March CPI Comes In Hot But S&P Holds 5150

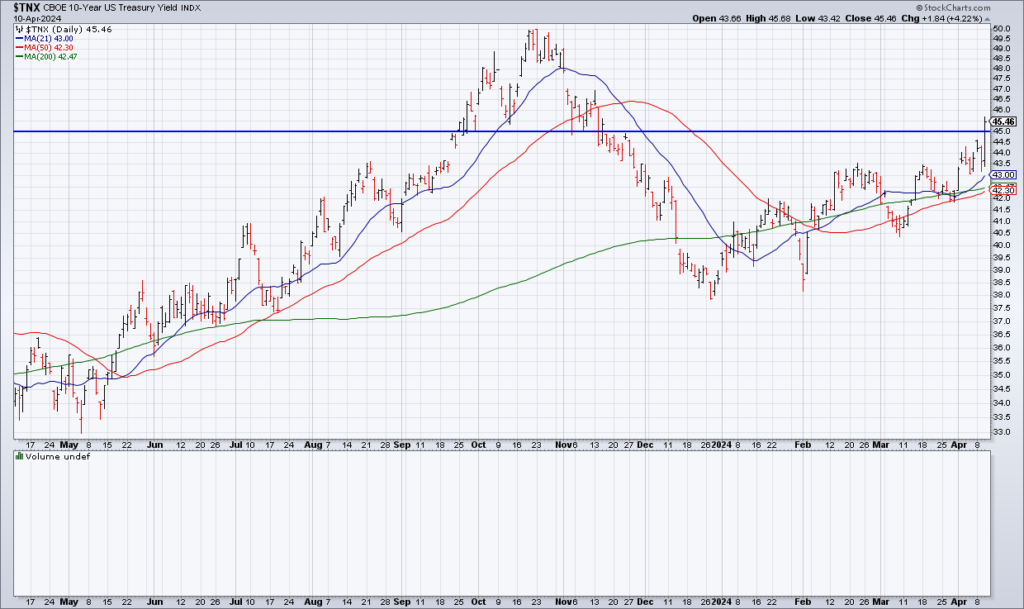

The March CPI Report came in hotter than expected Wednesday morning with both headline and core increasing 0.4% from a month earlier – compared to expectations (and hopes) of 0.3%. As a result, stocks fell and the yield on the 10-year treasury jumped 20 basis points to over 4.5%. However, the S&P did hold 5150 which was the closing low on last Thursday’s big reversal and therefore represents support.

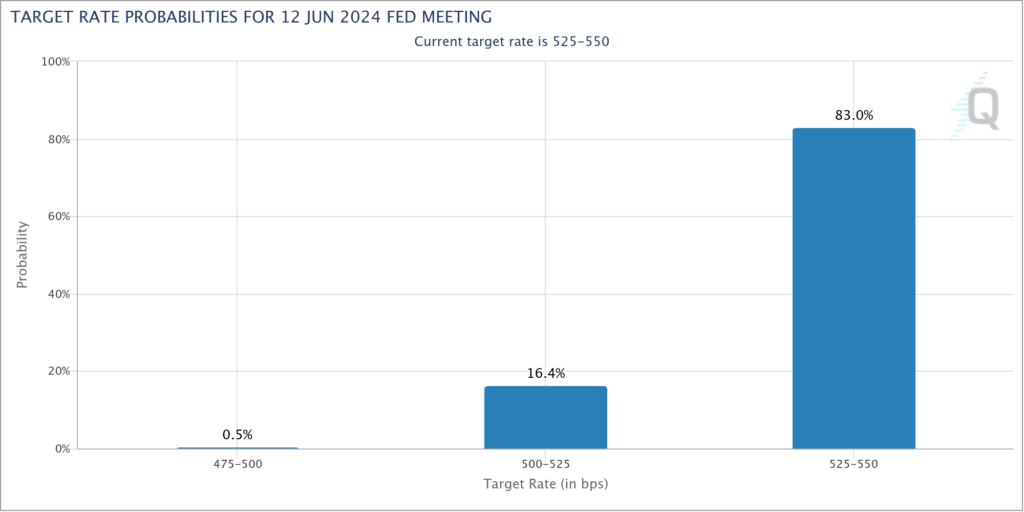

I’m surprised stocks didn’t get hit harder given that the report essentially took a June rate cut off the table. As you can see in the Fed Futures chart above, the probability of a cut on June 12 is now only 17%. Economists at Goldman Sachs and UBS, who previously expected three cuts this year starting in June, now anticipate only two cuts in July and September (“Hot Inflation Report Derails Case For Fed June Rate Cut” [SUBSCRIPTION REQUIRED], Sam Goldfarb and Nick Timiraos, WSJ A1, Thursday April 11).

Aaron Back and other stock market bulls see yesterday’s selloff as a buying opportunity because they think the economy can withstand higher rates for longer (“Buy The Stock Market’s Inflation Freakouts” [SUBSCRITION REQUIRED], WSJ, Thursday April 11). But economic logic and the historical evidence suggest that keeping rates elevated for longer increases the risk of throwing the economy into a recession (“Fed Rate Hiking Cycles And Recessions: A History Lesson”, Top Gun Financial, April 4).