Things Are Starting To Break

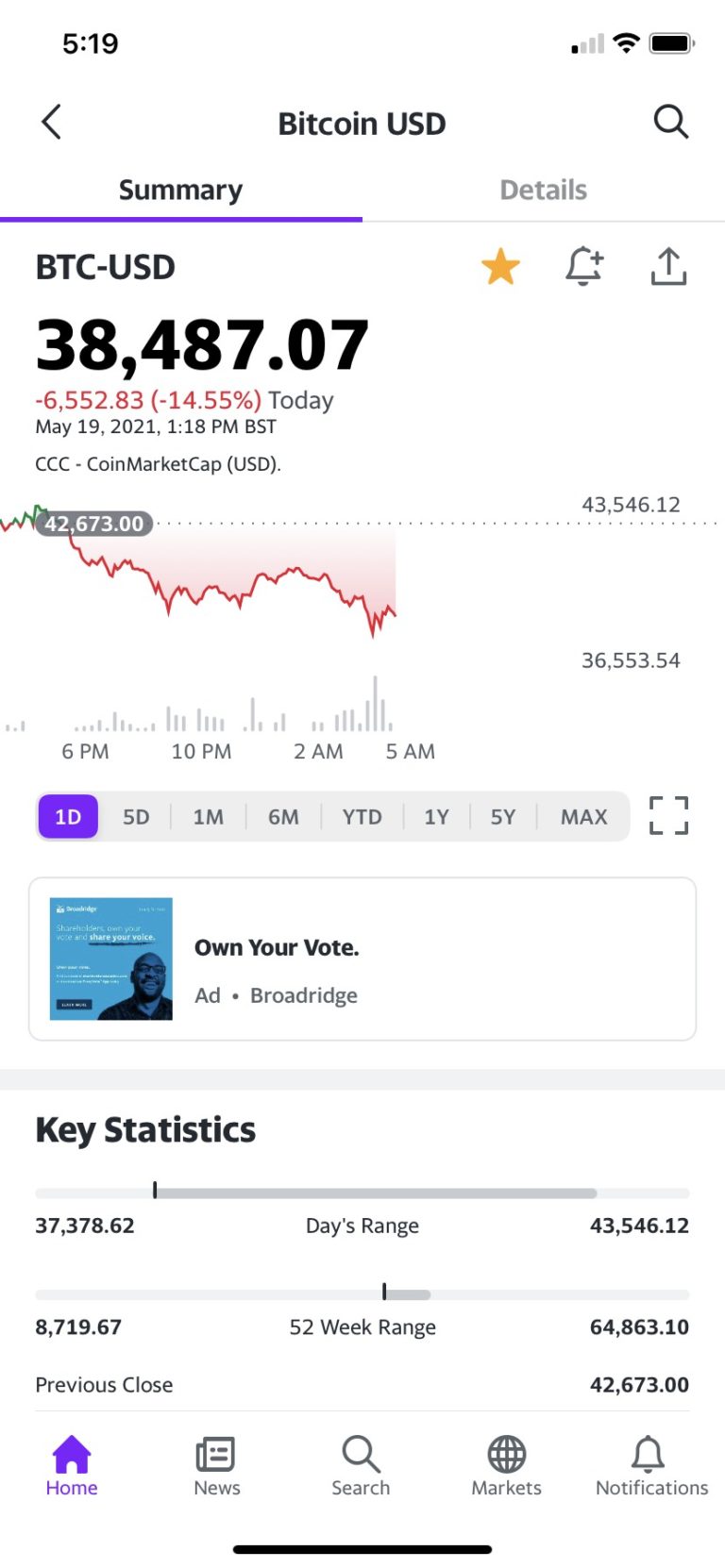

In late September I wrote a blog titled “Something Is Going To Break”. The premise was that if the Fed didn’t start to ease up soon something would break. With the failure of crypto exchange FTX it’s starting to happen….

In late September I wrote a blog titled “Something Is Going To Break”. The premise was that if the Fed didn’t start to ease up soon something would break. With the failure of crypto exchange FTX it’s starting to happen….

The Wall Street Journal ran a feature story over the weekend on Coinbase’s (COIN) overreach during the crypto boom – and how that has left it scrambling to right size the business as crypto melts down (“Coinbase’s Rapid Rise Left…

If you talk to people in the crypto space, and you tell them you’re 100% invested in Bitcoin, they think that you’re super-risk-averse. It’s like the boomer coin – Liz Young, Head of Investment Strategy, SoFi Technologies [Bitcoin is] not…

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber…

There is a debate among economists about whether we are on the verge of one of the greatest economic booms in history or whether the current market rally is the bubble of all bubbles. The consensus view reflected in market prices is the former. The latter is the correct one in my opinion…

