The Case For The Single Family Rental REITs

Last week, in an attempt to improve home affordability, President Trump announced a possible ban on institutional ownership of single family homes. This resulted in a selloff in the two leading single family rental (SFR) REITs: American Homes 4 Rent (AMH) and Invitation Homes (INVH).

While the possibility of legislation is a concern, the selloff further increased the value in these two REITs – which were already in a downtrend. The fundamentals remain stellar and the current price represents an excellent buying opportunity.

Let’s start with INVH. INVH owns more than 86,000 single family homes, with 71% of their 3Q25 revenue coming from the West Coast and Florida. They are guiding 2025 Same Store Net Operating Income (NOI) growth to +1.75-2.75% and Core FFO to $1.90-$1.94. That represents a 13.7x multiple on 2025 FFO. INVH also pays a 30 cent quarterly dividend which works out to 4.57% annualized.

AMH owns more than 60,000 single family homes, concentrated in the Sun Belt. They are guiding 2025 Same Store Net Operating Income (NOI) growth to +3.50-4.50% and Core FFO to $1.86-$1.88. That represents a 16.6x multiple on 2025 FFO. AMH also pays a 30 cent quarter dividend which works out to 3.87% annualized.

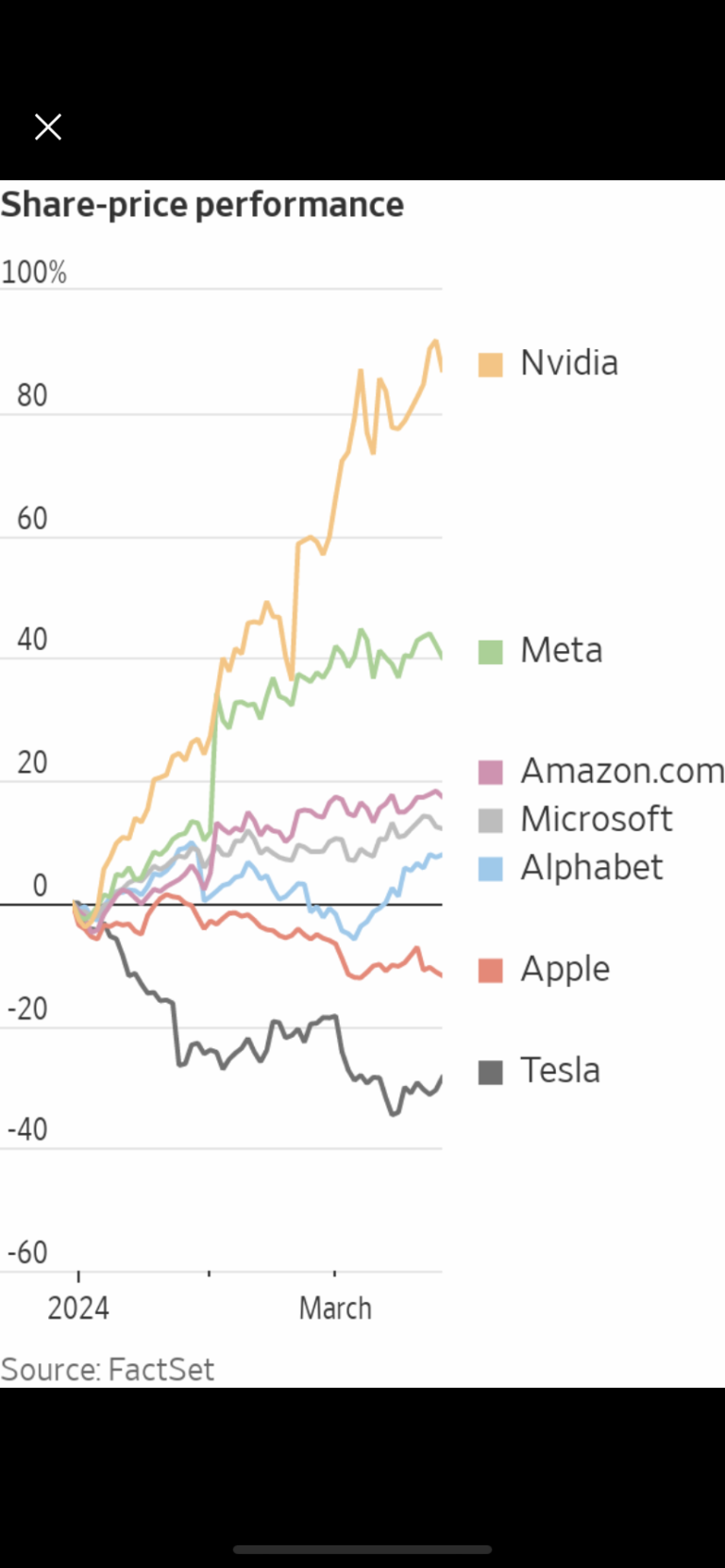

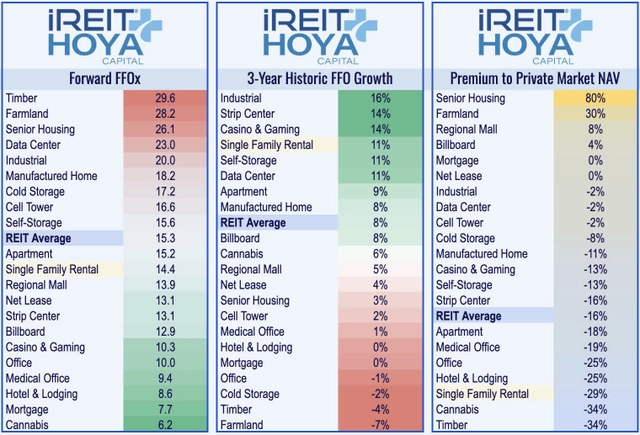

According to Hoya Capital, the SFR REITs are trading at a 29% discount to their market Net Asset Value while they have some of the best 3-year FFO growth (11%) in the REIT Space.

Real estate – as a hard asset – is also an inflation hedge if you are concerned about that as I am.

What if some sort of legislation against institutional ownership comes to pass? According to REIT expert David Auerbach in a long thread on Twitter, there is legal precedent for distinguishing REITs from private equity and therefore any legislation could have a carve out for REITs.

In a worst case scenario, since the SFR REITs are trading at a 29% discount to their market Net Asset Value, they could liquidate and still return more to shareholders than their current market price.

I used last week’s selloff to pick up a few shares of AMH and INVH on Monday.

Disclosure: Top Gun is long AMH and INVH.

*****

If you’re an income investor or retiree interested in putting together a portfolio of high yielding REITs that own the best real estate in the world without the hassle of property management, Top Gun is an expert in the REIT market.

I can put together a diversified portfolio of Apartment, Office, Logistics, Senior Housing, Mall, Net Lease, Single Family Home, Self Storage and Data Center REITs for you that yields 3-4% annually with good capital appreciation. Your account can be set up so that Interactive Brokers direct deposits your dividends to your checking account every month for current income.

If this is of interest to you, call me at (916) 224-0113 or email me at gfeirman@topgunfp.com

*****

Also see “Realty Income (O): A High Yielding REIT Income Investors And Retirees Need To Know About”, February 24, 2025