Is PANW Too Expensive?

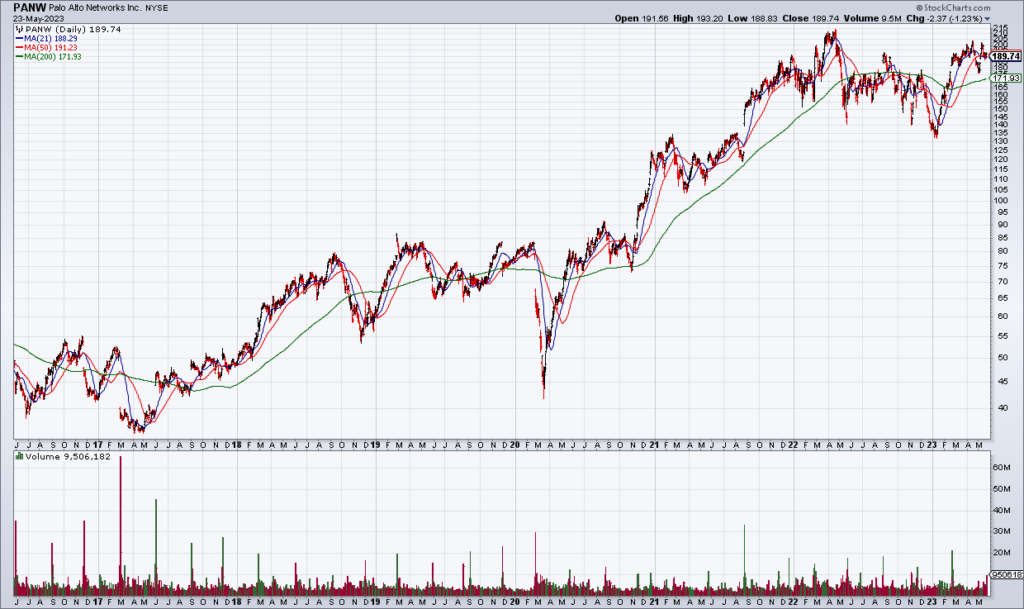

Cybersecurity leader Palo Alto Networks (PANW) reported earnings after the close Tuesday. I’ve long followed PANW because it has “Palo Alto” in its name and cybersecurity is a secular growth story. But I’ve never bought the stock because I’ve always thought it was too expensive. But is it?

Just like Zoom (ZM) looks cheap on current year metrics, PANW looks expensive on the same metrics. PANW just raised current year EPS guidance to $4.25-$4.29 (from $3.97-$4.03). If you divide the share price at Tuesday’s close by that guidance, you get 44x. “How can you possibly justify paying 44x earnings for a stock? – I can hear my old self saying. And yet PANW is a long term winner and the stock is up another 4% in the after hours.

The error here – as with ZM – is to overemphasize current year metrics – especially the P/E ratio. I did this for longer than I care to admit and so do many other value investors. The truth is that just as ZM may be a value trap whose future year earnings don’t even justify the low current year multiple, PANW’s future may be so bright that it easily grows into its valuation.

In other words, the quality of a business far outweighs simple valuation metrics in determining long term performance. It’d be nice if successful investing was as simple as buying “cheap” stocks but the reality is that quality is far more important – and you can’t measure quality. That’s why PANW is likely the superior stock compared to ZM – even though most value investors are sniffing around ZM and wouldn’t touch PANW.