20% Decline Is Just The Beginning

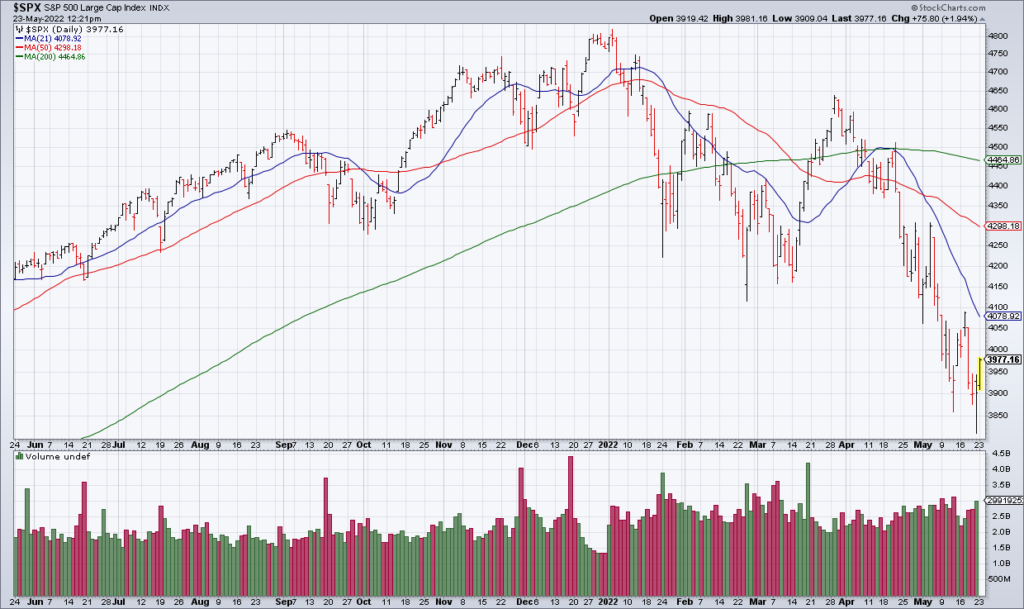

James Mackintosh wrote an excellent piece for The Wall Street Journal this morning (“Conditions Are Ripe For Deep Bear Market” [SUBSCRIPTION REQUIRED], Monday May 23, B9). A bear market is conventionally defined as a drop of at least 20% from a previous high and that condition was met briefly on Friday. In the past 40 years, according to Mackintosh, the S&P has bottomed out with an approximately 20% decline four times: 1990, 1998, 2011 and 2018. Another four times it had far bigger losses. Which kind of bear market are we in this time?

Mackintosh notes that in each of the four cases in which market losses were limited to about 20% the Federal Reserve eased monetary policy. And there’s the catch. With inflation raging, the Fed has other concerns besides for falling stock prices. Mackintosh favors the analogy to 1973-74 when inflation was also a serious problem. In that instance, the bear market lasted 20 months and the S&P lost about 50% of its value from peak to trough. In my opinion, Mackintosh is spot on; there will be no soft landing.