KMB’s War For ‘Poop Superiority’, NOC Earnings

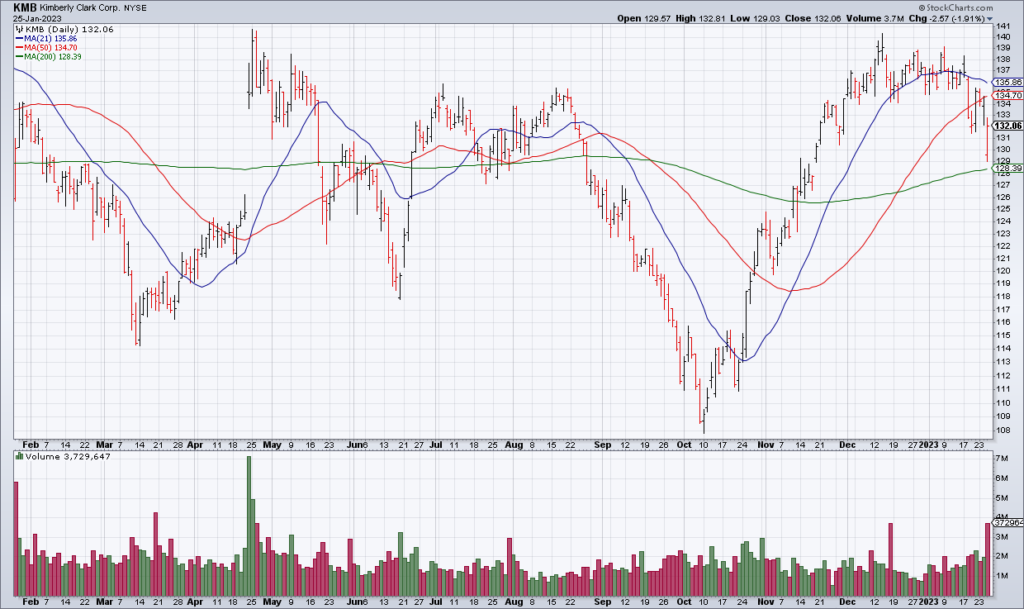

Yesterday on Kimberly Clark’s (KMB) 4Q22 earnings conference call, CEO Mike Hsu offered to take Barclay’s analyst Lauren Lieberman to KMB’s “war room on poop superiority”. Lieberman replied that it was on her 2023 agenda. Apparently this is an expensive war because KMB’s 2023 EPS guidance of +2% to +6% versus 2022’s adjusted EPS of $5.63 works out to $5.86 at the midpoint versus analyst expectations of $6.47. KMB shares were -1.91% Wednesday in reaction to the report.

(I found out about KMB’s war from Aaron Back’s article on their earnings report in Thursday’s WSJ [SUBSCRIPTION REQUIRED]).

Moving on to companies involved in real wars, defense contractor Northrop Grumman (NOC) reported 4Q22 earnings early Thursday morning. For 2023, NOC guided revenue to $38.0-$38.4 billion from $36.6 billion in 2022 and MTM EPS of $21.85-$22.45 compared to $25.54 in 2022. I continue to like – and own – both NOC and Lockheed Martin (LMT) as a hedge against any sort of geopolitical conflict like what happened in Ukraine last year.