A Preview of 1st Quarter Earnings

*****

There was a lot going on last week. While everyone was focused on the drama in Cyprus, a number of bellwether companies whose quarters ended in February reported earnings. Developments in Cyprus will likely dominate the headlines and market action this week. However, attention will soon turn to 1st quarter earnings. Studying these early reporters can give us clues into what to expect when earnings season gets underway in a few weeks.

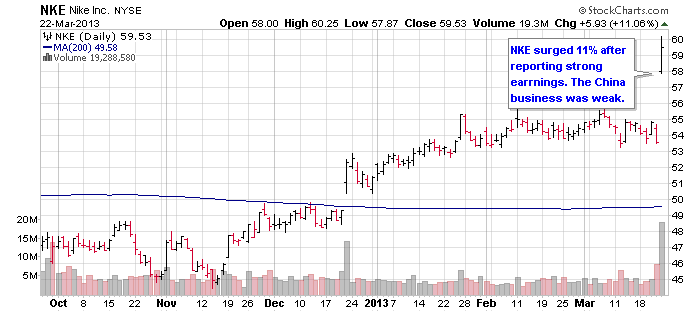

While Nike (NKE) reported a strong quarter after the close on Thursday, it was driven by North America and masked weakness in China. North America sales and profits were up 18% and 24% year over year, respectively, contributing to a strong overall report that drove shares up 11% on heavy volume. However, Greater China sales and profits were down 9% and 20%, respectively.

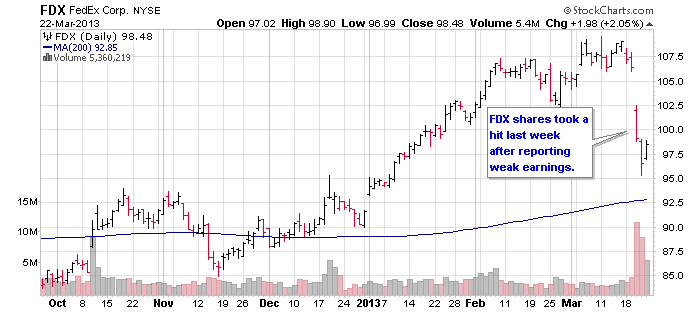

Also reporting last week was global transportation bellwether FedEx (FDX). FDX’s report was notably weak with only 2% revenue growth in its core Express Division. Domestic volumes and yields were each up about 1%, while a 4% increase in International Export volumes was offset by a 3% decrease in yield. Combined with an increase in expenses, Express Division operating margin decreased to 1.8% from 5.3% a year ago. Customers continue to select slower, less expensive shipping options, squeezing FDX’s profit.

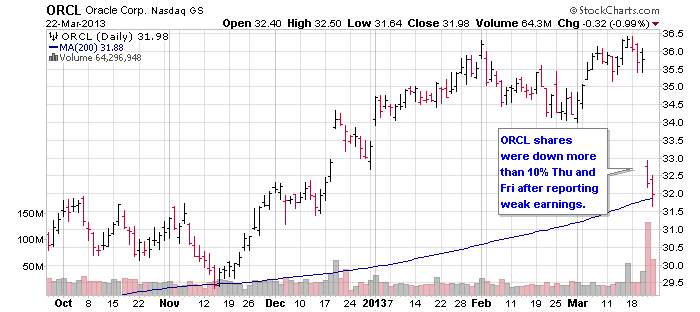

One conclusion we can draw from these three reports is an accelerating slowdown in China. Things seem only to have gotten worse since I wrote about this last year (“The Chinese Slowdown”, July 9, 2012). This is the primary reason we are short YUM Brands (YUM) which is more directly concentrated in China than any other S&P 500 company.

Finally, leading business software maker Oracle (ORCL) reported earnings Wednesday afternoon. Non-GAAP revenue, operating income and net income were all down 1% in a tepid quarter. Weakness was driven by sales of new software and hardware which are more sensitive to economic growth than revenues from updates and support. Oracle shares lost more than 10% on Thursday and Friday.

All in all, it is hard to draw much encouragement about the global economy from the testimony of these four global bellwethers.