The Case For (And Against) COIN: Fundamental, Technical and Philosophical Considerations

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Those who know me will be surprised to learn that I bought shares in Coinbase (COIN), the leading cryptocurrency broker, on Friday in the wake of its 1Q21 Earnings Report Thursday afternoon. That’s because my intellectual roots are in Ayn Rand, Ludwig von Mises, The Austrian School of Economics and therefore the gold standard. As a consequence, I’ve tended to be of the mindset of Warren Buffet toward Bitcoin and cryptocurrencies in general when he called the former “rat poison squared” at Berkshire’s 2018 Annual Meeting. However, that doesn’t mean I can’t trade it profitably.

To be completely honest, I didn’t even know COIN reported earnings Thursday until I started reading The Wall Street Journal Friday morning. The front page of their Money & Investing section had a prominent article on COIN’s earnings report. Once I started reading I was entranced. That’s because the growth COIN experienced in the 1Q21 was unlike anything I’ve seen before.

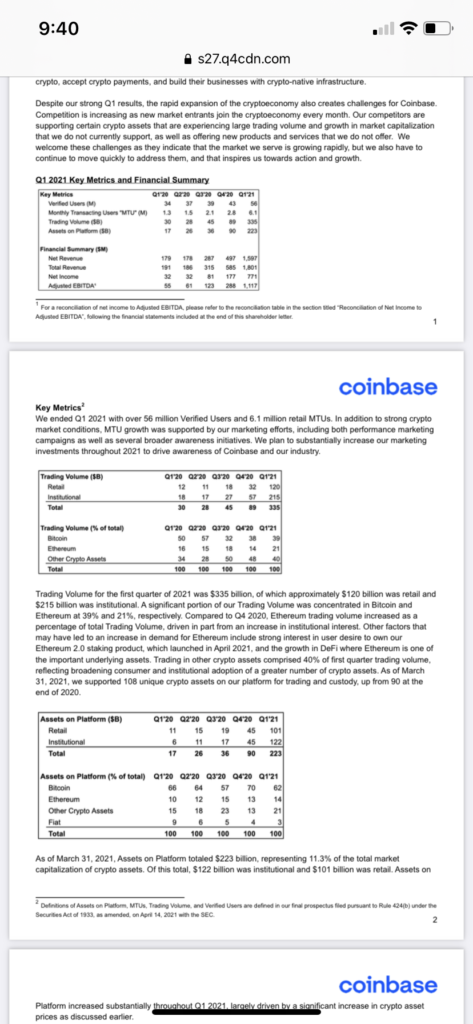

Monthly Transacting Users (MTUs) more than doubled to 6.1 million from 2.8 million in the 4Q20. Read that again: “from the 4Q20”. The numbers I’m going to cite are not year over year comparisons. They are quarter over quarter! Trading Volume exploded to $335 billion from $89 billion. As a result, Net Revenue surged to $1,597 million from $497 million and Adjusted EBITDA to $1,117 million from $288 million. Reviewing these numbers Friday morning I almost had an orgasm.

COIN earned $3.05/share in the 1Q21 and so I quickly reasoned (incorrectly it turns out) that if the crypto market could hold up through year end they would earn ~$12/share in 2021 giving the stock a P/E multiple of ~21.5x on 2021 earnings. (Upon a closer review of COIN’s report this weekend it turns out that this quick calculation was mistaken because COIN’s diluted share count has more than doubled since the end of the quarter! Therefore, given the assumption I made Friday morning about the crypto market holding up, they would earn ~$6/share in 2021 for a P/E multiple of ~43x on 2021 earnings).

With that kind of growth and a reasonable valuation, I eagerly bought shares for clients and myself. I believed I had found a conservative way to trade the crypto wave.

In my excitement over COIN’s incredible 1Q21 fundamentals, I failed to pay sufficient attention to its poor technicals. COIN has been in a clear downtrend since its IPO as you can see in the chart above. Why? Because, as you can see above as well, Bitcoin peaked around $64,000 on the very day COIN went public! In other words, COIN’s shares are unsurprisingly highly correlated with the price of Bitcoin.

And, unhappily for me, Bitcoin and Ethereum, which made up 39% and 21% of COIN’s 1Q21 Trading Volume, respectively, crashed over the weekend. COIN is currently (as of 7:20am EST) down ~3.5% in the premarket to ~$250 and is highly likely to breakdown today below the line I’ve drawn on the chart above at $256.76 representing its lowest close since its IPO. So I’m going to take a hit. I’d be fine with that if I was as confident now as I was Friday morning that COIN’s fundamentals would hold up for a while longer.

Let’s step back for a minute and address the raging debate at the very heart of crypto: Is it a bubble? Does crypto have any inherent value? Or is it a modern day version of Tulipmania?

In my estimation, there are three basic positions that have been staked out on this question. What I’ll call the conservative or skeptical position is that indeed it is a bubble. This is the position espoused by Buffett in 2018 and Munger at this year’s Berkshire Annual Meeting when he “left the criticism to others”.

What I’ll call the radical position is that Bitcoin and even some of the other cryptos will one day become money. That is, they will function like the dollar and other national currencies do now as mediums of exchange and you will be able to use them to buy goods and services at an ever increasing number of businesses as time goes on. This position is associated with the HODLers (“Hold On For Dear Life”) and is widely held by young people. The best investors who appear to hold some version of this position that I am aware of are Mark Yusko, Mike Novogratz and Raoul Pal.

Lastly there is a middle ground that I’ll call the agnostic position. As in the problem of God’s existence in Philosophy, holders of the agnostic position with respect to crypto claim neither faith nor disbelief. This position is held by the great Stan Druckenmiller who, despite claiming not to know if crypto is a bubble or the future of money, has successfully traded Bitcoin.

Where do I stand? I am somewhere between Buffett and Munger’s conservative/skeptical position and Druckenmiller’s agnosticism.

What does that mean for my investment in COIN? When I bought COIN Friday morning I didn’t intend it as a long term investment. My plan was to ride the crypto wave in a more conservative way than buying crypto itself. Hence, the key assumption I made in buying COIN was that crypto would continue to hold up for at least a few more months allowing me to profit from what I’ve always regarded as a likely bubble. With crypto breaking down, that assumption seems to me less likely to hold.

As I was about to publish this post around 11pm last night, Tesla (TSLA) CEO Elon Musk tweeted that TSLA has not sold any of its Bitcoin causing the crypto universe to find at least a temporary bottom. Because the price of Bitcoin and Ethereum are so essential to my trade, I will use last night’s low in Bitcoin as my stop for COIN. If Bitcoin’s price trades below $42,250 at any point during market hours I will sell COIN.