How To Play A “Hawkish Pause”

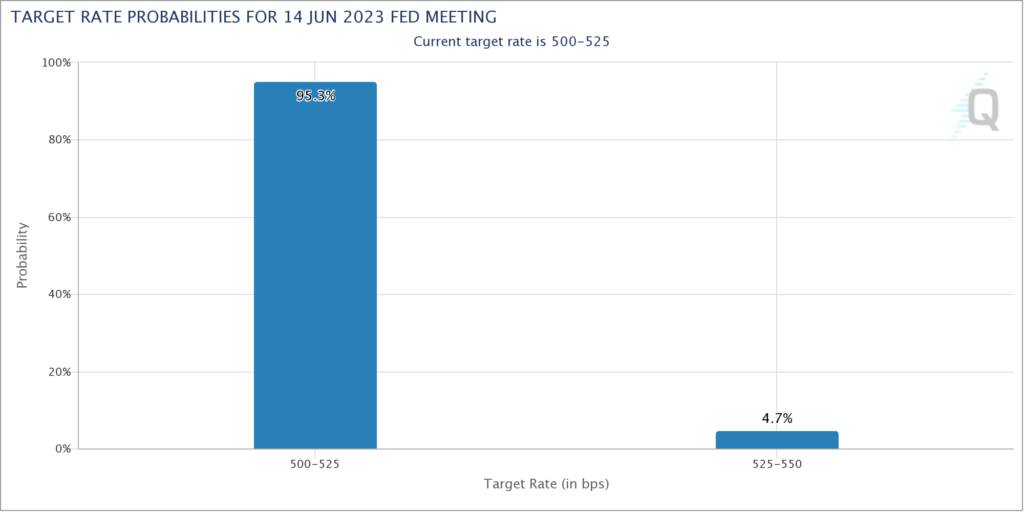

The Fed is widely expected to do a “hawkish pause” today. What exactly does that mean? It means that while they will not raise interest rates, Powell is expected to be hawkish in his press conference. That is, he will say things like “Just because we didn’t hike today doesn’t mean we’re necessarily done hiking”, “Inflation remains elevated”, etc…

The other important factor to consider is the market’s red hot run higher of late. Many believe a new bull market has begun – and the market is certainly acting like it. Nvidia (NVDA) and the hype around AI were the catalyst for the latest leg higher – but the rally is broadening out. To cite just one example, Tesla (TSLA) stock has been up for 13 consecutive days.

As the Fed has slowed the pace of its rate hikes in recent months, Powell has been consistently hawkish in his press conferences. In effect, he has been trying to keep a lid on the market to prevent it from overly loosening financial conditions and undoing the Fed’s work. As a result, the market has sold off in the wake of his press conferences on average the last six times, as you can see in the tweet above by Bespoke. Given the recent rally, it seems highly probable that he’ll use the same playbook today.

Therefore, I like QQQ $360 Puts with an expiration date of either Wednesday June 14 or Thursday June 15. I’ll be looking to purchase a few of them today before the Fed Decision.