HD Has Topped, COST Is Next

Behemoth home improvement retailer Home Depot (HD) reported 4Q21 earnings before the open Tuesday. The quarter itself was fine with US Comps +7.6% and EPS +21% to $3.21. The problem was guidance. HD guided 2022 comp growth to “slightly positive” with flat operating margins resulting in low single digit EPS growth – likely mostly a function of share buybacks.

This suggests to me that the post-COVID home improvement boom is over and other investors seem to be drawing the same lesson as shares are currently -9%. A look at the chart combined with the guidance means HD stock has likely topped.

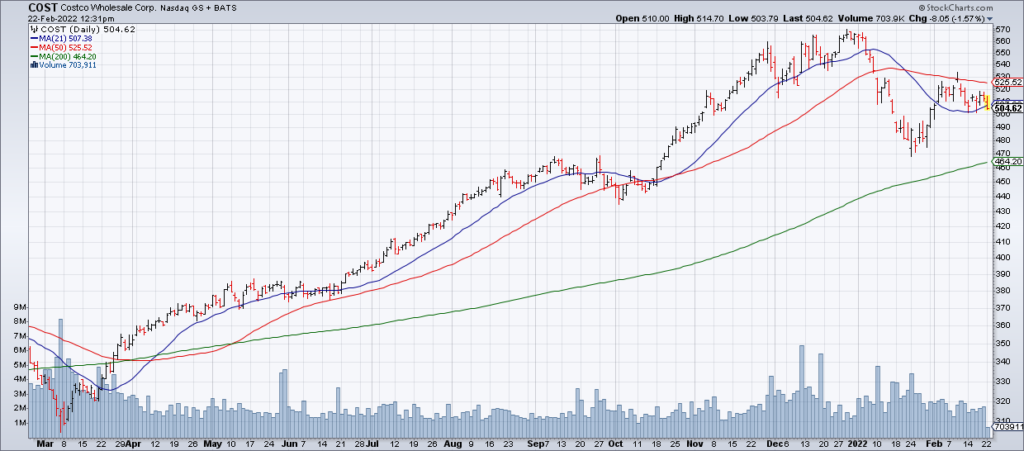

It is my belief that Costco (COST) is next. While fundamentals have remained stellar through January when comps excluding fuel were +10.8% (they were +11.5% in December), the stock is just too expensive at ~40x my estimate of current year EPS. Any weakness in their next quarterly report – which will be released next Thursday March 3 after the close – akin to HD today will likely send the stock tumbling.

HD and COST are legendary companies but now is not the time to own their stocks.