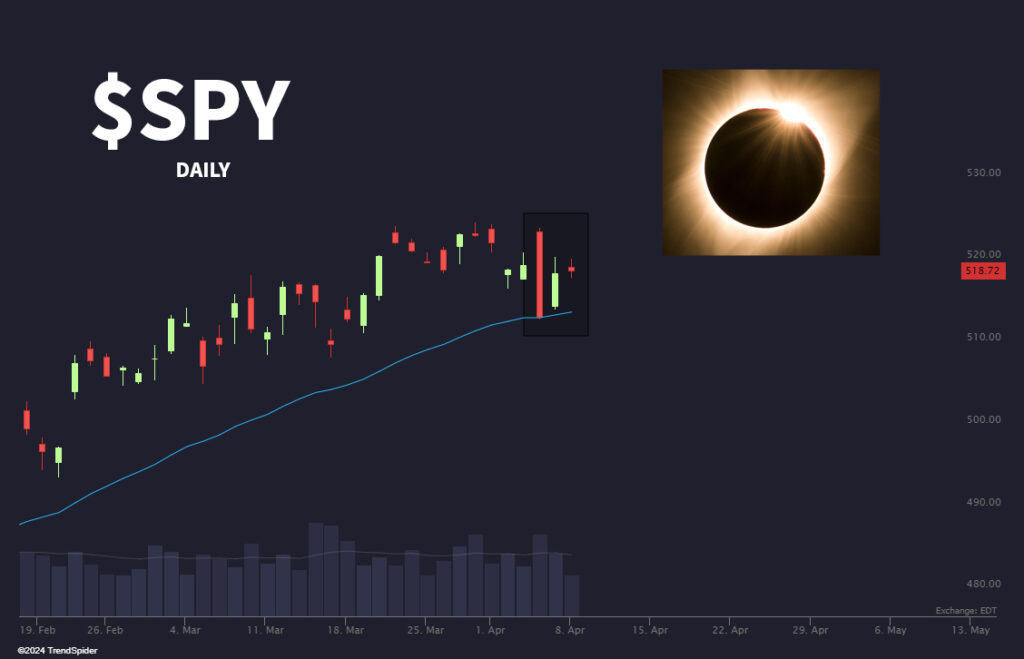

Monday Was Another Inside Day As Stocks Coil Ahead Of The March CPI

Last Thursday the market opened strong only to roll over hard into the close. The S&P had a 100 point range of approximately 5150 to 5250. Friday was an inside day in which all of the price action took place within Thursday’s range. Inside days are consolidation days as active market participants are unsure about which direction the market is going to take next. Incredibly, Monday was a second consecutive inside day – as you can see in the chart above from Trend Spider – with all of its price action taking place within Friday’s range. What is going on? I think the market is coiling and looking for direction ahead of Wednesday morning’s much anticipated March CPI Report.

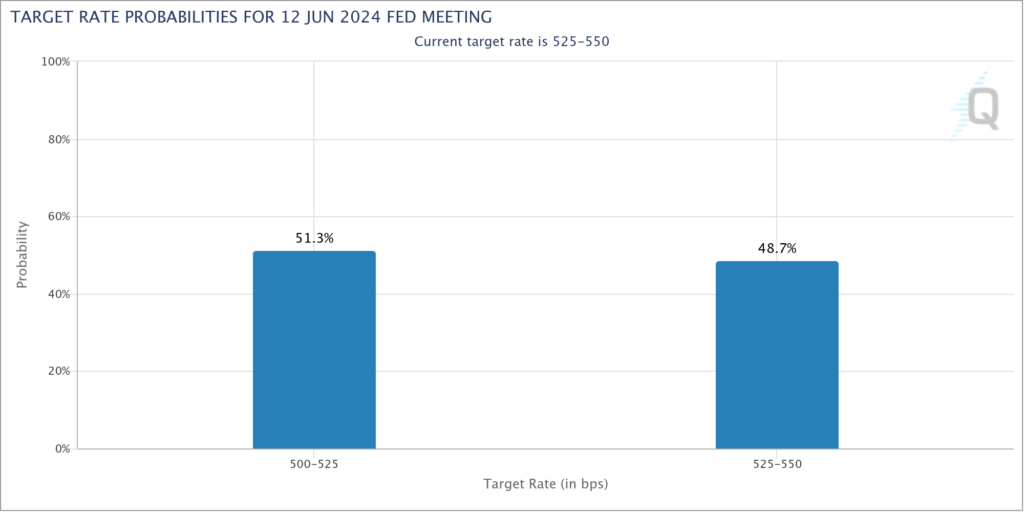

Adding to the drama, the Fed Futures are split 50/50 on whether the Fed will cut rates by 25 basis points on June 12. As I wrote on Friday morning, the June Fed Decision has even greater significance because there are only two more Fed Meetings after it before the 2024 Presidential Election. With the Fed not wanting to appear political, June may be the only live meeting in which cutting is on the table ahead of the election. To maintain the appearance of political neutrality, some think they will pause on July 31 and September 18.

