The Garbage Stocks

One of my favorite current commercials is one by Progressive Insurance in which a new homeowner cleans his garbage cans. When asked why he says: “You can never be too safe”. To which the interlocutor replies: “With trash?”

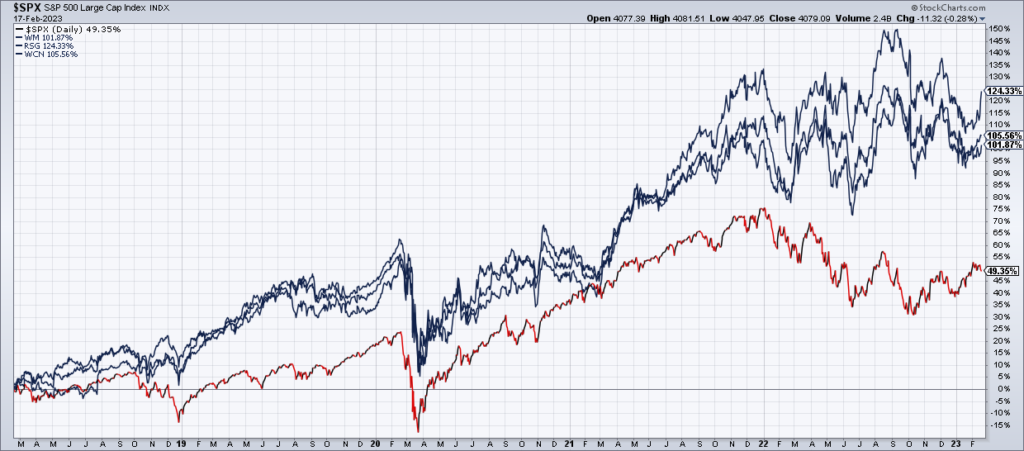

But maybe the new homeowner is on to something. Perhaps there really is treasure in trash. A look at the 5 year chart of the three leading garbage stocks – Waste Management (WM), Republic Services (RSG) and Waste Connections (WCN) – versus the S&P suggests there is.

In fact, trash is a terrific business. For one, every residential, commercial, government and industrial property needs trash service. For another, there isn’t a lot of competition in trash which gives the garbage companies pricing power. WM RSG and WCN core price rose 7.8%, 6.7% and 7.7% in 2022, respectively.

The one caveat with these stocks is valuation. Because of their monopoly like businesses, WM and RSG command about 25x 2023 EPS guidance while WCN is ~36x.