Stuyvesant Town And Peter Cooper Village Partners Turn Keys Over To Lenders

It’s the poster child for the entire housing bubble. There’ll be some other spectacular blowups, but this will be at the top of the pecking order.

– Daniel Alpert, Managing Partner, Westwood Capital

The fact that they have given the keys back is going to have a chilling effect. This was such an enormous transaction that it looks like most, if not all, of the equity is going to be wiped out.

– Keven Lindemann, Director of Real Estate, SNL Financial

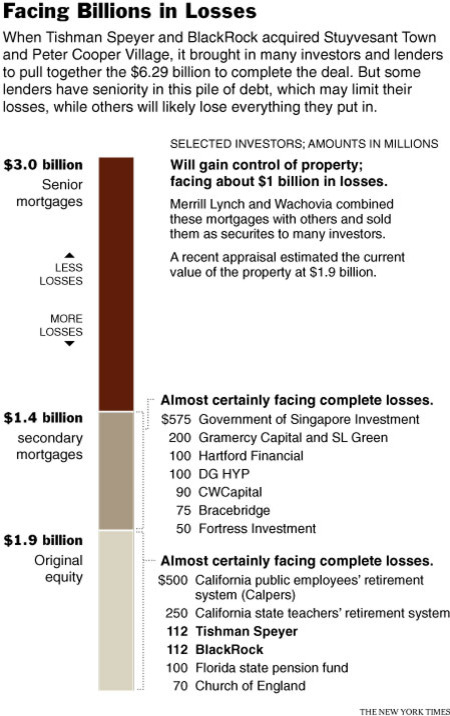

On Monday, Tishman Speyer and Blackrock, which led a group of investors in the $5.4 billion 2006 acquisition of one of the largest apartment complexes in Manhattan, Stuyvesant Town and Peter Cooper Village, turned over the keys to their lenders. This after defaulting on $4.4 billion in loans on January 8. A long list of equity investors and mortage lenders will probably be completely wiped out.

Source: “Wide Fallout in Failed Deal for Stuyvesant Town”, The New York Times, January 26, A1

For more see: “The Pain Still To Come In Commercial Real Estate And Private Equity”, Top Gun Financial, September 9, 2008.