Dispatches From The Bubble: GME, Chuck Vukotich’s 4 Bedroom In Penn Hills, PA and The Porn Star Pumping PAWG Coin

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Tesla had naysayers and Amazon had people who were against it, but it’s those two companies, and now Gamestop, that are transforming a whole mindset and methodology for how to do business. This could be huge – Robert Misener, a 50 year old individual investor from Florida quoted in Caitlin McCabe “Gamestop Loyalists Buy for the Long Haul” [SUBSCRIPTION REQUIRED], WSJ A1, Monday June 7

Early this year I was working out with my personal trainer on a Thursday morning when he said to me that his son had a stock idea and he wanted my opinion. Before he could mention the stock I said: “Gamestop”.

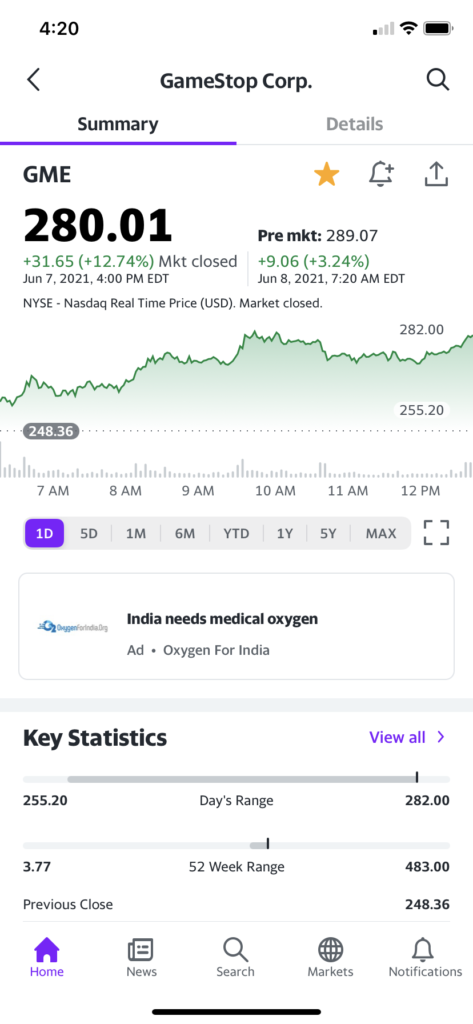

At the time, I thought this would be a short lived episode. But here we are almost five months later and GME is hot again. So hot that The Wall Street Journal ran a front page article on it yesterday. The article focuses on a 50 year old individual investor from Florida named Robert Misener and the faith GME bulls are putting in activist investor Ryan Cohen.

You can see Mr. Misener’s thought process regarding GME above. As for Mr. Cohen, he is in his 30s and considered an ecommerce wunderkid after selling online pet retailer Chewy to Petsmart for $3.35 billion in 2017. He’s gotten involved with GME as an activist investor and is now the company’s nominee for Chairman. Many individual investors in GME are hoping Mr. Cohen can replicate the success he had with Chewy.

On February 24, “Daddy Cohen” as he is known on Reddit’s WallStreetBets forum, tweeted out the above frog emoji and a picture of an ice cream cone from McDonald’s which sent individual investors into a frenzy causing them to push up GME shares 104% that day.

