The Bear Market Rally Is Over

In an interview on CNBC’s Closing Bell Wednesday [SUBSCRIPTION REQUIRED], BTIG’s Chief Market Technician Jonathan Krinsky said that the current rally is either the weakest start to a bull market ever or the biggest bear market rally ever. He said that Monday was only the 9th time that the NASDAQ was up greater than 1.5% but more stocks declined than advanced. He went to say that this would be the first time this far into a bull market in which less than 75% of NYSE stocks were above their 200 Day Moving Average (DMA). In other words, the rally since October has been led by the “Magnificent 7”.

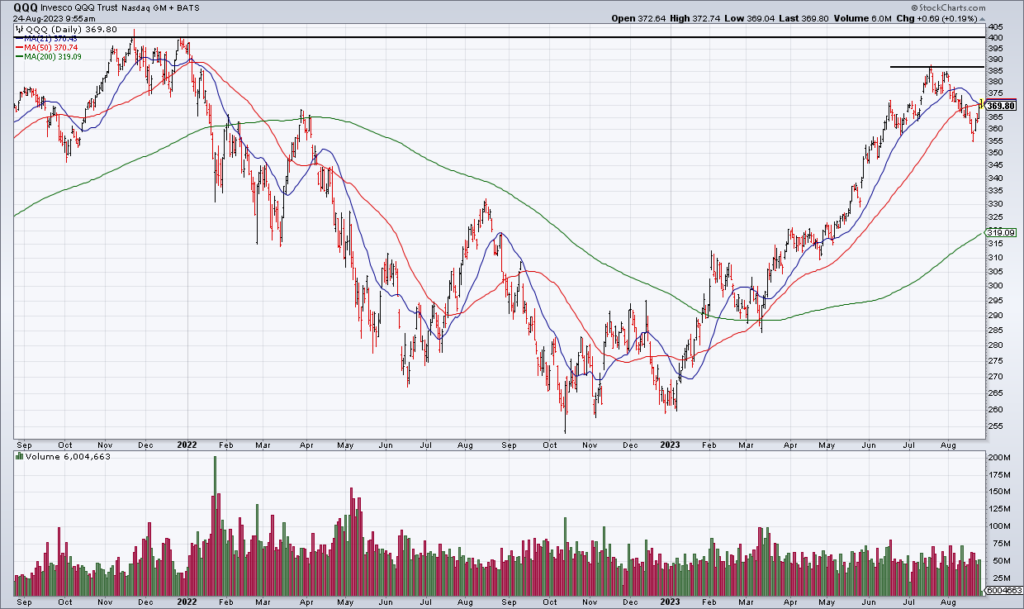

The chart above compares the performance of the QQQ – which is dominated by the “Magnificent 7” – to the equal weight S&P 500 (RSP) over the last year. As you can see, QQQ is up 18% over that period while RSP is up only 3%. This confirms Krinsky’s contention that this is a thin, top heavy rally.

In other words, if the “Magnificent 7” stop leading the market higher, the whole thing could unravel as the soldiers have not been following the generals. One would have thought that Wednesday’s blockbuster earnings report from Nvidia (NVDA) would have catalyzed the market today. The NASDAQ Futures were up more than 1% from the time they opened yesterday afternoon to the open this morning. But NVDA is up only 3% as I write and the NASDAQ just went negative.

The bear market rally is over in my opinion.