The Reopen Trade Is The Bull Market’s Last Pillar, DRI: A Case Study In The Reopen Trade

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

Yesterday (Thursday), the bulls were able to rally stocks off a down open to finish marginally higher. The S&P was +0.52%, the NASDAQ +0.12% and the Russell +2.29%. You can see the reversal in the tweet from unusual whales which shows the market at the open and close.

Nevertheless, as I wrote yesterday in section 2 “Tops Are A Process”, the market is following the script for market tops as one group of stocks after another appears to be topping and rolling over.

The one exception to this, the one group that has held up so far, is those stocks that are part of the reopen trade. These are the stocks that are supposed to benefit greatly from the reopening of the economy due to the containment of the coronavirus via the vaccines.

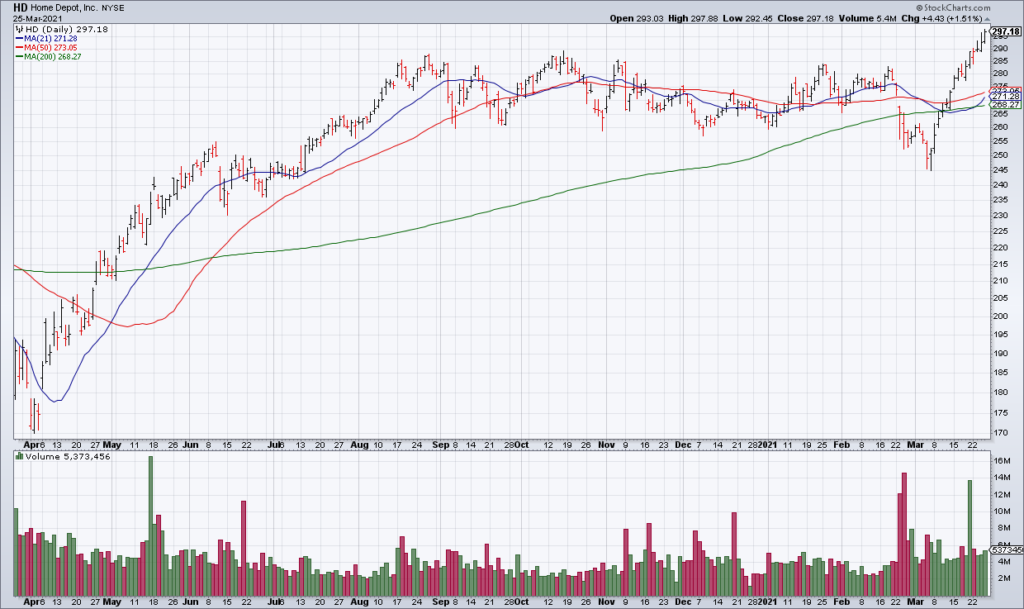

Some examples include Home Depot (HD), railroad Union Pacific (UNP), hail ride service Lyft (LYFT) and hotel operator Marriott (MAR). Take a look at their charts and you won’t see the kind of technical damage I showed yesterday in the charts of most areas of the tech sector (or if you do, that damage has already been repaired).

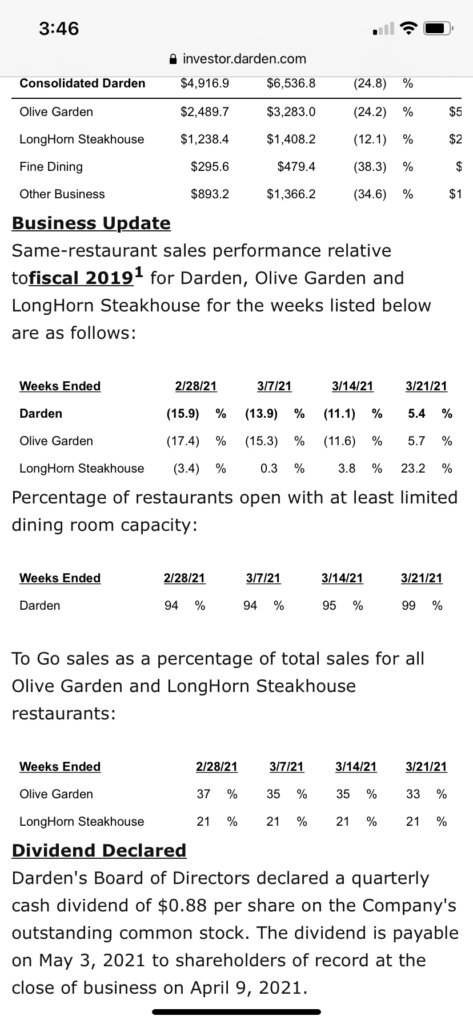

Another example of a reopen stock that I want to delve into this morning is Darden Restaurants (DRI, Market Cap $19 Billion) because they reported earnings yesterday morning and jumped 8.19% on almost 4x average volume off the report. Why? For the quarter ended February 28, 2021, DRI reported blended same store sales of -26.7%. Obviously that can’t be the reason the stock jumped.

However, a table showing blended same store sales in weeks subsequent to the quarter versus two years ago showed marked improvement, especially a 5.4% increase in the most recently completed week ended Sunday March 21. I believe that it was mostly on the strength of that one week that DRI shares surged so powerfully as investors are reading into it confirmation of a coming boom in the reopen stocks as the coronavirus is shortly contained and the economy reopened. As a result, DRI’s chart remains in a powerful uptrend despite so many other stocks and groups of stocks having rolled over.

While demand for an evening out is as high as ever after a year of lockdowns, investors should keep in mind that current stock prices reflect plenty of optimism – Charley Grant, “Olive Garden Parent’s Investors Are Still Feasting”, WSJ, Friday March 26 [SUBSCRIPTION REQUIRED]

The problem with DRI, and all the other reopen stocks, is that their massive moves have already more than priced in a return to boom times. For example, DRI now trades at 24x the Diluted EPS of the four pre-COVID quarters ended 2/23/20.

DRI is a middle of the road restaurant conglomerate, whose flagship brand is Olive Garden, that was reporting +2-3% comps in the quarters leading up to COVID. Personally, given the quality of the business and the uncertainty of the economic reopening, I would put a 10x multiple on peak earnings, not 24x, giving the stock an intrinsic value of $60.50 – 58% below its closing price yesterday.

There is a lot of money to be made on the short side in these reopen names in my opinion though there is no perfect ETF for shorting them like there is for what I call Mega Cap Tech (QQQ), Speculative Tech (ARKK) and Semiconductors (SMH). You can try a broad ETF like IWM or SPY, which is what I’m doing, but the best method would be to go through the components of the S&P Industrials (XLI) and S&P Consumer Discretionary (XLY) to cherry pick the best ones. DRI is one of those in my opinion though I have no position.

As a result, while these stocks remain technically strong and are the investor favorites of the moment, the topping pattern being shown by the rest of the market as well as their more than full valuations suggest to me that the top is just around the corner for these stocks as well which would put the final nail in the bull market’s coffin.