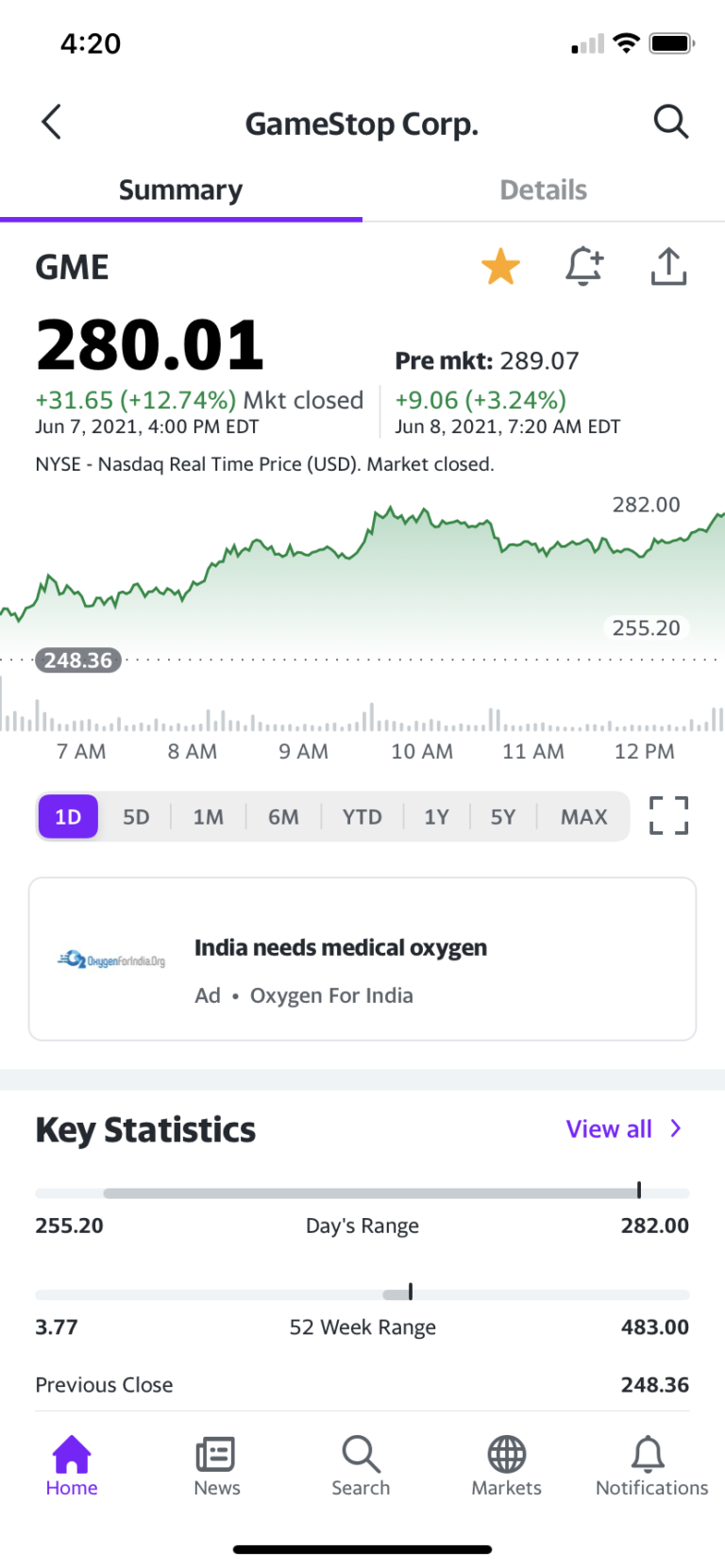

Those who know me will be surprised to learn that I bought shares in Coinbase (COIN), the leading cryptocurrency broker, on Friday in the wake of its 1Q21 Earnings Report Thursday afternoon. That’s because my intellectual roots are in Ayn Rand, Ludwig von Mises, The Austrian School of Economics and therefore the gold standard. As a consequence, I’ve tended to be of the mindset of Warren Buffet toward Bitcoin and cryptocurrencies in general when he called the former “rat poison squared” at Berkshire’s 2018 Annual Meeting. However, that doesn’t mean I can’t trade it profitably.

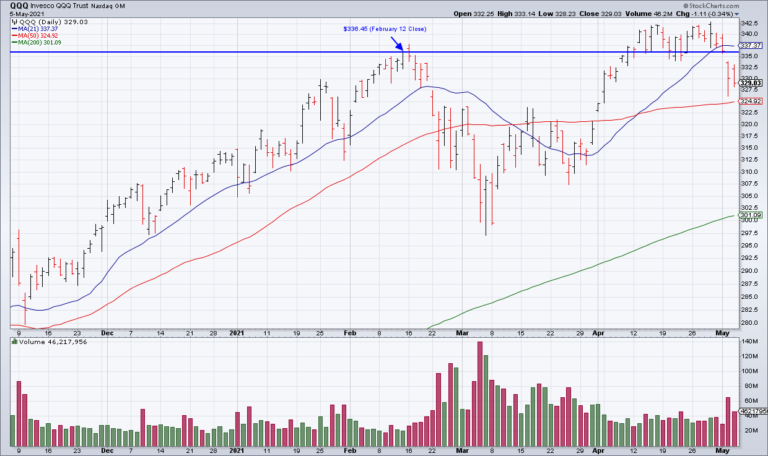

On Wednesday morning April 21, I first wrote about a potential breakdown in the QQQ. Yesterday morning, I revisited the subject after the QQQ broke below its February 12 closing high around $336 to close around $330 on Tuesday.