Extreme Valuation, Extreme Sentiment, Bank Technicals Ahead of Earnings

Note: To sign up to be alerted when the morning blog is posted to my website, enter your name and email in the box in the right hand corner titled “New Post Announcements”. That will add you to my AWeber list. Each email from AWeber has a link at the bottom to “Unsubscribe” making it easy to do so should you no longer wish to receive the emails.

We’re heading into 1st quarter earnings season with stocks showing relentless technical strength but valuation and sentiment are major red flags. Any way you look at it, stocks are beyond expensive. If you look at the first tweet from Callum Thomas, it shows that the S&P’s overall Price to Sales ratio is 1/3 higher than it was at the Dot Com peak while the median stock is 75% more expensive than it was then.

If you look at Callum Thomas’s second tweet, you can see that the Blended P/E, using the CAPE, forward and trailing P/E, is 33x – just shy of the Dot Com peak of 34.8x. The S&P 1500 Composite CAPE, or the P/E using average earnings over the last 10 years, is at 37x, twice the historical average and just shy of the Dot Com peak of 44x though higher than the 1929 peak of 33x. Gene Goldman, Chief Investment Officer at Cetera Investment Management, is asking the right question: “Is all the good news priced in?”

We’ve never really seen such a large and protracted tension like this, with the suggestion continuing to be that it’s risky for late buyers, and also risky to bet against the momentum – “With stocks surging, investors give up on hedges” [SUBSCRIPTION REQUIRED], Sentimentrader, Monday April 12

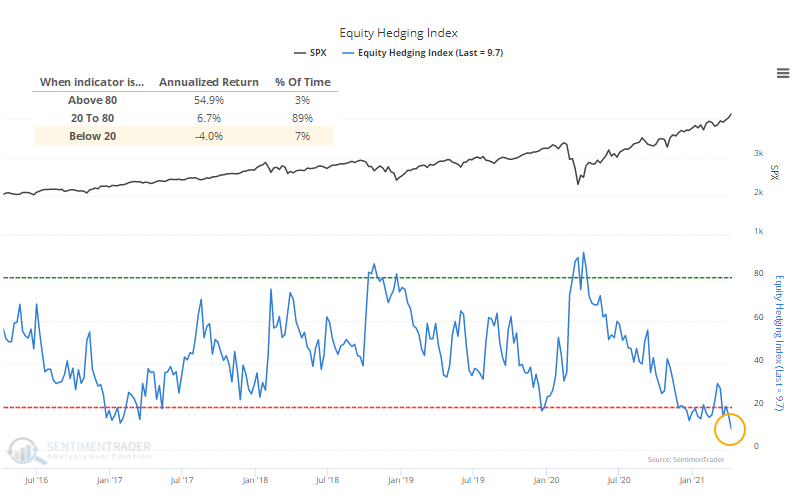

With stocks only going up, investors have thrown caution to the wind and given up hedging in the form of raising cash, buying puts, buying inverse ETFs and mutual funds, selling short futures contracts and buying credit default swaps. Sentimentrader’s proprietary Equity Hedging Index takes all of these into account and last week registered a reading of 9.7. In the almost 20 year history of the indictator, there have been only nine other weeks with readings as low. And in the 7% of the time that the index has been below 20, annualized returns are -4.0%.

First quarter earnings season kicks off in earnest tomorrow (Wednesday) morning with JP Morgan (JPM), Wells Fargo (WFC) and Goldman Sachs (GS) followed by Bank of America (BAC) and Citigroup (C) on Thursday and Morgan Stanley (MS) on Friday. From a technical standpoint, with the KBW NASDAQ Bank Index running into resistance in the form of a couple of downtrend lines on the chart of its relative strength versus the S&P, the great technician Carter Worth is a seller here.