The Fab 5 Are Priced For Perfection Heading Into 1Q Earnings

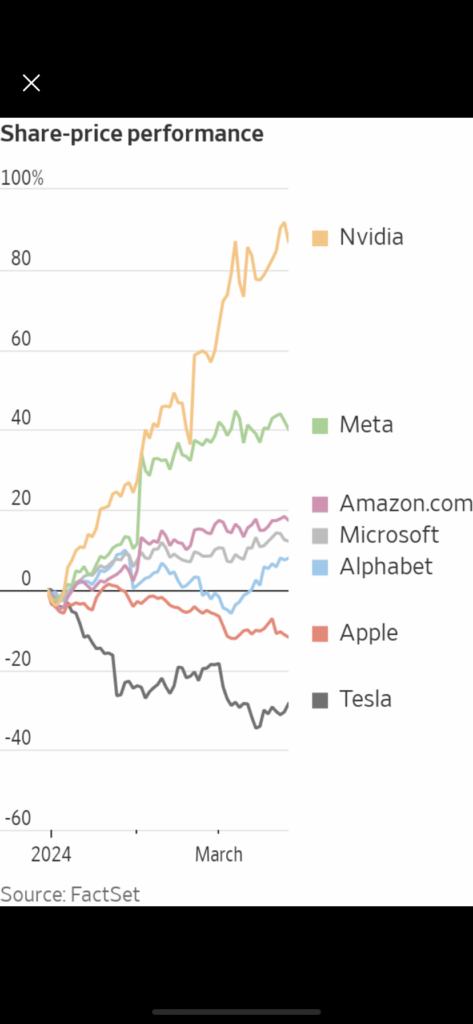

Thursday was a disappointing day for the bears as there was no follow through below 5150 after the hotter than expected March CPI Report Wednesday morning. In fact, the market grinded higher all day led by mega cap tech. There was some news about Apple (AAPL) revamping its Mac line with AI-focused chips. AAPL has been perceived to be lagging in AI and so the news lit a fire under shares, sending them up 4.33%. Nvidia (NVDA) rode AAPL’s coattails, rising 4.11%. All in all the QQQ – dominated as it is by the Mag 7 – rose 1.60% while the Equal Weight S&P (RSP) was barely up on the day (+0.7%). While RSP recently broke out to new all time highs above $158 in February, it’s been correcting the last couple of weeks. This market is still all about the Mag 7.

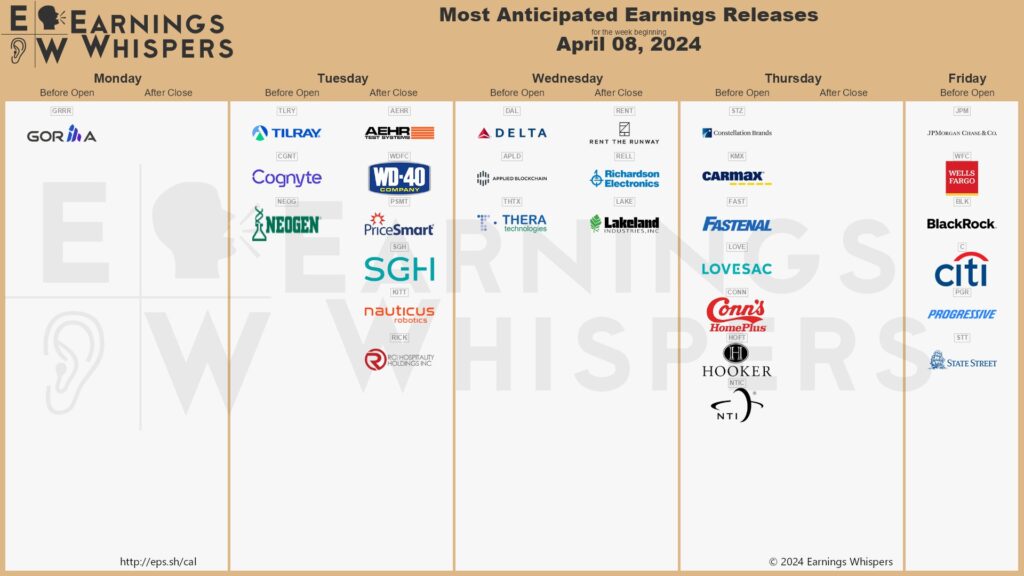

And so we move on to 1Q24 earnings season which begins in less than an hour with the big commercial banks. The banks have been exceptionally strong led by JP Morgan (JPM). Clearly they are pricing in a soft landing and no recession. I’ll be anxious to see their loan growth and and quality of their loans through 1Q24.

But the real earnings story, once again, will be the Mag 7. I have already addressed how fully valued Nvidia (NVDA) and Facebook (FB) are in “The Dissection of the Market That Underlies My Skepticism” (also see the blogs on each stock’s valuation linked to in that post). It’s hard for me to see these two leading stocks – which have contributed nearly 40% of the market’s YTD gains – moving much higher.

Apple (AAPL) and Tesla (TSLA) have already broken down. That leaves Microsoft (MSFT), Google (GOOG) and Amazon (AMZN). All three stocks closed at all time highs – or very close to them – on Thursday. But the valuations are already quite full in each case. Take the biggest one, Microsoft (MSFT), at $3 trillion. EPS is looking to grow ~25% in 2024 from $9.81 in 2023 to $12.26. But at its closing price of $427.93 on Thursday, that’s 35x current year earnings. How much higher can it go? I believe the same kind of analysis applies to GOOG and AMZN.

While the market shook off the hotter than expected March CPI Report on Thursday and the repricing of the Fed Futures from three Fed rate cuts to two this year – to my surprise – I personally don’t see 1Q24 earnings season as being a catalyst for another leg higher given how full the Mag 7’s valuations are. I continue to believe that this market is about to hit an “air pocket”, sending it down 20% in a matter of months.