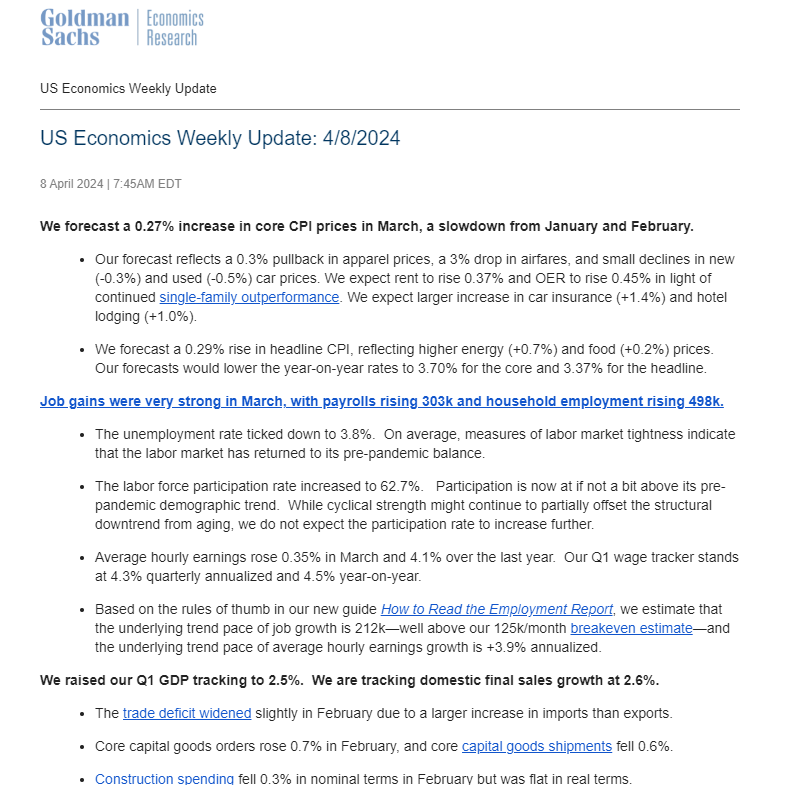

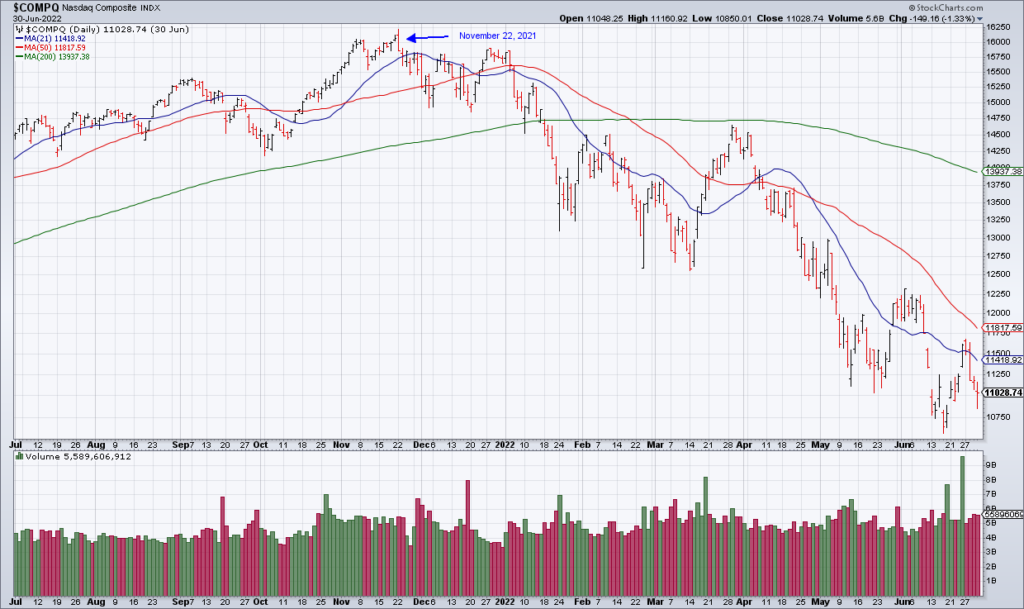

In sum, Wednesday morning’s March CPI Report may determine which side of the 5150 to 5250 range the market breaks out from. Goldman is expecting Core CPI to increase by 0.27% and JP Morgan 0.28%. If the number comes in dovish, we are likely to breakout higher and make new highs. If it comes in hawkish, the market may break down below it, lending support to my intuition that Thursday’s bearish engulfment was similar to the one on November 22, 2021 that marked the end of last bull market.