AZO Is Recession Proof

Autozone (AZO) is one of the few stocks in the market that has not broken down. That’s because its business – selling auto parts to consumers and repair shops – may be recession proof. You might not buy that new pair of Nike’s or go out to a fancy dinner when times are tough but you are likely to repair the car. No matter what you need to get to work and the kids need to get to school. A functioning automobile is a necessity in modern society.

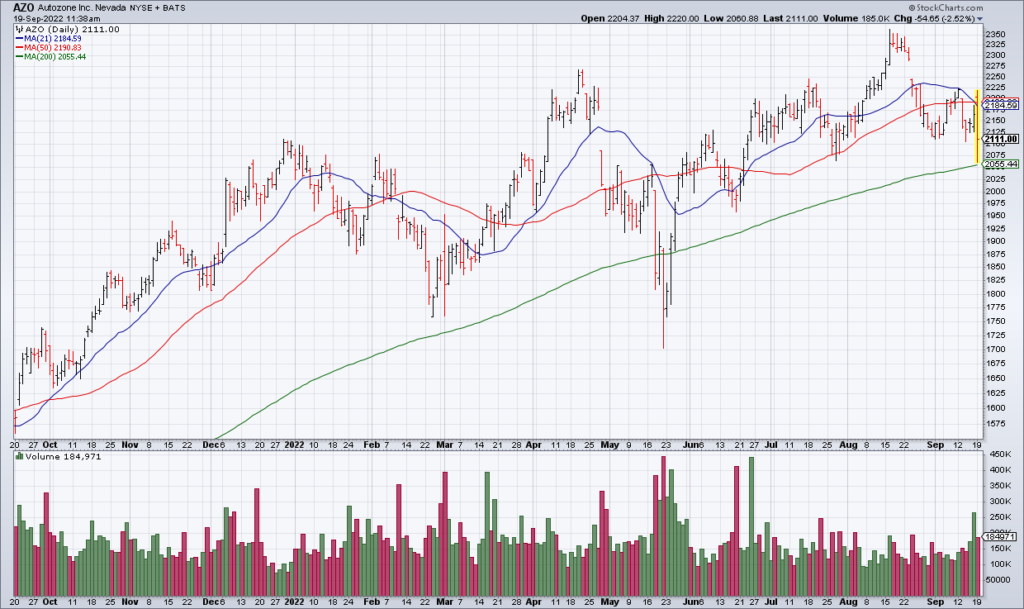

AZO’s FY224Q results out this morning bear this out. Comps for the quarter ended August 27 were +6.2% and EPS of $40.51 was +13%. For the fiscal year comps were +8.4% and EPS $117.19. I’m estimating comps +2.5% and EPS of $122.50 for FY23. At a current $2125 that’s a 17x multiple on current year earnings. Obviously I’d like to buy it cheaper but I’m not convinced the opportunity will come.

With the Fed tightening into a recession the inflation trade is over for the moment and it’s time to play defense. AZO suits the situation perfectly.