Partridge: It’s A Bull Market You Know

Perhaps the most important thing ever written on trading is Chapter 5 of Reminiscences of a Stock Operator – Jesse Livermore’s story. In that chapter, Jesse introduces us to Partridge. When told to sell his position in a winning stock and buy it back on a sure to come reaction, Partridge resists saying “It’s a bull market you know” and “I’d lose my position”. Jesse became a great trader when he finally understood the deeper meaning of Partridge.

What was Partridge saying? Partridge was saying that the big money is in the big swings, not the wiggles. Markets don’t move entirely in one direction or another. There will be countertrend moves along the way. But nobody can catch every wiggle. The key to making the big money is to stay with the larger trend – despite the shakeouts along the way. Too many traders take profits too quickly when the market moves against them on a given day – only to have lost their position and unable to reenter the trade as the market resumes the trend shortly thereafter. While they may well understand the larger trend, their overtrading prevents them from capturing it in full.

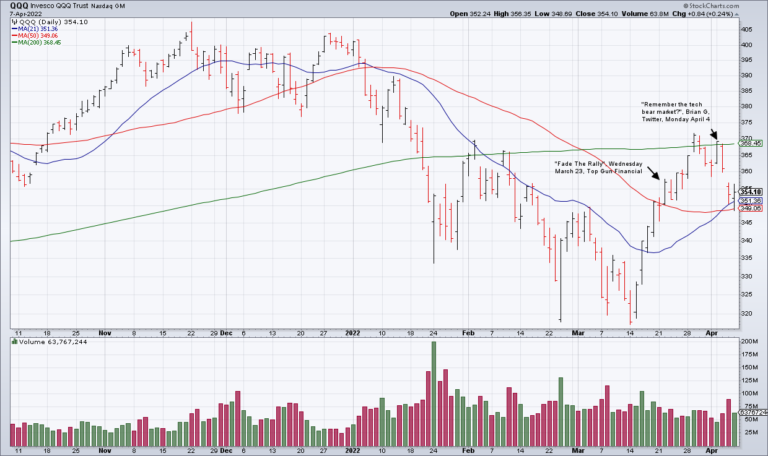

I was reminded of Partridge yesterday evening by a tweet from Strategas (above) pointing out that bonds are at oversold levels from which a bounce usually occurs. As you can see in the chart above, I’ve been short treasuries since the last day of February. There have been a number of reactions but I have not covered my short because I believe the trend of lower bond prices and higher interest rates is only in its early stages. I’m willing to endure some reactions in order to not lose my position and capture the majority of the move. As a result, while many traders have been in and out of this trade, I’ve held the whole way and am +10% in five weeks. So while Strategas may well be right and bonds may bounce here, I will continue to hold my TLT short. I don’t want to lose my position; it’s a bear market you know!

This point is bigger than my particular TLT trade. A lot of traders understand that inflation is a menace and likely to be with us for a while. As a result, the precious metals and their miners, commodities and their miners and defensive stocks are likely to outperform for the foreseeable future. There’s no need to jump in and out of these trade to try and catch every wiggle. Nobody can do that. There will be bad days but if you stick with it and sit tight you give yourself the best chance of capturing the majority of a big move. Most traders will jump in and out, scalping pennies and nickels as they come. The big money comes when you’re able to sit tight with your position despite the inevitable reactions in order to capture the majority of the move. As Jesse says, when you understand this, millions come easier than hundreds do when you try to capture every wiggle.