March CPI Preview

The moment has finally arrived: The BLS will announce the March CPI at 8:30am EST Wednesday. Trading has been subdued this week as investors position ahead of the report. While Tuesday was not a third consecutive inside day, its price action did all take place within the range of trading from last Thursday’s big reversal. Whichever side of that range – 5150 to 5250 – the market breaks out of is likely the direction of the next move. The March CPI is likely to determine that direction.

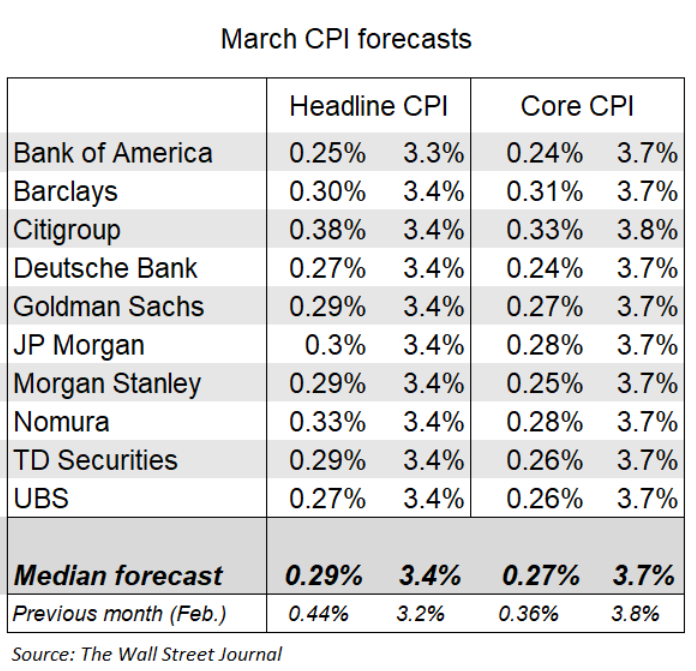

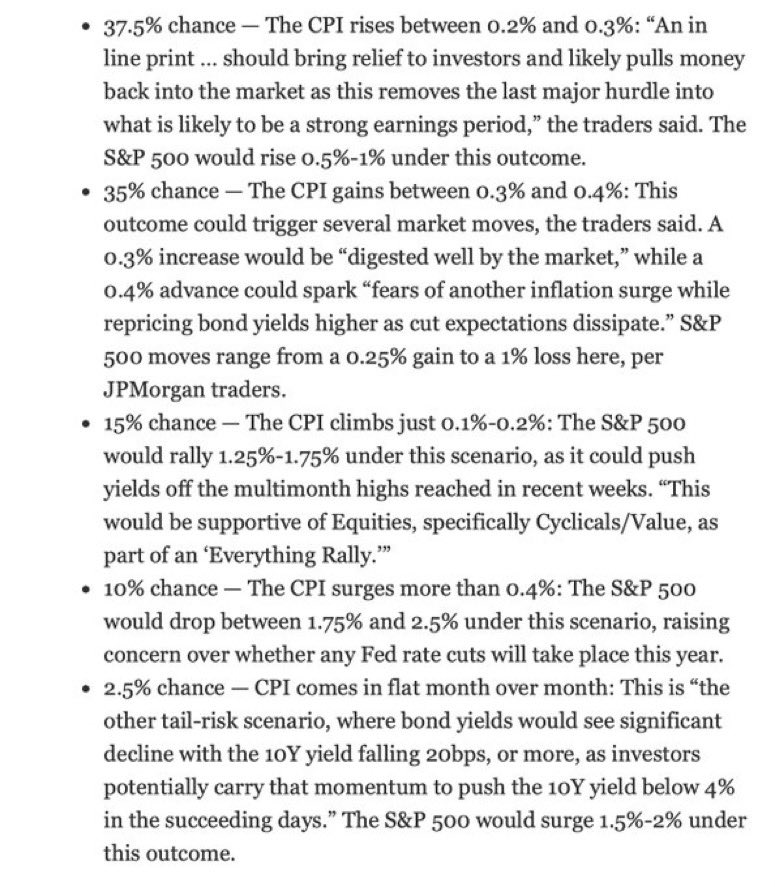

In the first chart above from Nick Timiraos, you can see all the bank’s estimates for the March CPI. The median forecasts for headline and core CPI are 0.29% and 0.27%, respectively. In the second chart, you can see JP Morgan’s breakdown of how things are likely to play out under different scenarios. JP Morgan thinks there’s a 37.5% chance of headline CPI coming in between 0.2% and 0.3%. That would be an “in line report” that would support the Fed cutting in June and would likely be met with a rally of 0.5% to 1%.

On the other hand, they think there’s a 35% chance of headline CPI coming in between 0.3% and 0.4%. A 0.3% increase or something close would we be “well digested” by the market, probably resulting in a small bounce. However, anything approaching 0.4% would cause “fears of another inflation surge”. Under that scenario. it would not provide an all clear for the Fed to cut in June and the market would be down up to 1%.

Get a good night’s sleep because Wednesday is likely to be an important day.