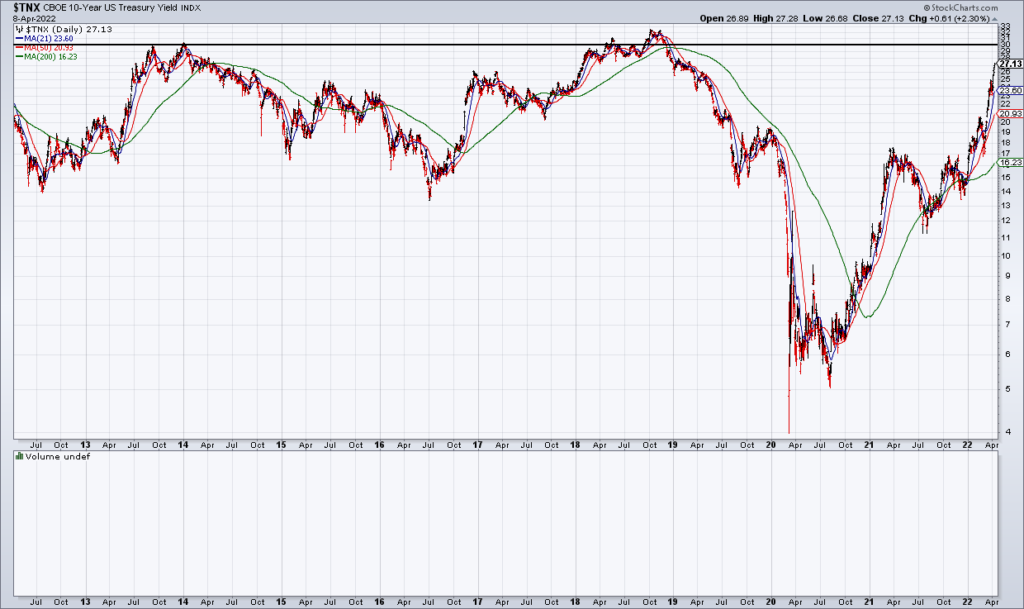

There’s really no more important economic metric in the world today than the yield on the 10 year treasury. And as you can see in the chart at the top of this blog, we’re approaching 3% and levels we haven’t seen in a decade. If you think this won’t affect the economy, I’d suggest you’re denying the economic equivalent of the law of gravity.