TGT Earnings, Powell On Deck

Target (TGT) reported solid earnings this morning. Full year 2023 EPS came in at $8.94 versus $6.02 in 2022 and TGT guided 2024 to $8.60-$9.60. Comps came in at -3.7% for 2023 but the company guided 2024 to 0% to +2%. In other words, there is reason to think the company is turning things around from its recent problems and as a result shares have jumped 12% at the open.

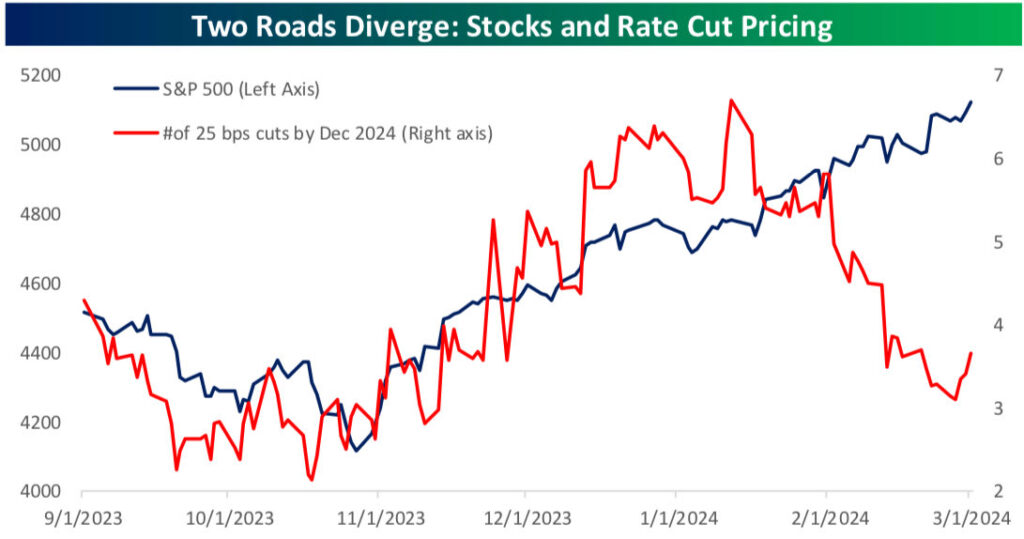

Fed Chair Powell is set to testify in front of Congress Wednesday and Thursday. Stocks are selling off today in anticipation of his “higher for longer” narrative. It’s interesting to note that this four month rally was at first premised on a Fed Pivot and up to 6 rate cuts in 2024. As the economy and inflation have held firm, that forecast has come down 3 rate cuts but the S&P has continued to trend higher. Either the market is no longer worried about any economic weakness or it has simply disconnected from fundamentals. Powell may try to take a little wind out of stocks’ sail tomorrow.

Lastly, Super Micro Computer (SMCI) breached $1150 Monday on its inclusion in the S&P 500 but then reversed into the close and has continued lower today. SMCI is not an important stocks except as a sentiment tell. Most investors are keeping an eye on it at this point.