Technical Analysis: The Golden Cross

Technician Michael Kahn has a piece up on Barron’s Online today on the Golden Cross (“Will Stocks Turn To Gold?” (subscription online), Michael Kahn, Barron’s Online, July 1). The Golden Cross is when the 50-day moving average moves above the 200 day moving average and is supposed to be a reliable buy signal. John Mauldin was ranting about some technician going on about the importance of the Golden Cross the other day.

In today’s piece, Kahn says the Golden Cross was triggered on the Nasdaq yesterday, suggesting the turn from bear to bull market. But a chart I made myself on BigCharts suggest the cross happened a few weeks ago in early June.

The Golden Cross buy signal was triggered last Wednesday (6/24) on the S&P 500.

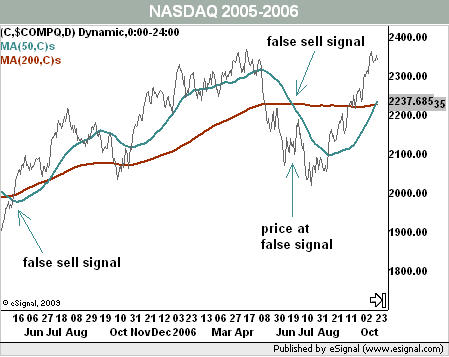

Anyways, the Golden Cross and it’s cousin The Black Cross have not always been reliable indicators. In fact, the Black Cross gave a false sell signal on the Nasdaq back in the summer of 2006.

However, the Black Cross was correct in signalling the shift to a bear market on both indexes at the end of 2007. For example, here’s the chart for the S&P 500.

Anyways, this is something technicians are keying in on right now. In the end, John Mauldin said it best on whether this indicator turns out to be correct this time around: “It means nothing until it means something, and we won’t know what that something is for some time.”