Does PG Have Pricing Power?

Consumer staples behemoth Procter & Gamble (PG) reports 3Q22 earnings tomorrow morning. PG’s brands like Tide laundry detergent and Crest toothpaste are some of the best known and highest quality but they come at a premium. The question is: Are consumers still willing to pay up given high inflation and a weakening economy? My bet is Yes.

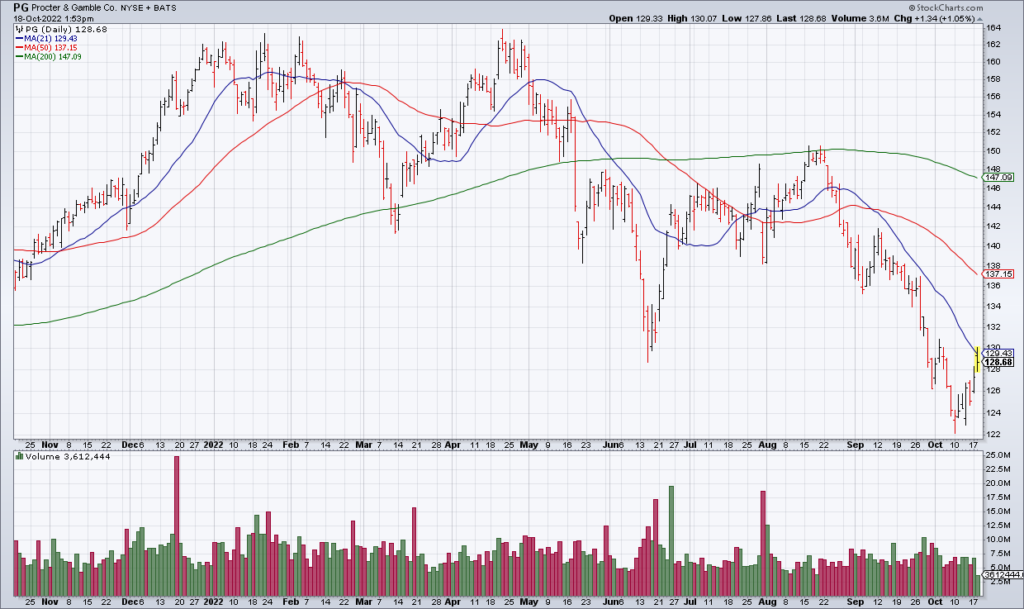

When PG last reported earnings three months ago they guided FY23 organic sales to +3-5% and EPS from flat to +4%. Given the weakness in the stock of late if PG’s quarter suggests they can meet those targets my sense is the stock is a buy and will go up. PG earned $5.81 in FY22 so their guidance implies $5.93 in the current fiscal year. At a current $129 that works out to 22x current year earnings. While that doesn’t sound particularly cheap it’s about as cheap as PG generally gets.