The Analogy To The Bear Market Rally Spring 2008

There is a lot of debate about the interpretation of the current rally. Is it the start of a new bull market? Or is it a relief rally in an ongoing bear market? My view is the latter but let’s start with a look at the case for the former.

The case that this is a new bull market is primarily technical and relies on the strength of the move off the lows we’ve seen over the last couple weeks. The technician Andrew Thrasher nicely captured this by showing how the current combination of extremely strong short term breadth and moderate long term breadth has occurred only three previous times – all at major market lows. I saw a tweet that encapsulated this by saying we’ve moved from Death Cross Twitter to Breadth Thrust Twitter.

My personal view, however, is that this has been a powerful relief rally in an ongoing bear market. Bank of America’s Chief Investment Strategist Michael Hartnett shares this view believing that the rally won’t last much longer given strong inflation, higher rates and a potential shock to growth. “A strong selling opportunity awaits in Q2”, Ben Levisohn quoted him as saying in his The Trader column [SUBSCRIPTION REQUIRED] in this weekend’s Barron’s.

However, this doesn’t mean the market has to reverse immediately and make new lows. The powerful move off the lows suggests to me that “a” bottom – though not “the” bottom – was put in earlier this month. The technician and trader ChessNwine made an interesting analogy to the bear market rally in the Spring of 2008 in his weekend overview last Sunday.

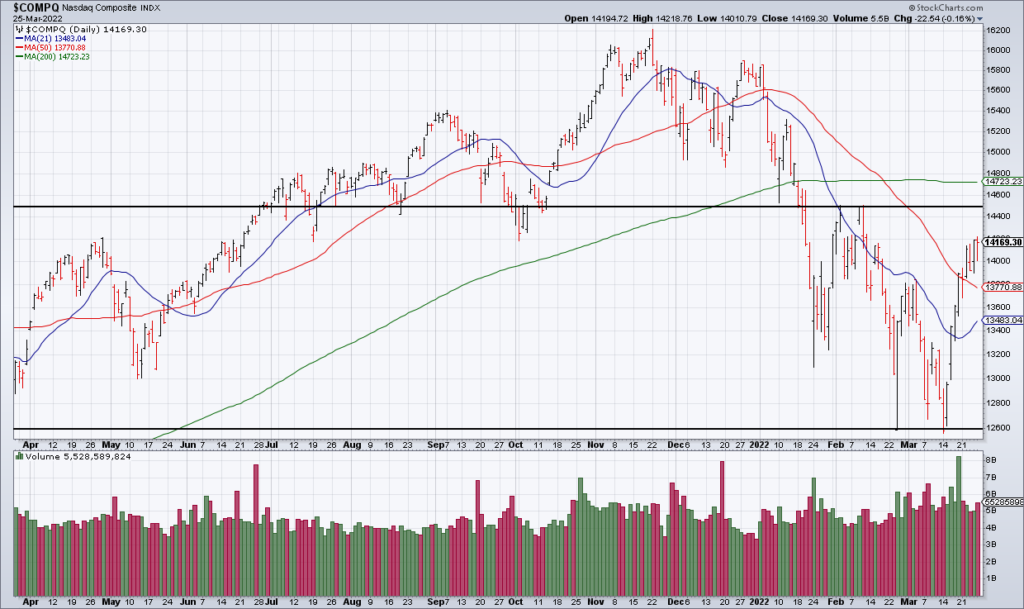

As you can see in the chart above of that period, the market made a new low at the open on Monday March 17, 2008 – following the collapse of Bear Stearns and its acquisition by JP Morgan for $2/share on Sunday March 16, 2008 – but then rallied hard in the ensuing days. The market continued to grind higher for about two months after that with the NASDAQ gaining almost 20%.

You could argue – as Chess does – that something similar is taking place right now. The market had already priced in the first Fed rate hike ahead of the announcement on Wednesday March 16 (which Powell had signaled would be a 25 basis point hike) and started to move higher in advance. Two weeks later the NASDAQ is up more than 12%. If the analogy holds the market could well grind higher in the ensuing days but the meat of the relief rally is already in the rearview mirror.

JP Morgan Technical Strategist Jason Hunter also shares this view: “We believe the S&P 500 will continue to trade within the early 2022 price extremes as the market comes to terms with the removal of easy monetary policy” (quoted in Ben Levisohn, The Trader column, Barron’s, March 26).

While it would be nice to believe that the correction over the last four months has worked off all of the excesses of the previous expansion, this is probably wishful thinking. While bulls may well get a reprieve over the next bunch of weeks, the bear market is far from over.