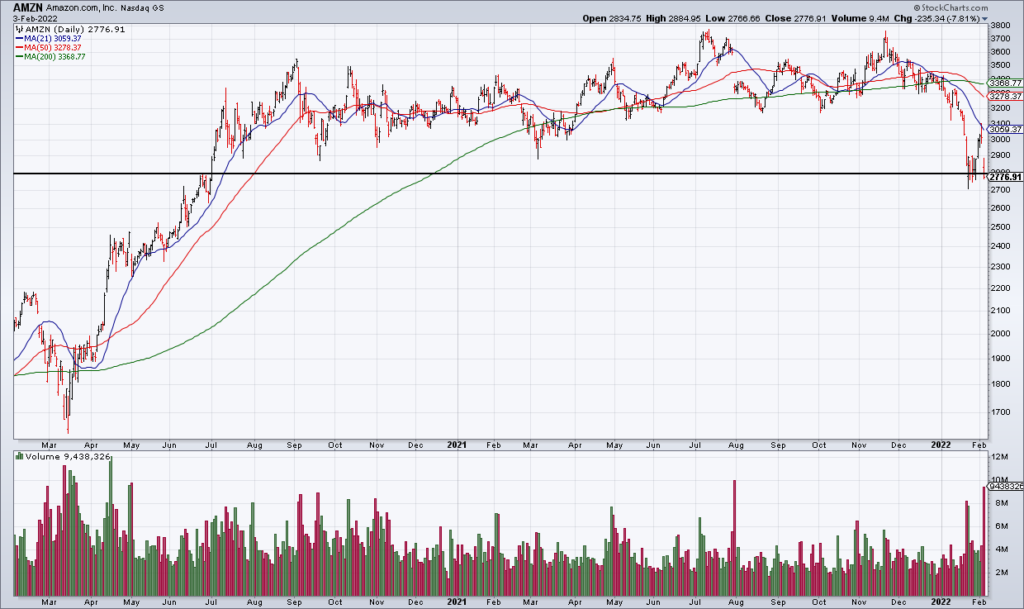

AMZN Saves The Market

The stock market got hit hard Thursday on the heels of Facebook’s (FB) terrible 4Q21 earnings report. The S&P was -2.44% and the NASDAQ -3.74% and the selling accelerated into the bell as investors feared a bad report from Amazon (AMZN) after the close that likely would have torpedoed the market Friday.

But Amazon’s (AMZN) report was “good enough” – though mixed. Overall Revenue was +9% compared to a year ago led by Amazon Web Services (AWS) which was +40%. A glaring weak spot was sales of AMZN’s own inventory from its online stores which was -1%.

In fact, operating income from AMZN’s retail operations was -$1.8 billion. AWS saved the day with operating income of $5.3 billion. This raises an important point: the great majority of AMZN’s value is in AWS, not the retail operations most of us know it for.

AMZN also reported blowout Diluted EPS of $27.75 but this number is misleading because more than three quarters of its pre-tax income came from gains in shares of electric vehicle maker Rivian (RIVN).

All the same, given the market’s oversold condition and the amount of fear, AMZN’s report was “good enough” and its shares are currently +17% in the after hours and giving a lift to the rest of the market.