That 2013 Feeling

NOTE: Every week or two I wrote a Client Note for my clients. I post most but not all of the notes to my blog but with a time delay usually between 1 day and 1 week. To receive the Client Notes at the same time as my clients, sign up in the box in the right hand corner of the website.

*****

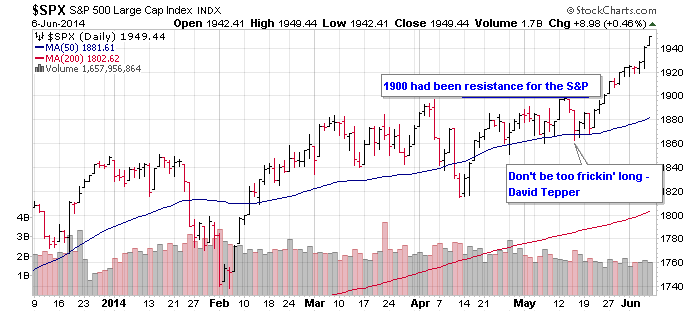

A few weeks later things feel decidedly different. The S&P powered through 1900 on its way to Friday’s close just below 1950 and the market’s animal spirits have been awakened. It seems likely that we are paving the road to S&P 2000 – which would mark a 200% advance since the March ’09 bear market lows.

While I am bullish and long, it is time to start making plans for becoming more cautious. The most recent issue of Jim Stack’s excellent Investech Newsletter included an aptly titled section “Conservative Investing For The Final Stretch”. Within that section, I was struck by the following sentence: “Based on historical bull market longevity a final top is almost certain in the next 1-2 years.”

In my opinion, investing intelligently at the moment entails striking the proper balance between the potential gains from a final leg higher against the potential losses in the inevitable next bear market.

(916) 224-0113