The Dissection of the Market That Underlies My Skepticism

Perhaps the key technical argument about the market has to do with the breadth of the rally. Bears argue that the market is thin – being led by only a few mega cap stocks. Bulls argue that many more stocks are participating. Both are right.

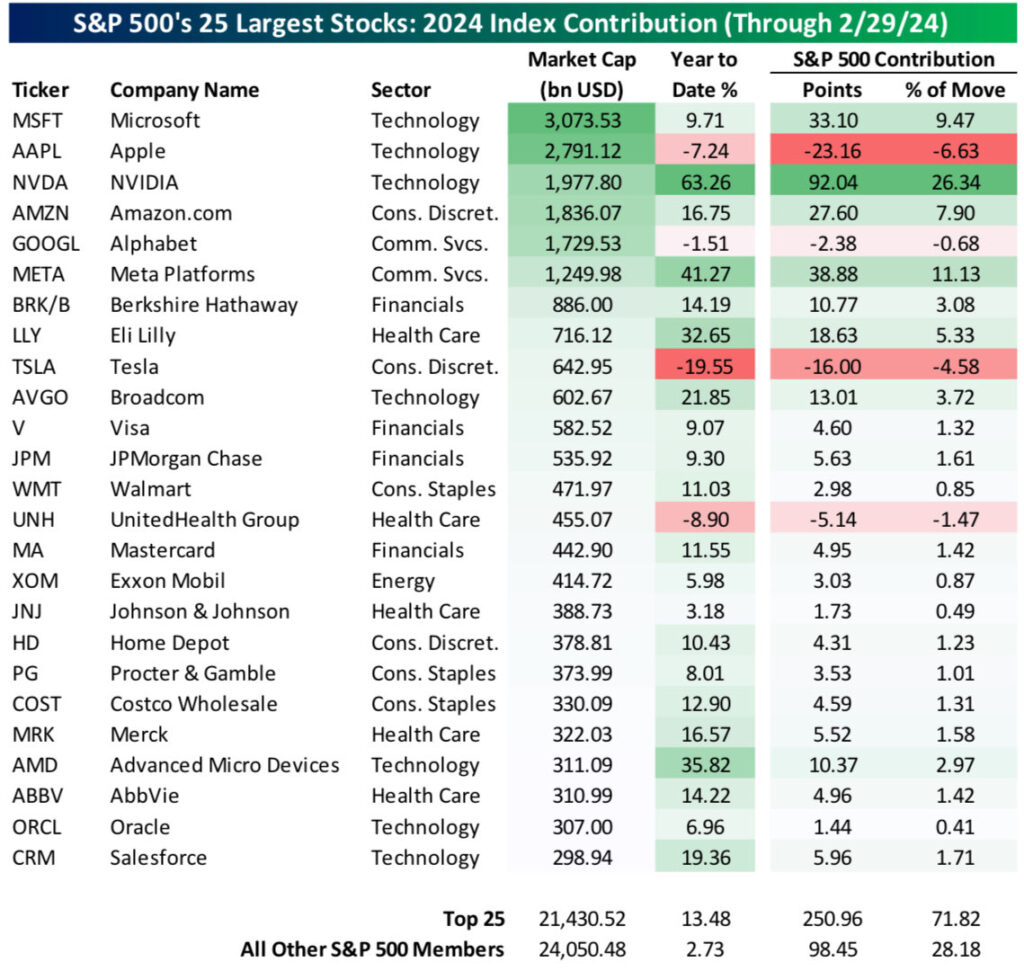

As you can see in the chart above of the NYSE Advance/Decline line which sums the Advancers minus the Decliners on the NYSE on a daily basis, more stocks by far have been advancing than declining on a daily basis for the last four months. On the other hand, when you look at the chart above by BeSpoke, you can see that Nvidia (NVDA) and Facebook (META) accounted for 37.5% of the S&P’s gain through February. Microsoft (MSFT) and Amazon (AMZN) contributed another 17.5%. In other words, four stocks account for more than half of the S&P’s gains this year. The rally has in fact broadened out over the last few months but gains at the index level are being driven by a few mega cap tech stocks.

Make of that technical evidence what you will, from a valuation perspective I also have big concerns. We all know by now that NVDA is only trading at 30x current year earnings. But that’s not the issue. The issue is the sustainability of the earnings over the next few years (see “Don’t Call It A Bubble”, 2/29). In other words, NVDA may still be overvalued at 30x current year earnings.

The same same thing applies to META. As I wrote in “META; 2024 Is Bound To Disappoint” (2/2), META’s “Year of Efficiency” led to a tremendous improvement in margins and profitability – and therefore stock price performance. But most of the gains from cost cutting have been achieved and 2024 will not be a repeat of 2023.

The same kind of valuation analysis applies to some of the other mega caps that are performing well. Take Costco (COST) and Broadcom (AVGO) – each of which is a top 25 market cap company. (Both companies report earnings Thursday afternoon). COST at 50x earnings is insane. As high quality a company as it is, it just isn’t worth that valuation. Further gains will only come from momentum and multiple expansion rather than fundamental reasons.

Now consider AVGO – “the poor man’s Nvidia”. AVGO is an important stock with a nearly $600 billion market cap that was +22% and contributed 3.72% of the S&P’s YTD gains through February. Three months ago, AVGO guided FY24 revenue to $50 billion and Adjusted EBITDA to $30 billion, which includes the VMware acquisition. 20x EBITDA is hardly cheap for a company delivering single digit revenue growth. It will be very interesting to see if the AI mania is going to show up in AVGO’s FY24 guidance when they report Thursday afternoon.

While bullish technicians are right that the rally has broadened out, the mega cap names – especially tech – are still driving gains at the index level and from a valuation standpoint they are fully valued at best. Further gains in these names can only come from momentum and multiple expansion, not fundamental reasons. It’s hard for me to be bullish on the market as a whole given this analysis.