The Dumbest Day In Stock Market History

When we see money piling into stocks or sectors strictly because they are going up, because speculative traders see the possibility of profit by jumping on a trend. This is momentum investment on steroids, when speculators see a trend and the only thing that matters to them is price movement. Fundamental valuations matter little, if at all. As with all investment strategies, there is a time and place when they work best. I seriously question whether a period of high inflation and Fed rate hikes is that time – Steve Sosnick, Chief Strategist Interactive Brokers, “The Flight To Crap Returns”, March 28

Blame it on Will Smith but today was the dumbest day in stock market history.

The leading stock was Hycroft Mining (HYMC) which rose 81% on enormous volume. Nobody would have ever heard of HYMC were it not for AMC’s bizarre investment in it two weeks ago. I know nothing about HYMC except for what I read in AMC’s press release. According to that, HYMC owns the 71,000 acre Hycroft Mine in Northern Nevada which has 15 million ounces of gold and 600 million ounces of silver. 99.9% of the investors who bought HYMC today don’t even know that much.

The second leading stock was AMC – which piggybacked off the move in HYMC due to its 22% stake – up 45% on enormous volume. By my calculations, AMC’s stake in HYMC increased in value by ~$47 million today – but AMC’s stock added ~100x that. (According to HYMC’s press release at the time of AMC’s investment, AMC bought 23.4 million units with each unit consisting of one share and one warrant). I am truly impressed by that math.

Meme stocks Gamestop (GME) and Bed, Bath and Beyond (BBBY) joined the party was well.

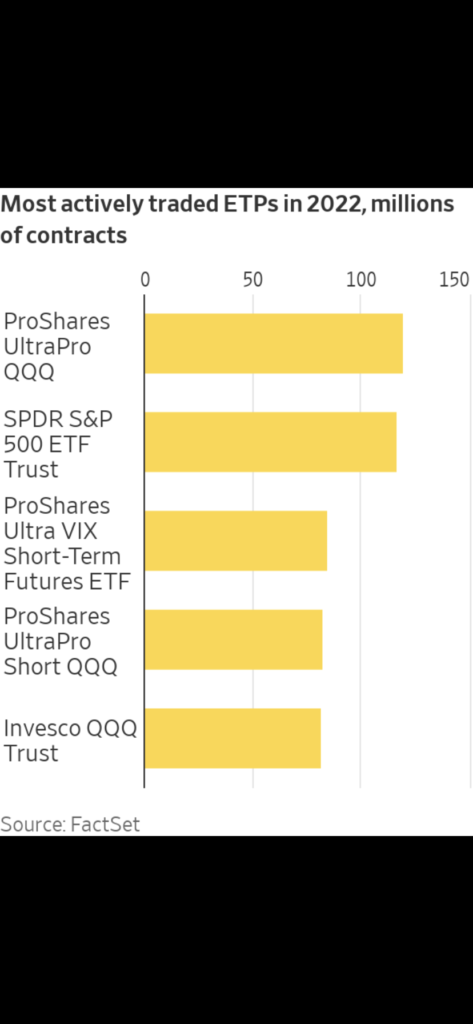

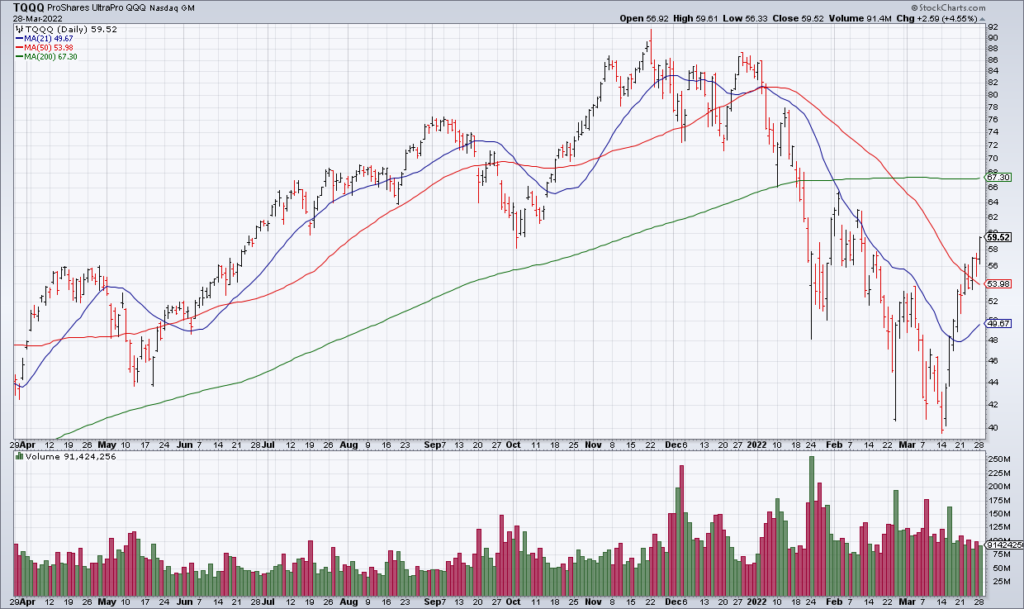

According to a front page WSJ story today by Gunjan Banerji, the ProShares UltraPro QQQ ETP (TQQQ) – which aims to return 3x the NASDAQ-100 – is the most highly traded ETF or ETP in 2022 (“The Riskiest Bets In The Stock Market Are The Most Popular” [SUBSCRIPTION REQUIRED]). Evan Fetter, a 25 year old who serves in the US military, poured $15,000 of his savings from working at Chick-fil-A and other restaurants into TQQQ with a goal of $50,000. With a +50% move in the last couple weeks I hope Mr. Fetter took some money off the table – but I doubt it.