The Fed Pivot Has Created A Moment Of Maximum Optimism, ORCL & ADBE Suggest Many Stocks Are Fully Valued, COST Is Too

The time of maximum pessimism is the best time to buy and the time of maximum optimism the best time to sell – John Templeton

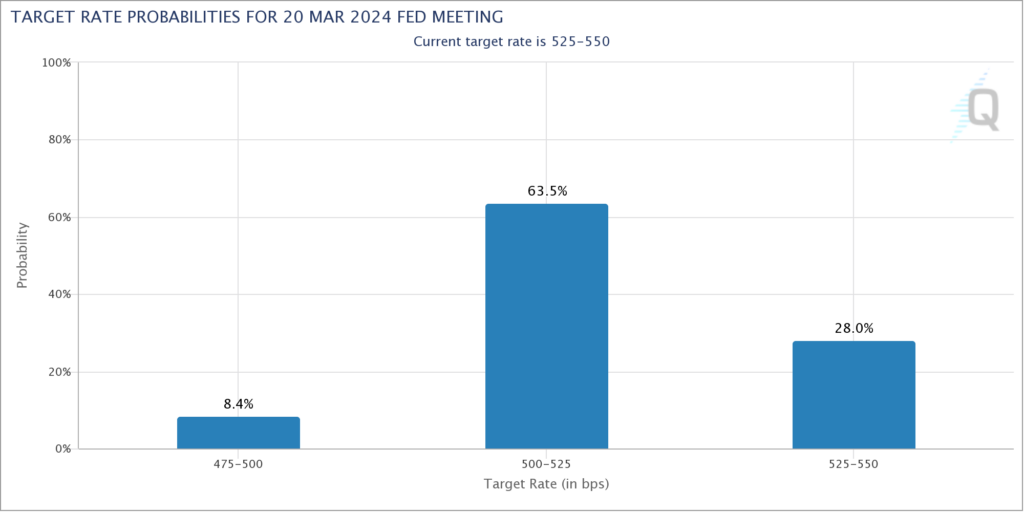

Powell and The Fed surprised the market Wednesday by changing their tune. Instead of their preoccupation with inflation, they pivoted to an equal concern with their other mandate: full employment or the economy. In other words, Powell confirmed that the Fed is done hiking rates and may well cut them shortly. Fed Futures Markets are pricing in more than a 70% chance of at least one cut by the Fed’s March 20, 2024 meeting.

Stocks and bonds – which were already in rally mode – levitated even higher after Powell’s press conference. The biggest moves have been in the small caps which stand to benefit most from easier money and bonds. As James Mackintosh wrote in today’s WSJ, a soft landing is now fully priced in (“Beware The Most Crowded Trade On Wall Street: Next Year’s Soft Landing” [SUBSCRIPTION REQUIRED]). Sentiment is euphoric and many are sure to pile in believing higher prices are now a sure thing but I personally took profits on many positions yesterday, including reducing my massive long term treasury (TLT) position.

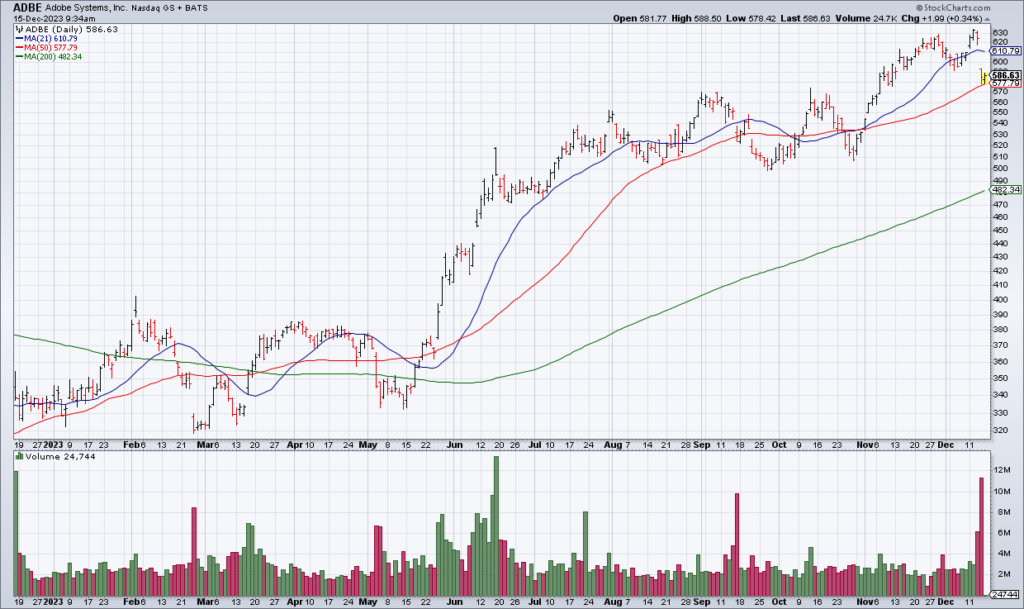

Oracle (ORCL) got spanked on Tuesday after reporting less than hoped for revenue growth Monday afternoon and Adobe (ADBE) followed suit yesterday as I suggested it might. ADBE forecast 10% revenue growth for FY24 and yet is still trading at more than 30x its FY24 EPS guidance. The AI hype seems to have pushed the stock beyond its intrinsic value and I remain short.

Another stock that looks fully valued to me is Costco (COST). COST reported an inline quarter yesterday as well a $15 special dividend. The stock is +$19 at the open and trading above 40x my current year EPS estimate so I took profits here as well just now.