Which Way Interest Rates?

A couple of important stories on interest rates this weekend in The Wall Street Journal and The New York Times.

The Wall Street Journal described the different forecasts for the year-end 10 year treaury yield by Morgan Stanley and Goldman Sachs (“Yield Views Couldn’t Differ More”, The Wall Street Journal, April 10, B1). Morgan Stanley, led by Jim Caron, thinks the 10 year will rise 1.50% to 5.50% by the end of the year. Goldman Sachs, led by Jan Hatzius, disagrees forecasting a 3.25% year end yield.

The difference reflects disparate views about the impact of $2 trillion in government borrowing this year and other investment opportunities that may or may not crowd out treasuries as the economy heats up – or doesn’t.

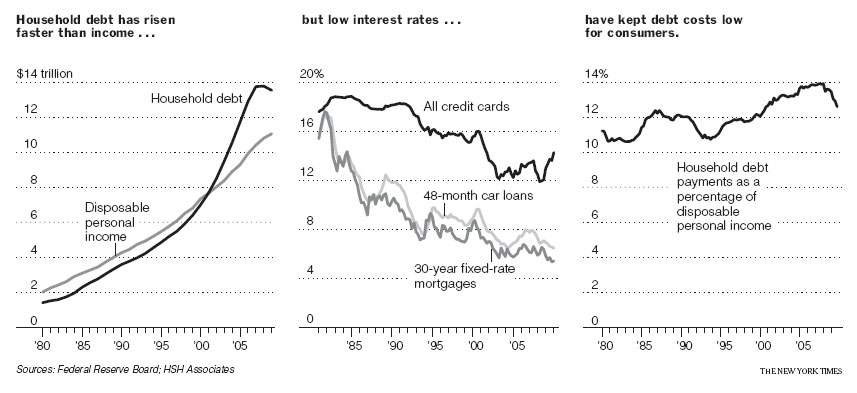

The New York Times weighed in on Sunday saying that, over the longer term, interest rates are heading up (“Interest Rates Have Nowhere To Go But Up”, Nelson Schwartz, The New York Times, April 11, A1). “It’s been a great thrill as rates descended, but now we face an extended climb”, Pimco’s Bill Gross told The Times. “We’ve had an almost 30-year rally. That’s come to an end,” said David Wyss, Standard & Poor’s Chief Economist. “Everyone knows that rates will eventually go higher,” summed up JP Morgan Securities Global Head of Fixed Income Strategy Terrence Belton.

Disclosure: Top Gun is short long term treasuries via the ProShares UltraShort 20+ Year Treasury ETF (TBT).