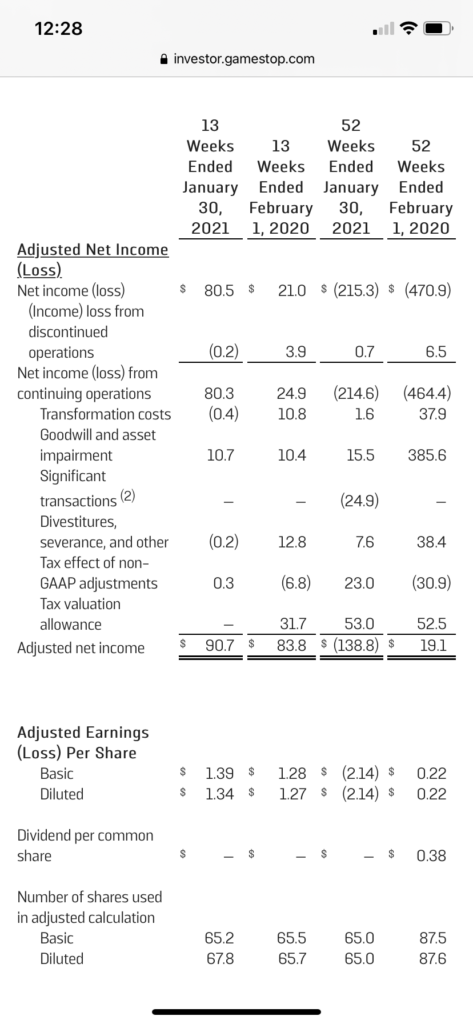

Back in the realm of sanity, GME reported an adjusted loss of $2.14/share for the year ended January 30, 2021 on March 23.

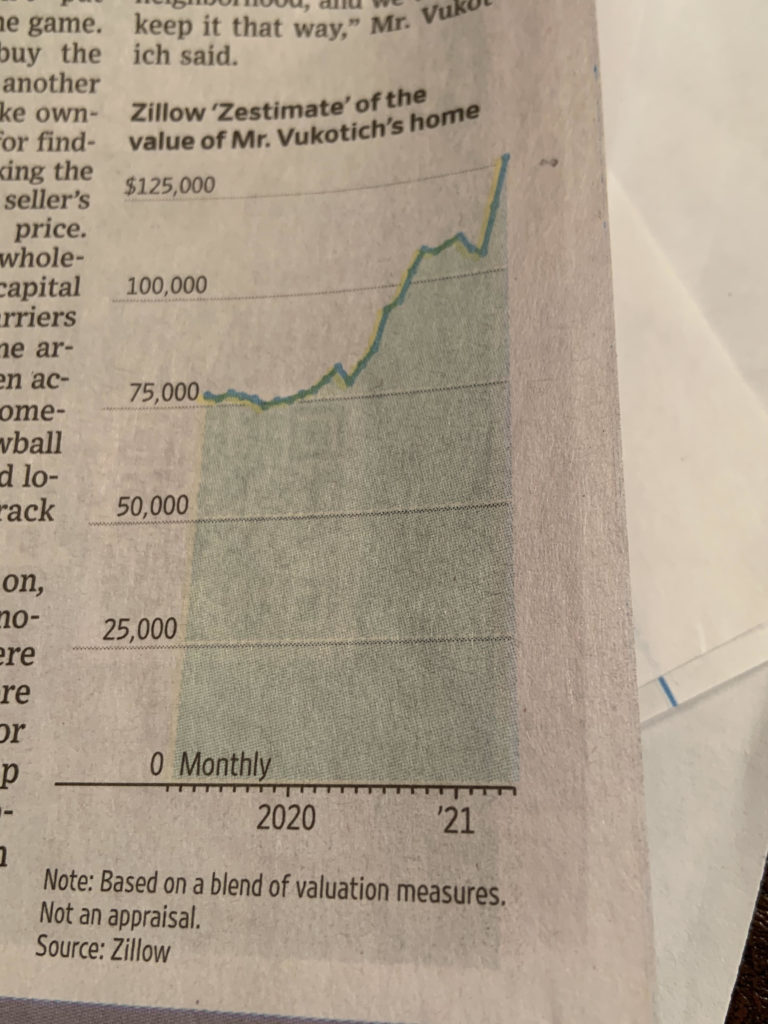

In another dispatch from the bubble, Ben Eisen had a terrific story in yesterday’s Wall Street Journal [SUBSCRIPTION REQUIRED] on the front of the Money & Investing section. It tells the story of Chuck Vukotich who bought his mother’s home in Penn Hills, Pennsylvania for $55,000 in 2016 and is now being bombarded by offers to buy it from individual investors despite the fact that he’s not trying to sell it.

One of those individual investors is 24 year old Nick Schindehette who got into real estate after he attended a tutorial event. Mr. Schindehette recently sent Mr. Vukotich a pitch on a pink note card: “Could we possibly discuss making you a cash offer? Either way, please let me know. Blessings, Nick”.

Mr. Schindehette mails out between 5,000 and 20,000 of these cards each month to homeowners in 20 ZIP codes. He considers a 1% response rate a success.

