Valuing AMZN: AWS + Retail

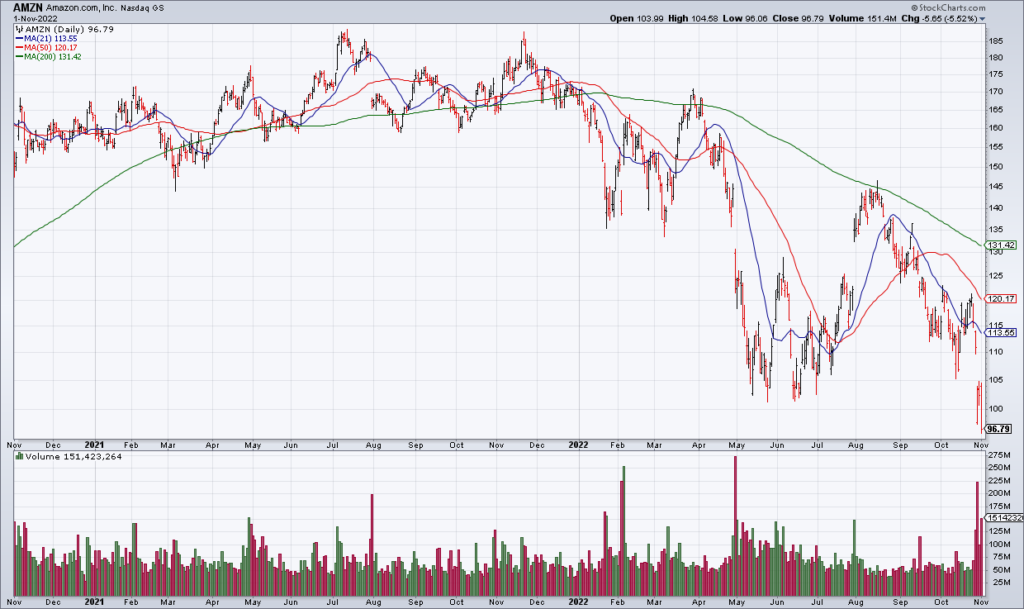

Amazon (AMZN) reported weak 3Q22 earnings last Thursday afternoon and the stock has been punished in their wake. But I think it’s overdone at this point.

When most people think of AMZN they think of the online retail business. However – for many years now – the jewel within AMZN has been its cloud business Amazon Web Services (AWS). While the retail business seems to be maturing and is not profitable AWS continues to grow and make a lot of money.

3Q22 revenue growth in AWS was 27% and operating income $5.4 billion. AWS operating income YTD is $17.6 billion. Based off of these numbers I think $26 billion is a conservative estimate for AWS operating income in 2023. Given AWS’s leading position in the cloud – and the secular growth story of the cloud itself – I think a 30x multiple on that is fair. In other words AWS itself is worth close to $800 billion IMO. AMZN’s entire market cap at its closing price Tuesday of $96.79 is $1 trillion. In other words AWS itself is worth almost as much as AMZN’s current price.

Let’s turn now to the retail business. AMZN breaks it up into North America and International. The segment is hard to value because both have operating losses YTD. I would argue that this is a choice on AMZN’s part. They are keeping retail prices low – everybody knows AMZN has great prices – in order to continue to grow market share. But they have pricing power; if they wanted to they could raise prices by 10% or 15% and – while they would lose some market share – the retail business would become instantly profitable. So many of us are in the habit of buying so many things from AMZN. The price and convenience make it an easy option. Even if they raised prices most would continue to do so.

Combined North America and International will have more than $400 billion in sales this year. Walmart’s (WMT) operating margins are ~4%. I see no reason AMZN couldn’t achieve similar margins. That works out to at least $16 billion in operating income. WMT is valued by the market at 25x EPS. Because AMZN doesn’t have 4% margins at this point perhaps it deserves a slight discount; let’s say 20x. In that case the retail business is worth $320 billion.

I think these are conservative assumptions. The upshot is that AMZN is anywhere from fairly valued to significantly undervalued at its current price. I think it’s time to start nibbling on shares.