Value In T & PM

While the focus for Thursday’s trading session with be Tesla (TSLA) and Netflix (NFLX) after their respective 3Q23 earnings reports Wednesday afternoon, I’ll also be watching AT&T (T) and Philip Morris International (PM) after both reported their 3Q23 earnings this morning. Both are unloved value stocks with some upside IMO.

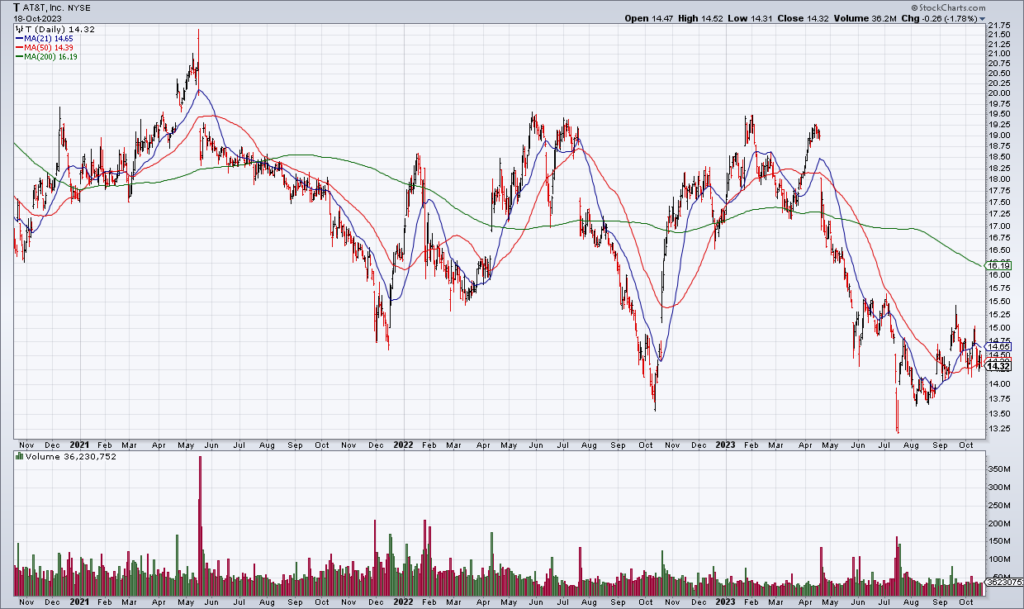

T has had a lot of problems obviously but it’s one of the two leading wireless carriers and I don’t think it’s going anywhere. 3Q23 revenue was +1% and adjusted EPS 64 cents. T also pays a 27.75 cent quarter dividend which works out to a 7.75% rate. While the dividend may get cut, it would still be high. T is a cheap stock that plays an important role in the economy and I’ll hold my 1% position. Shares are currently +4% in the premarket.

PM is another cheap, unloved stock that I like. While smoking is under political pressure, many people still smoke and will continue to do so. PM’s cigarette volumes were down only 0.5% from a year ago. PM is guiding 2023 EPS to $6.05-$6.08 which gives it a PE just north of 15 on current year earnings. It also pays a fat 5.45% dividend. I’ll continue holding my 1% position. PM shares are off marginally in the premarket.

Disclosure: Top Gun is long shares of T and PM.