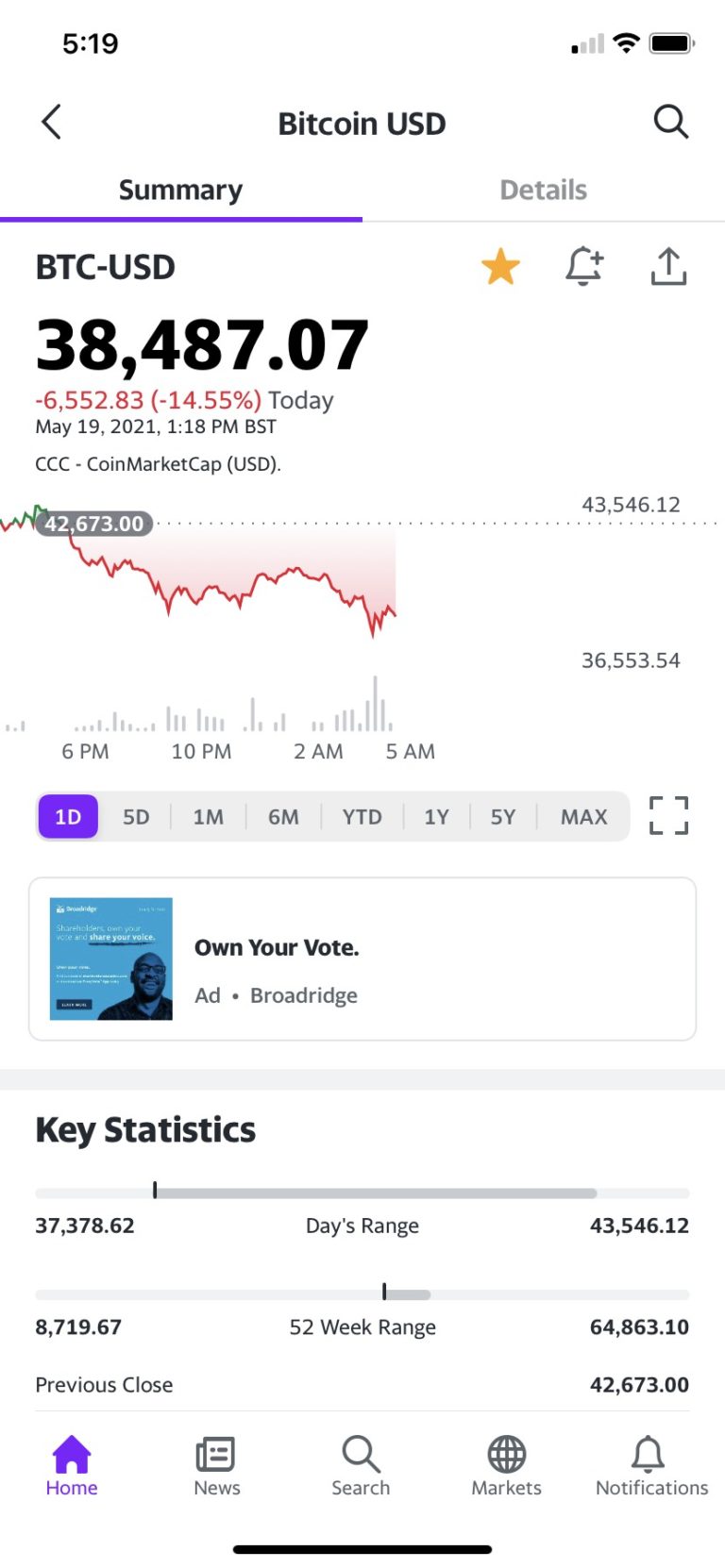

As you can see in Zillow Zestimate above, Mr. Vukotich’s home has appreciated by about 2/3 over the last year to about $125,000.

That’s a bargain compared to the $2,000,001 price of the median home in San Mateo County, CA where I live.

Lastly I must mention the story of porn star Lana Rhoades pumping a new cryptocurrency called PAWG coin. If you look at PAWG coin’s Twitter page you see the image of a peach in a thong and a profile that reads: “We aren’t just going to the moon, we’re going to URANUS”. The location is listed as Degens’ Island.