Fed Rate Hiking Cycles And Recessions: A History Lesson

In “The Market Will Soon Hit An Air Pocket And Drop 20% In A Matter Of Months” (Thursday March 28) the second reason I gave for the coming crash was:

Monetary policy acts with a lag and will hit the economy shortly. Historically, when the Fed hikes rates so much, it causes the economy to roll over into a recession. The lack of impact on the economy so far this time around has caused many to assume it’s not coming. But it is. There are extremely sound economic reasons why tightening the money supply so much slows down the economy. It’s not different this time.

In this blog I want to review the historical evidence for this claim going back to the Volcker Era.

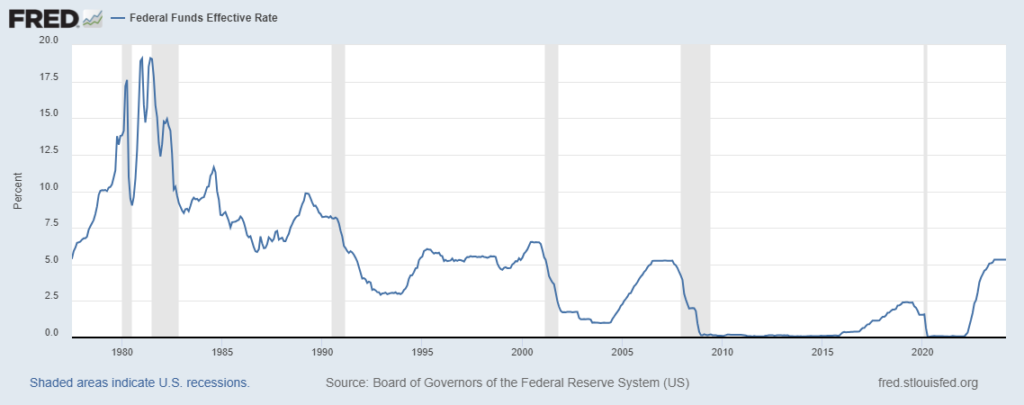

In the chart at the top of this blog, you can see the Federal Funds Rate going back to 1977 in addition to periods of recession shaded in grey. If you look closely, you can see that fed rate hiking cycles are invariably followed by recession.

Paul Volcker was installed as Fed Chair on August 6, 1979 by President Carter in order to beat back raging inflation. Due to huge federal deficits to pay for Lyndon Johnson’s War On Poverty as well the Vietnam War and OPEC’s oil embargo and manipulation of the oil supply, inflation was out of control in the 1970s under Chair Arthur Burns. Volcker came in with a mandate to crush it and that’s exactly what he did – by massively raising the Federal Funds rate.

But it was not without cost. As a result of such tight money, the economy rolled over into nasty recession. You can see this in the grey shading in the chart at the top of the blog. It wasn’t until the Fall of 1982 – three years after Volcker came in as Fed Chair – that the stock market bottomed, ending the secular bear market of 1966-1982, and the roaring bull market of the 1980s and 1990s began.

There was a brief recession in 1990 but let’s move forward to the Dot Com Bust. After cutting rates in the wake of the failure of the hedge fund Long Term Capital Management in the Summer of 1998, the Greenspan Fed started raising them. This played an important role in the collapse of the stock market bubble and the rolling over of the economy into recession.

The same thing happened when the Bernanke Fed raised interest rates in the middle of the 2000s. It put an end to the housing bubble which spilled over into the whole economy (subprime was not “contained” as Bernanke said it was in May 2007), tipping it into The Great Recession.

As we all know, over the last two years the Fed has significantly raised the Federal Funds rate from 0%-0.25% to 5.25%-5.50%. This was widely expected to cause the economy to go into recession in 2023. However, to the surprise of many including myself, that has not happened. As a result, people have come to believe that it won’t, that the economy is structurally stronger than in the past, that this time is different. My contention is that, for a variety of reasons, the lag with which monetary policy acts has been extended but has not disappeared this time around – and its effects will be felt shortly. History doesn’t repeat itself, Mark Twain famously said, but it does rhyme.